In 2007, CEO Rick Kent founded Merit Financial Advisors as a hybrid registered investment advisor out of Atlanta. He has since grown it into a $10 billion enterprise with more than 40 offices in the U.S., backed by Wealth Partners Capital Group and a group of strategic investors led by HGGC. And this month, Merit launched a new 1099 affiliation model.

Merit has added great talent along the way, including Brian Andrew, who recently joined as the firm’s chief investment officer from Johnson Financial Group. Andrew has been tasked with managing the firm’s investment department and asset allocation decisions. He’ll also play a key role in integrating new partner firms that Merit acquires.

WealthManagement.com recently caught up with Andrew, who provides a look inside one of Merit’s core model portfolios.

WealthManagement.com recently caught up with Andrew, who provides a look inside one of Merit’s core model portfolios.

The following has been edited for length and clarity.

WealthManagement.com: What’s in your model portfolio?

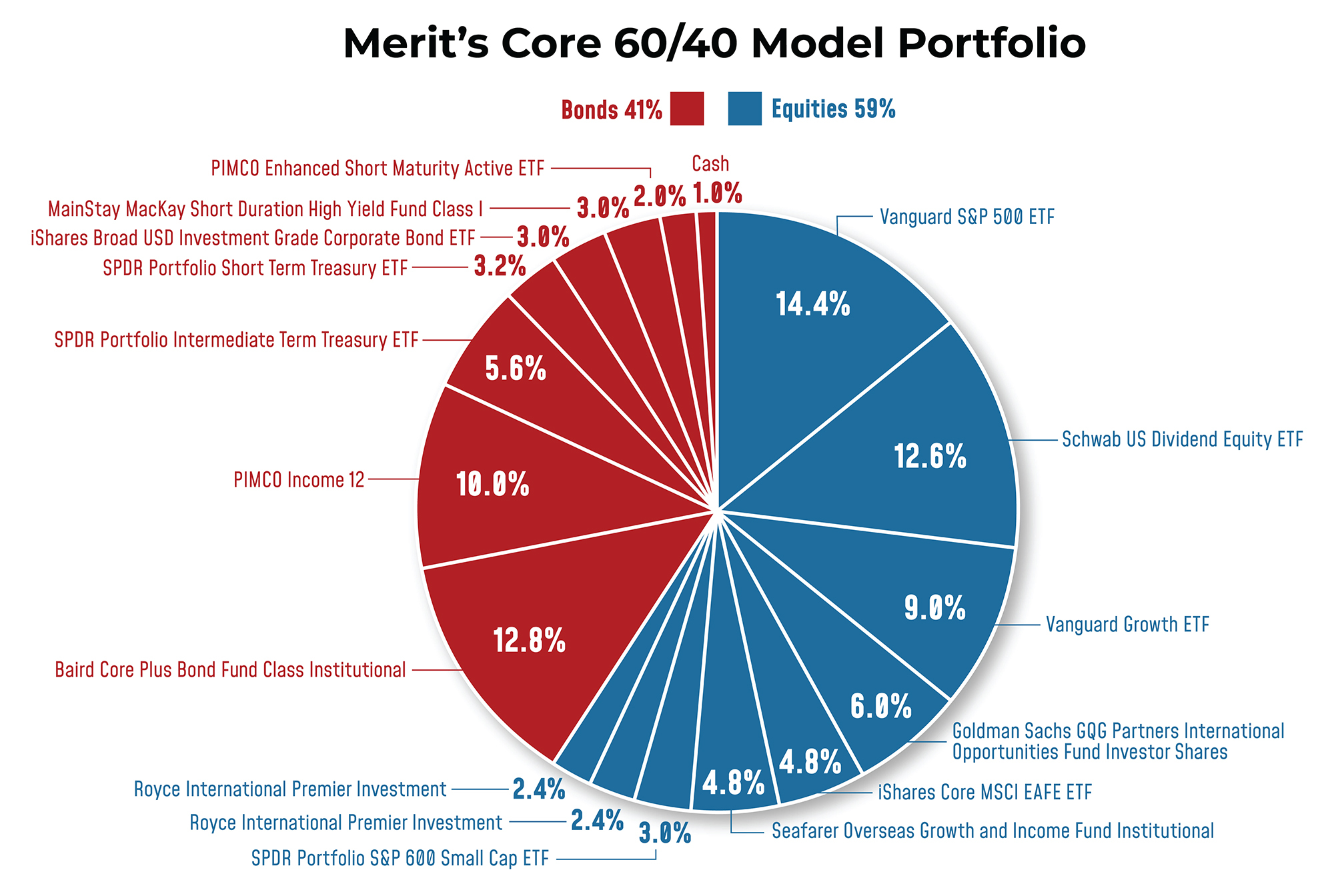

Brian Andrew: There’s a mix of passive and active in the portfolio—the passive being primarily ETF positions. We’re very cost-conscious in terms of the construction of portfolios for clients. And so, having ETF exposure helps with costs.

Second, we are tactical in nature, meaning that we’re interested in making changes on a nearer-term basis. Being able to make changes in ETF positions is easier. Obviously, they’re more sensitive to changes in the market, so that allows us to be more flexible in our tactical positioning. So, that’s the primary rationale for having exposure to both passive and active.

I will say, just given the size of Merit, we have all ETF model portfolios. This core portfolio that we’re discussing here is the one most utilized across the organization. But, for clients and advisors who are super cost-conscious and really want to just index, we have ETF portfolios that follow the same strategic and tactical positioning that the core portfolio follows.

This core model is about 60/40. We do maintain a cash position on average around 2%, and we’re not really making what I would call big strategic asset allocation bets where we’re 50% equity, and then we’re 75, and then we’re 25. We might overweight equity or underweight it by 2 or 3 percentage points, but not significantly.

The tactical changes really happen intra-asset class. If you think about large cap, versus smaller growth, versus value, or high credit quality, low credit quality, that kind of thing. On the bond side of the portfolio, we worry about interest rate sensitivity; we worry about sector allocation. We worry about credit quality.

We do think a little bit about the shape of the yield curve. Today, the curve is still inverted short to long, and so we believe there’s an opportunity in the middle part of the curve, and we would take advantage of that, whereas maybe at other times, we would be more barbelled short and long. So, that’s a positioning change that we would make on the bond side of the portfolio. That’s actually another good example of where ETFs would be easier to do that with than an active core bond manager.

WM: Within the equity allocation, what’s the weighting of domestic versus international?

BA: Our benchmark is the MSCI ACWI index. We have a higher international and emerging market allocation in our benchmark than if we used a blended domestic-international benchmark. So relative to ACWI, we’re underweight international emerging markets by about 10%. We have just under a third of the equity portion allocated to international.

People have been saying that international stocks are attractive on a valuation basis for a long time, but that continues to be the case. There are still some meaningful opportunities there. But when you look at the portfolio, there’s more active exposure because we think those active managers are better positioned.

The valuations are where they are for a reason. The European economy is not looking like it will have the same recovery that the U.S. has. There’s weakness in China, which delivers weakness throughout Asia. Many European companies, and manufacturers, in particular, are export-driven. That’s why the valuations are where they are. But I think that’s where having that extra exposure, if you will, presents some opportunity at this point in time.

We’re also a little bit overweight small and mid-cap stocks, and that’s similarly due to valuations. Small cap, in particular, has been very out of favor. And we all know if you look at the S&P 500, and you take the top seven to 10 names out, you remove more than 75% of the performance.

If you look at the valuations of the Russell 2000 as an example, it is trading at a relatively low level as compared to the Russell 1000 growth. I would say that we’re probably in small-cap managers that don’t need a big cyclical recovery to win. I don’t think our view is that the economy is going to go from 2% growth to 5% growth in 2024. I think we’ll be lucky to get 2% for the year. But still, from a valuation perspective, there’s more opportunity in that part of the market, we think.

WM: Have you made any big allocation changes in the last six months or so?

BA: The overweight to small- and mid-cap stocks is a change that took place toward the end of last year.

The other change is more on the fixed income side of the portfolio, where we had been short duration. Our benchmark is the Bloomberg Aggregate Bond Index, which has a duration of around six years. We have been well below four and are currently just over four years. So that increase in duration came from yields backing up between the third and fourth quarters. But we still remain short.

We also changed the structure of the active managers to improve credit quality. Our view is that we haven’t seen all the weaknesses we’re going to see. And the difference in yield between treasuries and corporates, for example, is still very tight on a historical basis. We think having a higher credit quality portfolio relative to the benchmark makes sense. The high-yield bet that was there is gone for the most part, and we’ve moved up in average credit quality across the portfolio.

WM: You mentioned that you hold 2% in cash. Why do you hold cash?

BA: I wish I could tell you there was science to that, but two things: One is, if I could run it at zero, I would, but we know that there are always distributions or expenses like investment management fees that come out of the portfolio. To make sure clients can be fully invested and not end up having costs associated with being overdrawn, we maintain a little bit of cash. Two, Merit has done a great job of improving the way we use trading technology, so that number has come down. My hope is we can get back to a 1% number there. That number was probably closer to 5% before we made the improvements in terms of how we trade and the technology we use.

WM: Are there any particular structures you put that cash into?

BA: For clients that we know we can do something with their cash, we may trade that out of a money market fund and into an ultra-short duration fund, given the fact that their duration’s going to be closer to a year as opposed to 30 days in the money market fund. You get a pretty decent yield pickup with cash to the extent that you can own that, and people can take the marginal volatility that comes with an ultra-short-duration fund. That would almost happen client by client, not necessarily in a model, but we have that flexibility built into the way we’re doing things.

WM: Do you allocate to private investments and alternatives? If so, what segments do you like?

BA: The organization has been using liquid alternatives for some time and has some model portfolios using liquid alternatives available to advisors as sleeves for clients who are interested in that alternative allocation. And that really came about as a result of the low-yield environment that existed for so long. It was a way for clients to have an income component using alternatives as opposed to using traditional fixed income.

Within that sleeve, there’s exposure to private equity, private credit and real assets, like infrastructure or commodities, through liquid alternative funds. People can own that and fund it from either the income or equity part of their portfolio, depending upon their return objective.

On the private placement side, we’re in the process of evaluating outside partners. We’ll likely start with a partnership with a larger national firm, like a CAIS or iCapital, that can provide us access to private placements. That would eventually lead us to create our own white-labeled fund, where we’re choosing what investments end up in that fund, and then make that available to clients that are able to invest in alternatives because of their accredited or qualified stature.

We don’t need a partner to get us access to funds. It’s really more about how they can help us from a technology perspective with subscription docs, research and due diligence, and then help us think about how to put those funds together into strategies for clients.

WM: What differentiates your portfolio?

BA: I mentioned earlier the idea of using passive and active in the same model portfolios and having all passive available as well.

Another thing is that it’s as important to understand an active manager’s performance cycle as it is to understand how they manage money. What I mean by that is that people talk a lot about tactical shifts between factors like size or growth versus value or dividend yield, for example. If you look at a particular segment like small-cap growth, not every small-cap growth manager is the same, and they have different cycles of performance through a market cycle. Some are more or less competitive depending upon the underlying economic themes. And one small-cap manager’s catalyst is not another’s.

One of the things that differentiates us is getting beyond just understanding the long-term performance track record to understand the team, their stock-picking approach, and how it works at different points in a market cycle, and based on what the underlying economic environment looks like. Because then you can be not just tactical, moving in and out of small or large, but also one manager versus another based on how they perform relative to their peers. That allows you to take advantage of when a manager has outperformed by a lot; you can be more comfortable selling your winners and buying the losers because you understand that strategy over time’s going to work.