By Rachel Evans

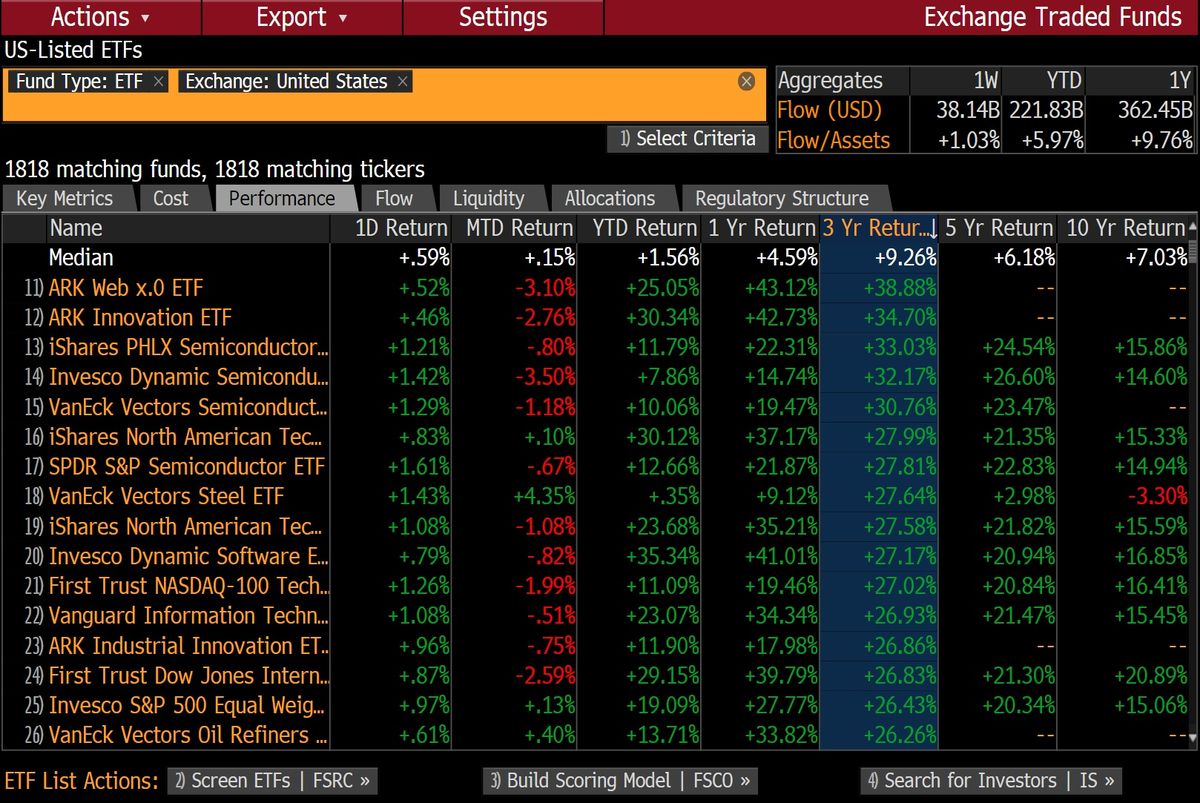

(Bloomberg Markets) --Something pretty striking emerges when you sort all of the 1,818 U.S.-listed, unleveraged ETFs by three-year return: Three of the top 15 are managed by the same person.

Cathie Wood, founder and chief executive officer of Ark Investment Management LLC, runs the No. 1 and the No. 2 exchange-traded funds—and for good measure, she also runs the 13th-best performer. In first place was the $653 million Ark Web x.0 ETF, which returned 39 percent annually during the three years through Sept. 20. In second was the $1.41 billion Ark Innovation ETF, which was up 35 percent a year. The 13th-place ETF was the Ark Industrial Innovation ETF, which returned 27 percent a year over the period.

How did Wood, 62, rack up those returns? She did it by focusing on stocks of companies involved in disruptive innovation. Also, there was Bitcoin.

Wood knew she was taking a risk when she decided to invest in the cryptocurrency. It was 2015, and a cloud hung over the Bitcoin market. Mt. Gox, once the world’s largest crypto exchange, had imploded the previous year after being hacked and losing about 850,000 Bitcoins.

Even staff at Ark—Wood’s then-fledgling New York-based fund company—feared Bitcoin was a Ponzi scheme. But Wood was intrigued. After a career of covering cutting-edge industries, she knew innovation when she saw it. Bitcoin seemed to be the real deal.

In particular, Wood thought the digital ledger behind the virtual currency—the blockchain—had the potential to revolutionize everything including mortgage agreements and customer identification. She wanted a piece of that growth for a clutch of ETFs she’d just set up to invest in disruptive innovation. She’d bought stocks of a handful of semiconductor makers that stood to gain from blockchain’s spread, but she wanted a purer play. Bitcoin, she reasoned, was the purest play possible.

So as the Greek debt crisis raged throughout the summer of 2015, Wood watched how the currency fared as a store of value. She studied its potential for the remittance market. She dug into the plumbing of a Bitcoin trust run by Grayscale Investments LLC, even buying a small stake with her own money. Because of U.S. fund regulations, the trust would be her only way into the cryptocurrency. If she decided to take the plunge, it had to work. “The joke is that—you’re a pioneer—you just don’t want to be a pioneer with arrows in your back,” Wood says.

Bitcoin passed the test, and Wood bought 1,100 shares in the Bitcoin Investment Trust in September 2015. With the currency trading at around $230, her stake in the trust was worth $33,000 at purchase. In less than two months, she had almost doubled her money. The gamble—both on Bitcoin and on her ETFs—had started to pay off. “I didn’t know if it would be successful,” she says of her fund management business. “But I knew if I didn’t do it, then I would have missed my calling.”

Ark, which manages more than $6 billion, is a rare breakthrough story in the increasingly competitive market for ETF sponsors. The biggest companies—BlackRock, Vanguard, and State Street—together control 82 percent of assets. More than 80 smaller issuers compete for the remaining piece of the $3.8 trillion pie. Attracting a large investor is typically what makes or breaks a fund. Cost-cutting is the norm.

Not so at Wood’s company, where ETFs charge an average 75 basis points, or $7.50 for every $1,000 invested. That’s far above the median 49 basis points for the industry. Pension funds and insurers are largely absent from Ark’s ETF clientele, which is instead dominated by financial advisers who serve smaller retail investors.

With the U.S. Securities and Exchange Commission recently dashing prospects for ETFs focused on virtual currencies, Wood’s funds have been the only ETF play on Bitcoin. But the company’s crypto exposure is just one way the funds stand out from the crowd.

Although 98 percent of ETF assets track an index, four of Wood’s six funds are actively managed stock portfolios—which would seem to rebut the claims of many star managers that front-runners could exploit the daily disclosure required of ETFs. Wood also shuns the investment industry’s treasured notion of proprietary research. She and her team publish white papers on social media and then incorporate feedback from communities on Twitter, Medium, and Facebook.

And rather than churn through trendy companies, Wood invests for the long term. Shares of Nvidia, Red Hat, and Tesla have been part of her portfolios since Ark began in 2014. When controversy arises about such companies, she uses it as an opportunity to trade around news, taking profits and then buying back at lower prices, for example.

It was this approach that persuaded Resolute Investment Managers Inc., owner of mutual fund giant American Beacon Advisors Inc., to take a stake in the business in 2016, when ETF assets were only around $40 million. “We weren’t hellbent” on investing in an ETF issuer, says Jeff Ringdahl, Resolute’s president and chief operating officer. “We went into the meeting thinking, Disruptive innovation—so that’s the latest gimmick. Cathie’s the opposite of that. Cathie’s a real investor.”

Resolute now has a 23 percent stake in the company and helps Ark sell its funds in the U.S. Nikko Asset Management Co. owns an additional 16 percent and took Ark global, engaging Wood to manage three Japanese mutual funds that now outweigh her U.S. products.

For an ETF issuer to run a mutual fund is unusual. To do so overseas is even more uncommon. But Wood has always been something of a maverick. Born in Los Angeles, she spent the first 10 years of her life moving among U.S. Air Force bases in Alabama, England, Ireland, and upstate New York because of her father’s job as an expert in radar systems. An investing enthusiast, he turned Wood on to finance, encouraging her to study economics at the University of Southern California. Wood still speaks with her father every day.

As a scrappy junior analyst at Jennison Associates LLC in the 1980s, she made the most of stocks no one else wanted, covering cellphone network providers when handsets were the size of bricks. She managed thematic portfolios at a hedge fund before the dot-com bubble even bloomed, then joined AllianceBernstein LP, where she ran similar strategies focusing on innovation.

In the summer of 2012, though, it dawned on Wood that the industry most in need of disruption was her own. ETFs were revolutionizing capital allocation; they were the perfect vehicle for her boundary-pushing strategies. Starting ETFs, however, proved a step too far for a mutual fund powerhouse such as AllianceBernstein. Despite initial enthusiasm for the concept, the company couldn’t stomach the daily transparency required of these funds. “Most traditional asset managers will not take these risks,” she says. So Wood decided to go it alone.

Fast-forward to today and the rash of new entrants trying to mimic her success. At least six funds started this year promise exposure to the blockchain, while many other companies—including heavy hitters State Street Corp. and Goldman Sachs Group Inc.—are looking to set up products focused on innovative technology. “Ark’s on our radar,” says Matthew Bielski, co-founder of Defiance ETFs, whose first fund focuses on virtual-reality technologies. “They’re a great firm. They have great intellectual capital, great research, and, if anything, they’re at the forefront of this disruptive technology.”

As competition heats up, Wood remains sanguine about the prospects for her company. For one thing, she’s slashed exposure to Bitcoin. Her decision to cut holdings in December, and again in January, proved as prescient as her initial investment. After skyrocketing to $18,000 in 2017, Bitcoin traded at $6,377 on Sept. 20. Bitcoin accounts for 0.3 percent of her Web x.0 fund, after being almost 10 percent last year. (Her funds aren’t permitted to hold more.)

Wood is now back to playing the blockchain through semiconductors. In 2017 the Ark Web x.0 generated a blockbuster total return of 87 percent. But with some 60 percentage points of that gain coming from stocks, she’s confident her performance won’t suffer. “We like to sort out what the attribution was for Bitcoin because we like to understand that the other number was pretty good, too,” she says.

Holding Bitcoin in an ETF meant entering new territory, yet Wood came through that bit of pioneering unscathed. “Even though the move seemed audacious in the beginning, now we seem appropriately conservative in how we think about picking our spots,” she says.

As for what comes next, Wood says she thinks the biggest opportunity is in digital wallets. “The wallet provider can effectively disintermediate banks because blockchain technology is pretty much peer to peer,” she says. “The one that gets there first has the best shot of becoming the world’s bank.”

To contact the author of this story: Rachel Evans in New York at [email protected]