The United States Tax Court’s (the “Court”) long-awaited opinion on the matter of the Estate of Michael J. Jackson, Deceased, John G. Branca, Co-Executor and John McClain, Co-Executor v. Commissioner of Internal Revenue (the “Dispute”) was finally released on May 3, 2021. (Estate of Michael J. Jackson, Deceased, John G. Branca, Co-Executor and John McClain, Co-Executor, Petitioners, v. Commissioner of Internal Revenue, Respondent, Docket No. 17152-13, T.C. Memo. 2021-48, filed May 3, 2021.)

The 271-page opinion was highly anticipated by the parties of the Dispute, the estate advisory community, valuation professionals, Jackson’s fans, and many others. Factors generating the wide degree of interest include Jackson’s high profile, the amount of money at stake, the significant length of time between Jackson’s death and the opinion, and the significant differences of opinion between parties regarding the value of certain assets at issue.

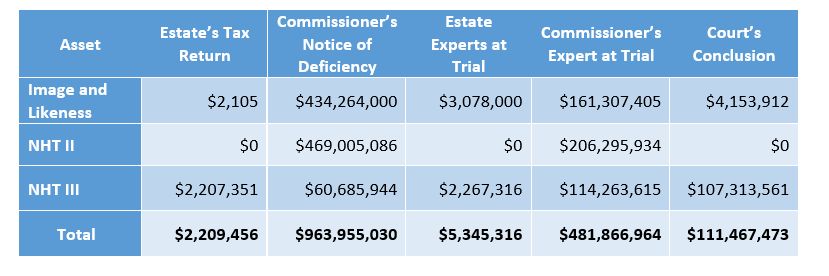

Ultimately, the Court concluded that the fair market value of the three assets at issue – all of which related to intellectual property – totaled $111,467,473. This conclusion will likely be construed as a win for the Estate of Michael Jackson (the “Estate”), as its valuation experts provided the Court with an opinion that the three relevant assets were worth a total of $5,345,316, while the Commissioner of Internal Revenue’s (the “Commissioner”) valuation expert opined that the assets had a value of $481,866,954.

We believe that the Court’s opinion provides important insight and guidance regarding a variety of valuation issues.

Background

Jackson – one of the preeminent stars in the history of pop music – passed away on June 25, 2009. Beginning in 1993, Jackson endured a wave of negative publicity stemming primarily from allegations associated with the sexual abuse of various children. Jackson was never found guilty of these allegations, and though they significantly affected his ability to earn sponsorship and merchandising income, his music continued to sell relatively well for a period of time. Despite some sustained fiscal success with his music, Jackson’s finances suffered, and he took on significant debt.

After his death, the Estate completed and submitted a U.S. tax return listing the value of Jackson’s various assets. After an audit of the Estate’s tax return, in May 2013 the Commissioner issued a notice of deficiency that adjusted the Estate’s reported values relating to a group of specific assets. The result of these adjustments led the Commissioner to conclude that the Estate has underpaid Jackson’s estate tax by approximately $500 million and that, as a result, the Estate had accrued penalties of nearly $200 million.

The Estate and the Commissioner ultimately settled most of the valuation disputes, apart from three assets which remained in contention:

- Jackson’s right of publicity (“Image and Likeness”)

- New Horizon Trust II (“NHT II”), which held Jackson’s 50% ownership interest in Sony/ATV, one of the largest music publishers in the world and which, among other things, owned a large catalog of copyrights, including those related to at least 175 songs by The Beatles

- New Horizon Trust III (“NHT III”), which held Jackson’s ownership interest in Mijac Music, a music-publishing catalog that owned copyrights to compositions that Jackson wrote or cowrote, as well as compositions by other songwriters

The following table provides a summary of the various valuations proffered by the parties to the Dispute, along with the Court’s ultimate conclusions:

As indicated in the table above, there were significant disagreements between parties regarding each of the three valuations. Ultimately, the Court’s value conclusions tended to align more with 1) the Estate as it related to the valuations of Jackson’s image and likeness and NHT II, and 2) the Commissioner as it related to the valuation of NHT III.

Expert Observations

Among the three valuations, the following represented some of the issues addressed by the Court that we found to be most interesting:

- Reliance on historical financials versus management projections to forecast cash flows when performing an Income Approach

- Accounting for taxes when performing an Income Approach

- Reliance on information known or knowable as of the valuation date

- Credibility of the valuation experts and the information they rely upon

The Court’s comments and actions relating to these issues provide key insights to valuation experts regarding some of the matters they must address while performing valuations for trust and estate tax compliance purposes.

Reliance on historical financials versus management projections to forecast cash flows when performing an Income Approach

For purposes of valuing NHT II using an Income Approach and discounted cash flow (DCF) method, the Court was required to project future cash flows of NHT II. When projecting future cash flows, it is not unusual to have multiple sources of information that could form the basis of such projections. Specifically, valuation experts are often challenged to determine the influence that 1) historical financial data and 2) management projections should have on the cash flow forecast. As with the selection of all such inputs and assumptions, whether the use of one, or the other, or both, is most appropriate is based on the facts and circumstances associated with a particular valuation. However, we find the Court’s comments on this issue, in the context of the valuation of NHT II, to be particularly instructive of how it thinks about this issue. More specifically, in its opinion, the Court stated:

With the discount rate established, we shift to cashflow projections. We first have to decide whether we find it more reasonable to predict the future with the past or with the prediction of a third party – Sony/ATV – that had an interest in getting it right. We think it more reasonable to use Sony/ATV’s own projections. Our major reason is that the music-publishing industry was (and has remained) in a state of considerable uncertainty created by a long series of seismic technological changes. Digital downloads, the advent of easy-to-use pirating software, the development of countermeasures to defeat that software, and similar revolutionary changes in the identification and marketing of new singers and songs make historical data about cashflow exceptionally unreliable in this industry. We think that projections of future cashflow, if made by businessmen with an incentive to get it right, are more likely to reflect reasonable estimates of the short- to medium-term effects of these wild changes in the industry that even experts, much less judges, are unlikely to intuit correctly. We therefore find that Sony/ATV’s projections are more reliable and will, like Wallis, use these midrange projections for the first four years as the most reasonable.

The Court’s comments are a good reminder that valuation analysts should consider different options available for valuation inputs specifically in the context of the facts and circumstances of each valuation. There is not a one-size-fit-all answer to whether historical financial data or management projections are necessarily the better option when projecting cash flows.

Accounting for taxes when performing an Income Approach

In its opinion, the Court stated: “A second consideration that affects our valuation of all three assets here is tax affecting. Each of the Estate’s experts takes tax affecting into account in his valuations.” In this context, the concept of tax affecting relates to the adjustment of projected cash flows when implementing an Income Approach, to account for the taxes an owner might have to pay as a result of earning the relevant cash flows.

The Court starts by identifying whether or not taxes are paid by a corporate entity, depending on whether that entity is a taxpaying entity (such as a C corporation) or a “pass-through” entity (such as a partnership, S corporation, or LLC, all three of which do not pay taxes at the corporate entity level but, instead, pass income along to shareholders who then pay taxes on this income). As it relates to this issue, the Court stated:

Because pass-throughs do not pay tax at the entity level, their projected cashflows will not account for any tax consequences. But almost always – and, in fact, in this case – the rate used to discount projected cashflows to present value is derived from after-tax, publicly available C-corporation information. Proponents of tax affecting argue that this mismatch between pretax cashflows and after-tax discount rates must be corrected, or tax affected. We have acknowledged as much in our cases, stating: “[I]f, in determining the present value of any future payment, the discount rate is assumed to be an after-shareholder-tax rate of return, then the cashflow should be reduced (‘tax affected’) to an after-shareholder-tax amount. If, on the other hand, a preshareholder-tax discount rate is applied, no adjustment for taxes should be made to the cashflow.” Gross v. Commissioner, 78 T.C.M. (CCH) 201, 209 (1999), aff’d, 272 F.3d 333 (6th Cir. 2001). Whether, and precisely how, to tax affect a pass-through’s earnings, however, is the subject of significant dispute in this case.

The Court goes on to state:

There has, it seems, been only one case where we allowed tax affecting in a valuation. See Estate of Jones v. Commissioner, T.C. Memo. 2019-101, at *41-*42… The experts here strongly disagree on the appropriateness of tax affecting. We view this disagreement just as we have in the past, as one that is a dispute about fact. And we find, as we have done consistently in the past apart from Estate of Jones, that by a preponderance of the evidence tax affecting is not appropriate here because the Estate has failed to persuade us that a C-corporation would be the hypothetical buyer of any of the three contested assets. The Estate’s experts did not even discuss in a persuasive way their reasons for assuming that a C-corporation would be the only or even likely buyer for these assets.

The Court further notes that 1) the Estate’s experts did not sufficiently persuade the Court that a taxpaying entity would be the likely hypothetical buyer of the assets at issue, 2) the Estate’s experts did not consider the tax detriments and benefits of pass-through status, and 3) the Estate’s expert disagreed on the appropriate tax rate.

On this issue, the Court ultimately concluded that “tax affecting is inappropriate on the specific facts of this case.” However, the Court also stated: “We do not hold that tax affecting is never called for. But our cases show how difficult a factual issue it is to demonstrate even a reasonable approximation of what that effect would be. In Estate of Jones, there was expert evidence on only one side of the question, and that made a difference. That was not the case here.”

Reliance on information known or knowable as of the valuation date

Professional valuation standards generally require that valuation experts rely on information that is known or knowable as of the valuation date. For example, the American Institute of Certified Public Accountants’ (AICPA) Statements on Standards for Valuation Services (SSVS) states the following:

The valuation date is the specific date at which the valuation analyst estimates the value of the subject interest and concludes on his or her estimation of value. Generally, the valuation analyst should consider only circumstances existing at the valuation date and events occurring up to the valuation date. An event that could affect the value may occur subsequent to the valuation date; such an occurrence is referred to as a subsequent event. Subsequent events are indicative of conditions that were not known or knowable at the valuation date, including conditions that arose subsequent to the valuation date. The valuation would not be updated to reflect those events or conditions. Moreover, the valuation report would typically not include a discussion of those events or conditions because a valuation is performed as of a point in time—the valuation date—and the events described in this subparagraph, occurring subsequent to that date, are not relevant to the value determined as of that date.

In its opinion, the Court on multiple occasions rejected the use of certain information on the basis that valuations must rely on information that is known or knowable as of the valuation date.

For example, in its opinion, the Court stated:

Anson believed that these projects were potential opportunities that a rational investor could implement and that would create revenue attributable to Jackson’s image and likeness. They also bear some considerable resemblance to deals the Estate, under its competent management, did do in the years after Jackson died. Though Anson carefully said that he didn’t rely on events after Jackson’s death in his valuation, he did look at them to assess the reasonableness of his projections. For each of these opportunities, Anson tried to show how those opportunities were foreseeable at the time of death and then projected revenue streams from each.

However, the Court ultimately rejected Anson’s testimony related to the future commercial opportunities associated with Jackson’s Image and Likeness in part because he “included unforeseeable events in his valuation.” More specifically, the Court stated: “We also find that Anson included revenue streams that were unforeseeable at the time of Jackson’s death. Even if these potential revenue streams were traceable to Jackson’s image and likeness, they were not foreseeable when Jackson died, which means we should not include them in the Estate’s gross value.”

In making these comments, the Court stated the following:

Section 20.2031-1(b), Estate Tax Regs., defines the fair market value of an estate as limited to what a buyer and seller would have reasonable knowledge of at the time of a decedent’s death. Caselaw tells us to hypothesize a buyer who is reasonably informed and who asks a hypothetical willing seller for information not publicly available. Estate of Kollsman, 113 T.C.M. (CCH) at 1175. Foreseeability can’t be subject to hindsight. Gallagher, 101 T.C.M. (CCH) at 1706. Four of the five revenue streams that Anson included in the valuation of image and likeness were unforeseeable at the time of death.

The issue of relying only on what is known or knowable at the valuation date came up a second time as it relates to the opinion of one of the Estate’s experts – Owen Dahl – who valued NHT III. More specifically, the Court’s opinion stated:

Dahl relied heavily on a 2011 research paper from the University of Zurich (Zurich Study)-- which included the death of Jackson in its study and would not have been available at the time of death--to determine the amount of a postdeath spike …

We begin with the postdeath spike, which affects a couple of these income streams. We find that--for the most part-- Anson is more reasonable in his estimate. The Zurich Study that Dahl relied on was not available at the time of Jackson’s death, and it included Jackson’s actual postdeath numbers.

These statements are an important reminder that valuation experts, particularly when valuing assets well after the valuation date, must continually focus on making use only of information that was known or knowable as of the valuation date, and that overreaching in this regard may be disqualifying.

Credibility of the valuation experts and the information they rely upon

On multiple occasions, the Court’s opinion references the credibility of the valuation experts involved and suggests that the Court’s decisions related to its own independent valuation analysis are significantly affected by issues of expert credibility.

This issue is most obvious in a section of the opinion specifically devoted to the credibility of the Commissioner’s expert, Weston Anson. As it related to Anson’s credibility, the Court stated: “As the Commissioner’s only expert witness, Anson’s credibility was an especially important part of this case. And it suffered greatly at trial.” The Court goes on to document at least two areas of Anson’s testimony that it plainly calls “lies.” Interestingly, despite Anson perjuring himself and being caught by the Court during trial, the Court allowed Anson to provide his expert testimony anyway, finding that excluding Anson’s testimony was “too severe” a consequence. Instead, the Court stated that “[a] more proportionate remedy would be to discount the credibility and weight we give to [Anson’s] opinions.” Finally, the Court concluded that “Anson did undermine his own credibility in being so parsimonious with the truth about these things he didn’t even benefit from being untruthful about, as well as in not answering questions directly throughout this testimony. This affects our factfinding throughout.”

On a more specific issue relating to the number of unreleased Jackson songs that existed at the time of his death (in the context of valuing NHT III), the Court sided with the Estate’s expert, Dahl, over the Commissioner’s expert, Anson, citing the issue of credibility as one motivating factor. Here, the Court stated: “Dahl’s source, which is the Estate itself, is more reliable here, and on any close question we can rely more on Dahl simply because he didn’t create the same problems with credibility that Anson did. This means we find that there was a total of 83 unreleased songs available at Jackson’s death.”

The issue of expert credibility was not limited to Anson’s opinions on behalf of the Commissioner. The Court also found that certain opinions related to the valuation of NHT III provided by the Estate’s expert, Dahl, were also not credible and, as such, could not be relied upon by the Court. For example, in its opinion the Court stated: “Dahl failed to adequately explain his reasoning or methodology, and we even spotted several blatant mathematical errors … This persistent divergence between his verbal explanations and his numbers undermine Dahl’s overall credibility.”

In at least one instance, the lack of credibility among both parties’ experts led the Court to reject both experts’ opinions and seek its own answers to a particular question. More specifically, in its opinion relating to the starting point for developing DCF projections for the valuation of NHT III, after reviewing the divergent views of both parties’ experts, the Court stated:

This left us with a mess. Anson’s credibility is already shaky at best, see supra pp. 58-60, and his report contains some errors on a cursory review. And Dahl’s report has many inconsistences; he stated he was doing one thing but then in his calculations did something quite different. This inconsistency makes his calculations less reliable and his reasoning less persuasive. See Boltar, LLC v. Commissioner, 136 T.C. 326, 338-39 (2011); Estate of Bell v. Commissioner, 54 T.C.M. (CCH) 1123, 1125 (1987) (no confidence in expert report riddled with math errors). It also means that we ourselves need to figure out a starting point for each of the five groups of songs that Mijac held.

Finally, we found at least one section of the Court’s opinion that did not necessarily address the credibility of the experts in general or the work they performed but, instead, the source of information relied upon in performing one of valuations. More specifically, the Court rejected Anson’s selected input on behalf of the Commissioner as it related to the number of unpublished songs that existed at the time of Jackson’s death, due to a lack of credibility regarding the source of the information. Here, the Court stated:

We believe Anson’s much higher total number of songs is unreliable for several reasons. The sources of his information are unreliable--Wikipedia, an interview that is over two decades old, and a book whose own sources are unclear. Dahl’s source, which is the Estate itself, is more reliable here, and on any close question we can rely more on Dahl simply because he didn’t create the same problems with credibility that Anson did.

The Court’s statements relating to the credibility of the experts and their work is an important reminder to valuation experts that honesty, lack of bias, mathematical accuracy, and the reasonableness of assumptions are all important factors in influencing the Court’s decisions when assessing value.

Takeaways

The Court’s opinion related to the value of certain assets – primarily related to intellectual property – in the context of the Dispute provides many important reminders and to valuation experts and may act as a guide to help experts perform valuations for trust and estate purposes in the future. More specifically, we believe that valuation experts can take away the following guidelines:

- The decision to rely upon historical financial data versus management projections when forecasting future cash flows should be determined on a case-by-case basis, determined by the facts and circumstances of each valuation. Particularly, in situations where the dynamics of an industry are changing, management forecasts may be more reliably than historical results.

- The Estate’s experts valued NHT II and NHT III on a C corporation basis. No adjustments were made to account for the different tax attributes associated with pass-through entity status. The Court found the assertion that the most likely buyer would be a C corporation to be unpersuasive, citing this point as the reason it rejected tax affecting. While the Court acknowledged the conceptual mismatch between applying a C corporation derived rate of return to pre-tax cash flows, by rejecting tax affecting, it accepted this flaw in its decision. Prior tax court decisions have also consistently rejected the concept of valuing pass-through entities like C corporations where no adjustment was made to account for the tax differences between these types of entities. By stating that the tax affecting issue is a fact-based exercise, the Court has apparently left some leeway for future decisions on this issue. Our view is that an analysis of the tax differentials between C corporations and pass-through entities would have provided the Estate’s experts more solid footing.

- The reliance on information that is known or knowable as of the valuation date continues to be a standard that valuation analysts must keep at the front of their minds as they make decisions regarding their chosen sources of information and the selection of inputs and assumptions presented in their valuations.

- The credibility of the valuation experts generally – along with their specific selection of assumptions and information sources, the accuracy of their calculations, and their verbal statements relating to those calculations – were influential in the context of the Court’s opinion. A lack of credibility by one expert can cause the Court to move away from reliance on that expert’s opinion towards the other’s party’s opinion.