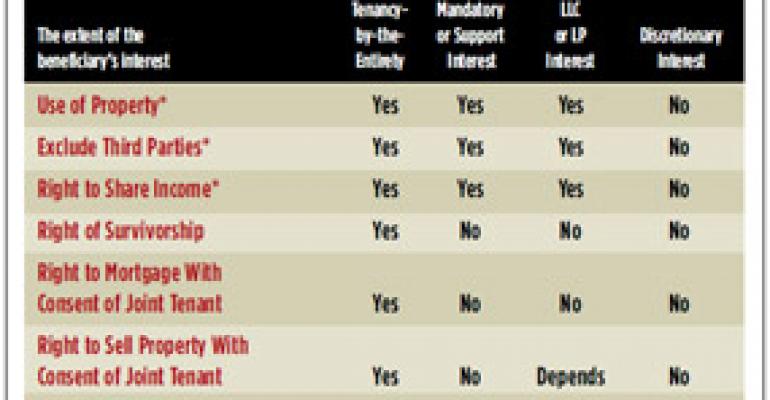

Is there such a thing as bulletproof asset protection against federal claims? Many estate planners say “yes” and advise their clients to use or rely on certain techniques and tools like state exemptions, tenancy-by-the-entirety property rights, limited liability company (LLC) interests or beneficial interests in trusts. But many of these same estate planners offer their advice based on two mistaken assumptions: first, that state law defines what a property interest is, and second, that all

All access premium subscription

Please Log in if you are currently a Trusts & Estates subscriber.

If you are interested in becoming a subscriber with unlimited article access, please select Subscription Options below.

Questions about your account or how to access content?

Contact: [email protected]