It takes a little time for me to brew coffee in the morning. If I’m up too early for the morning newspaper delivery, I usually cozy up with a few technical charts while waiting for my first Java jolt. Today, I pored over the pictures of the gold market, including those of the SPDR Gold Shares Trust (NYSE Arca: GLD).

GLD hasn’t gotten much play in the press recently. Not directly, at least. Everybody seems fixated on the strength of the U.S. dollar and the low yields on Treasury debt.

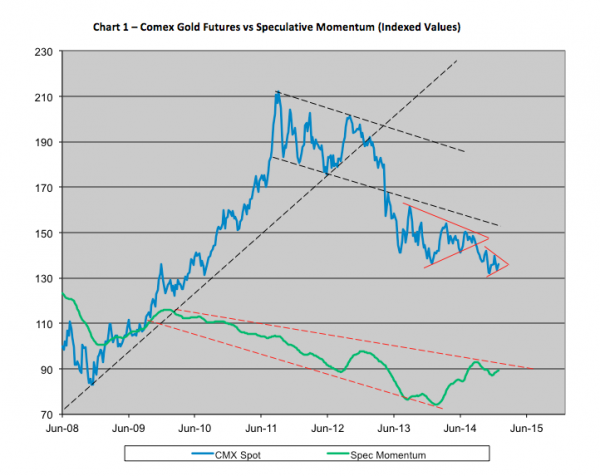

Partly, that’s because GLD’s been sort of stuck. It’s that fact that attracted me to its chart and that of its analog, Comex gold futures. Take a look at Chart 1. It’s a snapshot of the weekly price momentum (though not the actual price) of the Comex front-month contract. Notice the wedge formations?

Those are preludes to breakout moves. Gold broke down from the big wedge in early September 2014. A month later, with bullion $50 lower, the smaller wedge started to take shape.

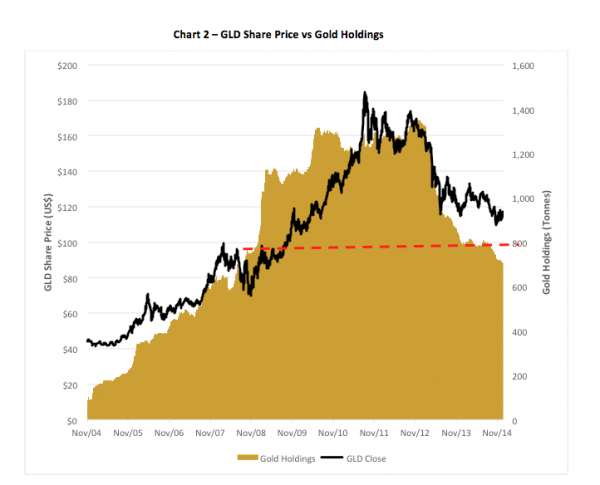

And GLD? Pretty much the same thing. You get a better sense of gold market dynamics by looking at the current redemptions in the gold trust (Chart 2). In the past month alone, holdings have fallen by nearly 12 percent.

While bullion’s been leaving the trust, money flows have stepped up in secondary market trading for GLD shares. That, to a point, should be expected after year-end book squaring. Nonetheless, that’s fuel for future market action.

Here’s the bottom line. Nothing really happens ‘til GLD breaks out of its recent trading band. That means $119 on the upside or $109 below (the ETF now trades at the $117 level). If buying or shorting GLD isn’t your cup of tea, er, coffee, you can straddle the GLD market with options. At-the-money March contracts can be purchased for less than $650 now. The option package yields expiration breakevens around $123 and $110, but could produce profits at less far-off prices if GLD moves soon.

For me, the sooner the better. I don’t want my coffee to get cold.

Brad Zigler is former head of marketing and research for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.