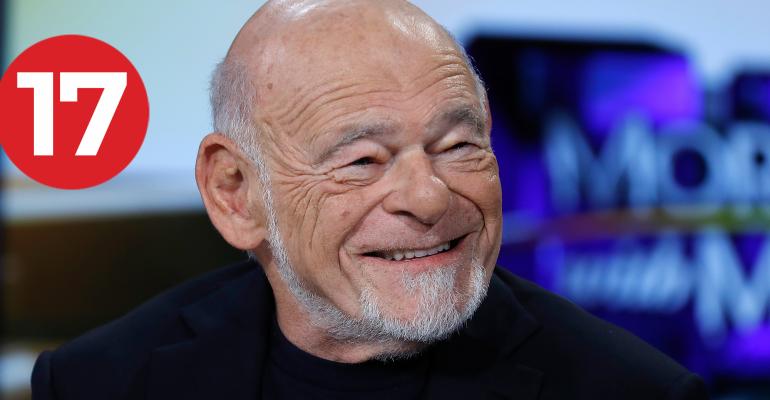

- Billionaire Real Estate Investor Sam Zell Remembered for Revolutionizing His Industry “After emerging as one of the nation’s wealthiest real estate investors, Zell embraced his rebellious reputation, traveling the world by motorcycle with a group of friends known as ‘Zell’s Angels.’ Zell, who married three times, also was known for publicly calling out politicians and economic policy makers, often in blunt, foul language.” (CoStar)

- Sam Zell, contrarian billionaire real estate investor, dies “He threw himself into real estate and stitched together a serious portfolio, including a collection of 573 office buildings he held under Equity Office Properties Trust. In one of the most consequential business deals of the generation, he sold Equity Office to Blackstone Group in 2007 for $39 billion — at the time the largest private equity deal in history.” (The Real Deal)

- Sam Zell, 81, Tycoon Whose Big Newspaper Venture Went Bust, Dies “Unlike Donald J. Trump and Harry Helmsley, who used their names on trophy properties and as self-promotion, Mr. Zell was relatively anonymous for most of his career, known largely in financial and real estate circles as an audacious investor whose vision — to create a national brand — did not materialize because real estate sales are largely local.” (The New York Times)

- Sam Zell, elfin figure who became a billionaire ‘dancing on the skeletons of other people’s mistakes,’ dies at 81 “The Chicago-born son of Polish refugees, he built a fortune in real estate and a hodgepodge of investments that included radio stations, drug stores, parking lots, mattresses and Schwinn bicycles. He amassed a net worth of $5.9 billion, according to the Bloomberg Billionaires Index.” (Fortune)

- Sam Zell, Architect of Modern REIT Era and Former Nareit Chair, Dies at 81 “Nareit President & CEO Steve Wechsler described Zell as the principal ‘architect and progenitor of the modern REIT era, with a vision that few had and one that has truly come to fruition. It’s proved his far-sightedness, came about through his diligence and doggedness, benefited from his creative spark, and underlined his will to achieve as well as his ability to overcome barriers.’” (Nareit)

- Sam Zell’s Saltiest Moments, as Chronicled by Observer “When the subject turned to the advertising market, Mr. Zell asked, ‘What ad market?’ Mr. Quintanilla clarified that he meant newspaper advertisers, which prompted the outspoken Mr. Zell to bark, ‘I’m trying to find one of ’em!’” (Observer)

- Debt Default Could Prove Catastrophic for Commercial Real Estate: Here’s Why “And because of the interconnection between Treasurys and the global financial system, commercial real estate executives at even the largest firms are bracing for unprecedented disruption in capital markets if the creditworthiness of Treasuries is called into question by the nightmare of default.” (Commercial Observer)

- Mathrani's 'Total Shock' Departure From WeWork Drives Investor Confidence To New Low “In Goldfarb’s note to investors Tuesday night, which he said he had to quickly rewrite after the announcement, he wrote that the resignation so soon after an investor roadshow was ‘certainly a first’ in his two decades on Wall Street. But, the note added, ‘We believe in the vision and strategy Sandeep laid out. The question is whether the interim and, ultimately, permanent CEO can generate the same trust in execution.’” (Bisnow)

- Regency Centers to Acquire Urstadt Biddle in All-Stock Deal Worth $1.4B “Regency Centers and Urstadt Biddle Properties, both of which grocery-anchored neighborhood and community centers, have entered into a definitive agreement in which Regency will acquire Urstadt Biddle in an all-stock transaction, valued at $1.4 billion, including the assumption of debt and preferred stock.” (GlobeSt.com)

- Top 10 rankings shift… a little “The top three global fund managers remain as they were in 2021, though individual AUM has increased substantially. Blackstone leads the field (€475 billion), followed by Brookfield Asset Management (€246 billion) and Prologis (€183 billion) in third position. Nuveen (€145 billion) moved up from fifth to fourth place, while MetLife Investment (€138 billion) claimed the fifth spot – replacing PGIM which moved to eighth position.” (INREV)

- Disney Pulls Plug on $1 Billion Development in Florida “On Thursday, Mr. Iger and Josh D’Amaro, Disney’s theme park and consumer products chairman, showed that they were not bluffing, pulling the plug on a nearly $1 billion office complex that was scheduled for construction in Orlando. It would have brought more than 2,000 jobs to the region, with $120,000 as the average salary, according to an estimate from the Florida Department of Economic Opportunity.” (The New York Times)

- Signature Bank’s CRE Head Joseph Fingerman Laid Off With 11 Key Team Members “The $60 billion sale of Signature Bank’s loan portfolio is expected to commence shortly, but roughly 12 key members of its commercial real estate originations team were just laid off and given a last day of May 31, sources familiar with the situation told Commercial Observer.” (Commercial Observer)

- NYC is sinking under the weight of its buildings, geologists warn “New geological research warns that the weight of New York City’s skyscrapers is actually causing the Big Apple — whose more than 1 million buildings weigh nearly 1.7 trillion pounds — to sink lower into its surrounding bodies of water.” (New York Post)

- The CRE CLO Repurposed: Part II “I forgot something important: The use of CRE CLO technology as an alternative to the sale of CRE assets by lenders either needing capital relief or relief from excess concentration in CRE exposures.” (JD Supra)

- SL Green, Vornado plan office sales despite dreadful market “SL Green Realty and Vornado Realty Trust are planning large-scale asset sales this year — a move others are resisting. But with their stock prices plummeting and debt costs mounting, both New York-focused REITs are under pressure to buy back shares and shore up their balance sheets.” (The Real Deal)

- The mall's new proposition “As we continue to experience consolidation among retail real estate venues and as weaker malls and shopping centers are repurposed, there is a new calling for the strongest brands to join the strongest centers and maximize foot traffic and sales.” (Chain Store Age)

- In a Turbulent Market, Know Your Lenders “Pain has already been felt, but not in equal measure for all. Those who invested conservatively in the years leading up to this cycle shift are still thriving as there is an abundance of debt liquidity available for prudent real estate owners.” (Commercial Property Executive)

0 comments

Hide comments