As the late afternoon sunlight casts shadows through the lecture hall, a handful of students at William Paterson University in Wayne, N.J., watch their professor fill a whiteboard with the words “broker,” “wirehouse,” “insurance,” “RIAs” and “suitability.”

“Has anyone heard of the fiduciary standard before? What is a fiduciary standard; what does that mean?” asks Lukas Dean, a professor and director of the financial planning program at William Paterson, to the 17 students gathered in a lecture hall built for twice as many. “The goal is to cover the financial advice industry and to help you understand the regulatory framework.”

That’s often a challenge for professionals, but the students in Dean’s class are comfortable with the topic. To some, these kids are the future of an industry still trying to define and legitimize itself as it moves away from a sales-based model. Michael Cerone, a transfer student to William Paterson, had some doubts before deciding to declare his major. “I love the investment aspect of it, but I knew I didn’t want to be a stockbroker,” he says.

Indeed, making financial planning a viable academic pursuit for undergraduates is meant to overcome one of the industry’s big obstacles: the fact that young people just don’t seem that interested in joining it. Consider that only 11 percent of all financial advisors were under the age of 35 in 2013, according to data from Cerulli Associates. More advisors retire every year than are replaced.

“We talk about the next generation within the industry, we talk about the need for the next generation to come in as successors, but all that dialogue is in the industry and not on the university campus where the future candidates are,” says Craig Pfeiffer, founder and CEO of Advisors Ahead.

Yet even on campus, Pfeiffer admits, demand (and support) can seem frustratingly lackluster. Programs suffer from lack of recognition and are often placed in the more remote academic outposts. While there are no clear all-encompassing numbers, college programs graduate an estimated 600-2,500 students in a financial planning-related field each year.

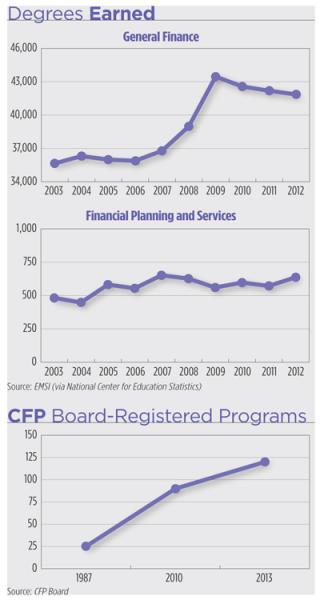

Dean puts the number closer to 750. According to data gathered by EMSI from the National Center for Education Statistics, only 637 graduates actually earned a degree specifically in financial planning in 2012. Moreover, the number of students earning this degree has remained relatively flat in recent years. (See chart) Consider that Merrill Lynch alone has 3,500 recruits in its training program annually.

Of course many are earning degrees in other disciplines while taking financial planning courses. A vast majority of the college programs have registered with the CFP Board, which provides curriculum and scholarship requirements to the schools in exchange for the board’s stamp of approval. They started with 25 programs in 1987, just two years after the organization’s creation. Today, there are over 360 registered programs, including certificate, baccalaureate, master’s, and doctoral programs. The number of baccalaureate programs alone has grown from 90 in 2009 to 120 in 2014, with 52 additional programs currently in development.

Yet the number of students has stayed relatively flat. Of the colleges that offer a financial planning curriculum, Pfeiffer estimates that half have 10 or fewer students enrolled. Only a handful have more than 100.

Even new areas of study, such as homeland security and computer game design—both of which didn’t exist 10 years ago, according to financial aid website FastWeb—are gaining traction at much faster rates. Over 150 colleges now offer computer game design degrees, including Massachusetts Institute of Technology’s Game Lab and related programs.

“In other professions, such as accounting, corporate finance, portfolio management, the gaming industry, there are clear roadmaps to success and far fewer barriers to entry for new professionals,” Pfeiffer says. It’s easier to rapidly build a college program if administrators understand the degree, know there is industry support and see a clear career path for students after graduation.

What, Exactly, Is Your Major?

When a student graduates with a bachelor’s degree in accounting, they’ve usually attended classes within the university’s business school and studied taxes, financial analysis and general business. There’s no such assumption in financial planning, as the programs vary school-to-school.

Out of the 120 baccalaureate programs registered with the CFP Board, less than a dozen offer a bachelor’s degree specifically in financial planning or personal financial planning. Instead, many students graduate with diplomas in business administration, finance, economics and business studies. In at least one case, the program leads to a degree in agricultural economics.

In fact, a majority of these financial planning programs are not even housed in a business school. Texas Tech University’s program is housed in the College of Family and Consumer Sciences. Part of Virginia Tech’s program is in the Department of Agricultural and Applied Economics. And these are among the best financial planning programs in the country.

“These programs are not positioned in the right place—they should be in the business schools, but they’re not,” says Nexus Strategy President Tim Welsh.

Why do they need the halo of the business school for legitimacy? “The biggest issue is awareness. I just don’t think a lot of students know this career path exists,” says former Financial Planning Association President Michael Branham. “If you look at where these programs are at Texas Tech and others, they’re not in the business school or finance programs. Students might not even know that this type of program exists—it might not be appealing to them because it’s outside the business school.”

There’s certainly an advantage to placing a financial planning program within a business school, Dean says. It attracts students with a predisposed interest in money management and finance. His program is based within the university’s Cotsakos College of Business; the financial planning bachelor’s of science degree has expanded to 90 graduates annually since launching in 2009. Many are dual majors also earning accounting or business administration degrees.

So why aren’t more financial planning programs taking advantage of being in a business school? Historically, business programs were not at all interested in personal or household finance, says University of Georgia Professor John Grable.

“Most business programs talk about corporate finance, but never address personal or household finance,” he says. Business schools also tend to consider personal finance to be a less significant degree. “There’s definitely a pecking order at universities in terms of majors,” Grable says.

The real problem is that the universities still think of the work as more a trade than a profession, Pfeiffer told an industry conference last month. “The academic principles in the schools of business won’t allow them in.”

“They’re in the school of agriculture and economics and they’re in the school of humanities because (those schools) have more tolerance for bringing in this kind of external, or around-the-edge type of curriculum,” he says.

The CFP Board is trying to change that as one of the only institutions attempting to design a shared body of knowledge that would be the basis for a professional degree. To be sure, more programs are starting in the business departments, says Charles Chaffin, the director of academic programs and initiatives at the CFP Board. “That’s where it’s trending towards.”

Show Me the Money

Another issue is funding. Where other majors see millions in donations, grants and scholarships from degreed professionals, financial planning on a whole has been left to fend for itself in the university system.

Even at the top schools, financial backing from the industry is lackluster. Texas Tech, arguably the most well-known program, receives just $300,000 a year in cash donations, according to Associate Professor Deena Katz.

Most programs don’t even see a fraction of that level of funding. In the past two years, William Paterson University received a $50,000 grant, $45,000 in scholarships and $6,250 in student competition cash prizes. The money does more than fund a program, Dean says. It shows support for the program and raises its profile in the eyes of university administrators.

The University of Georgia's program receives less than $10,000 a year from financial services companies. Grable says alum support is also low, noting that a majority of industry leaders are primarily older men who perhaps didn’t go to college. Or if they did, they graduated with a general degree—not in financial planning, Grable says. So when it comes time to make a donation, they generally send to their alma mater and not a financial planning program. “That will never actually make an impact for financial planning,” he notes.

At Virginia Tech, which has more than 125 undergraduate students, Assistant Professor of Practice Derek Klock says the school does not have any corporate donors who have stepped up to fund scholarships, faculty or programs. “The vast majority of our ‘donor-based’ money is from individuals—either alums or people who have hired our grads,” Klock says. The support has allowed the school to provide a few, small scholarships.

Ron Rhoades, former NAPFA president and a professor, occasionally donates a speaking fee to help support his program at Alfred State University, which has 30 students.

“Financial services needs to find better ways to support NextGen advisors,” Rhoades says. It doesn’t cost a lot to run a financial planning program, he adds, but industry support helps elevate the importance of a degree.

There is some indication the industry is starting to step up. TD Ameritrade Institutional launched the NextGen Grant Program last year, pledging to award over $1 million in grants and scholarships over the next 10 years. The program awards $50,000 annually to an established financial planning program, $25,000 to a university with an emerging program and up to 10 student scholarships. In 2013 the program awarded $50,000 to William Paterson’s program and $50,000 to 10 students.

Technology vendors, such as MoneyGuidePro, are also helping these programs by providing free software. This year, MoneyGuidePro provided 65 universities access to its software, with plans in place to increase that to 100 universities by next fall. The company is also partnering with other technology vendors such as RedTail, Orion and Laser App, to bring additional resources to campuses. “We want young financial advisors to embrace our philosophy that clients deserve comprehensive financial plans,” says Will Gilfillan, head of the company’s educational licensing program.

The bulk of any additional funding comes in the form of donations or scholarships sponsored by local financial planning firms, as well as FPA chapters. The Central California FPA chapter sponsors a $500 scholarship annually, while the FPA of Greater Kansas City also provides several yearly scholarships, the amount of which varies.

Scholarship website SchoolSoup.com lists less than 50 scholarships for financial planning majors, with most only worth a few thousand dollars at most. In addition to individually sponsored scholarships, many are provided by community banks, as well as insurance companies like MassMutual and State Farm. Meanwhile, other degrees like Chemistry have almost 2,000 scholarships listed, several providing tens of thousands of dollars in aid.

“Maybe part of it is our fault,” suggests Kansas State’s Director Ann Coulson. “We haven’t asked. We haven’t made a concerted effort.” Coulson says that the university programs need to learn to ask for funding—not just scholarships and internship opportunities for their students.

A Profession? Or a Trade?

Part of the problem lies in the perception of the industry as a trade, rather than a profession. For lack of any other institution granting legitimacy to these programs, the CFP Board is, in a sense, a de facto accreditation group. The curriculum taught at the degree programs must be based, in part, on the CFP exam in order to be registered, so the schools act as a funnel of students to the designation.

“Institutions are looking for third-party validation of their programs of study across all disciplines,” Chaffin says. “This validation, coming from CFP Board as program registration, offers oversight as well as suggestions designed to improve program sustainability and student achievement.”

“The CFP Board is the right sanctioning body for programs that are going to be developing people to take the CFP exam,” Pfeiffer says. “But that’s different than the industry having a consortium of the many stakeholders—an independent body to promote the professional financial advisor performing in any channel—sanction these programs.”

There already is a process for the regulators to supervise the business, he says. Instead, the industry needs a governing organization that is going to educate and attract candidates to the business and condone these programs based on industry-wide standards, Pfeiffer says.

The CFP Board keeps standards admirably high. It requires universities and colleges to provide a four-year program for undergraduate degrees in financial planning, with a minimum of 15 hours worth of coursework. Recommended coursework encompasses 78 topics that are seen as necessary competencies, including financial planning fundamentals, estate planning, taxation, insurance planning and securities analysis, among others.

Faculty should have appropriate graduate degrees or, alternatively, a CFP certification and a bachelor’s degree in a related field, according to the CFP Board registration criteria. Finding advanced degree holders can be difficult: There are only five schools registered with the CFP offering Ph.D.s in financial planning. Schools must submit a 50-page application to the Board for review.

But what if a school fails to requalify and the Board refuses to approve the program? Not much. “When students choose this major, it’s not because it’s a Board-certified program,” says Purdue undergraduate Academic Advisor Margaret Story, noting she suspects student enrollment would not significantly drop as a result. While registering with the Board makes the school accountable to a higher set of standards, Story says that there’s little practical impact on students and their potential job prospects. “They can go on the good graces of Purdue’s name.”

The University of Georgia’s director agrees, saying if it lost its registration with the CFP Board, there wouldn’t be any consequences for students. “They would still be hired with or without it,” Grable says.

Almost 70 percent of students with a bachelor’s or master’s in financial planning had not yet taken the CFP exam, according to an August study conducted by the Board and San Diego State University of over 500 students.

Part of that low percentage may be the $600 cost to take the exam, as well as review courses that cost from $800 to $1,000, and the fact that the students need three years of full-time experience.

“The reality is, Wells Fargo, Merrill Lynch, Morgan Stanley, UBS, Edward Jones and Raymond James will hire a student with or without a CFP, so what’s the incentive?” Grable says.

Regardless of where the structure comes from, proponents of advisor education say more attention has to be paid to colleges and universities as a source of educated planners that share a common body of knowledge and standards. “We’re in the very early stages of a dramatic expansion. There’s never been more people, more investors, in need of quality financial advice from a qualified professional,” Pfeiffer says.