There is an inescapable truth that exists in the RIA community. The fact is, an overwhelming majority of advisory firms want to buy another firm. Their desire to grow inorganically is the same, whether they have $2 billion, $200 million or $25 million of assets under management. Where does this desire come from? We like to refer to it as the “Buyer’s Bias,” which is comprised of a series of factors that support the notion that along with being human, advisors are vulnerable to human biases.

The Supporting Data

Each year, we analyze the aggregated data of completed subscriber profiles within the RIA Match database to measure goals and trends within the marketplace. Last spring, out of 800 completed profiles, 41% selected “merge” as a goal. Compare that figure to this year’s analysis, which indicated 37% of 1,130 completed profiles intended to merge, and you’ll find this level of interest noteworthy. Much can be inferred from this data point— we normally think of inorganic growth from acquisitions, a tuck in from wirehouse breakaways or an independent broker-dealer (IBD) hybrid migrating to the fee only space. Merger interest is a different flow. This movement between RIAs is a sign of the high demand for experienced talent against the backdrop of the talent shortage and the desire for inorganic growth as the challenges of organic growth bear down upon advisory firms.

The IKEA Effect

Why are most independent financial advisors buyers? There is actually a good explanation for this, backed by extensive research by behavioral economists. In Dan Ariely’s book, The Upside of Irrationality, he discusses these findings.

Think about the times you’ve toiled away at assembling a Do-It-Yourself project, such as a dresser for your daughter’s first apartment. The instructions are never quite right and the collections of screws roll around the floor as you try to steady the pre-cut pieces and screw them together. You finally get it done and you stand there, proud of your work. The pride of creation and ownership runs deep in human beings. We are proud of our creations, whether it’s a DIY project or the advisory firm we built from the very first client.

The effort that a business owner puts into creating their firm does not merely impact the bottom line. The sweat and tears poured into every aspect of the business changes the way the owner evaluates the firm. This bias is why advisors tend to overvalue what they build; why they lose their ability to be objective.

Loss Aversion and the Endowment Effect

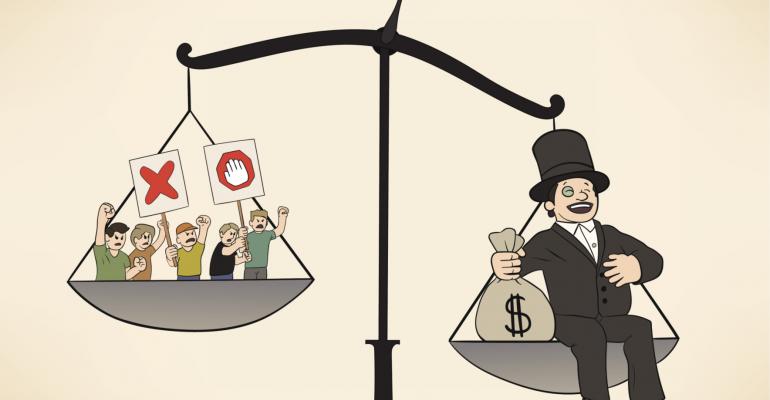

Loss aversion means that our emotional reaction to a loss is about twice as intense as our joy at a comparable gain. Finding $100 feels pretty good, whereas losing $100 is absolutely miserable. Money that is gained and then lost has a higher psychological impact than money we never had in the first place.

Once you have built a firm, you don’t want to risk losing it or selling it. The pain of the loss is twice as intense as the joy of the sale.

This is called the Endowment Effect; we get used to owning something and it becomes the baseline by which we judge future gains and losses. Once ownership is established, people become biased and tend to overvalue the item—in this case, their firm. We focus on what we could potentially give up, much more than what we could gain. When considering a transaction, regardless of what the most advantageous choice would be from an objective economic viewpoint, we have a hard time letting go.

FOMO - Fear of Missing Out

Fear of Missing Out is a function of regret— when we evaluate our happiness not just from where we are, but where we could be. If you are close to your goal but you miss it, you have great regret. You imagine the alternative reality and you feel the loss of missing out. Comparatively, if you miss your goal by a larger margin, the regret seems less because you couldn’t have imagined closing the gap.

There was a study of Olympic winners and their happiness levels. The Bronze winners were more grateful to be on the podium and the Silver medalists regretted not getting the gold. Similarly, most advisors tend to hold out for the gold, for fear of getting less.

How to Overcome the Biases

These are biases that come with being human, and which play a role in how we approach M&A in the advisory space. Knowing they are in most cases inevitable, there are systematic ways to overcome the biases, to make good decisions about the sale, purchase or merger of our firm. Daniel Kahneman, author of Thinking Fast and Slow, creates a framework for understanding how we make decisions. Kahneman proposes that human beings have two modes of processing information and making decisions—System 1 is automatic, instinctive and emotional; where our cognitive biases live. System 2 is slow, logical and deliberate thinking and it is here that advisors should put their processes.

Most importantly, find advisors that share your philosophy and culture. Get to know them, put System 2 thinking to work and maybe a future is there for you together— even if you are both buyers.

Kathleen Asack is Founder and Principal of AmplifyRIA. Mary Ann Buchanan is CEO and founder of RIA Match.

Asack and Buchanan recently launched RIA Match Concierge Consulting, which combines the advisor database of RIA Match with AmplifyRIA's M&A consulting.