Brokerages have an outmoded and inefficient way to train new advisors. The high expense and low success rate of broker trainee programs is increasingly problematic for branch managers, who must continually find new talent.

Wall Street broker/dealers hire only about four to five percent of the prospective rookies who apply for a job, according to Andre Cappon, head of the CBM Group, an international industry research and consulting firm. But that doesn't lead to success. “Less than 20 percent of these hires, who cost as much as $300,000 to fully train, survive past year two or three of a four-year training plan,” Cappon says.

As a result, most firms have scaled back these programs, pinning their hopes instead on recruiting established teams of veterans. But with many top advisors aging out of the business, and countless others bound to their firms by golden handcuffs, B/Ds realize something must be done to prevent an advisor shortage, Cappon says.

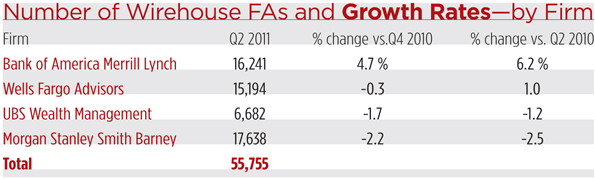

According to Cerulli Associates in Boston, the number of FAs industry-wide dropped from 334,919 in 2004 to 320,378 in 2010. At wirehouses, the total fell from 60,960 to 50,742. Exacerbating the problem of short supply, in 2011, the average FA’s age was 49.6; and, at the wirehouses, it was 50.6, the firm reports.

“The cost of recruiting high producing advisors is trending dramatically upward, with some advisors getting as much as three times their gross production to switch firms,” Cappon says. “It can take years to get that kind of investment back. So now, firms are looking at their training programs and saying, ‘Let’s give this another shot.’”

But FA training programs have yielded some pretty dismal results in recent years, says Cerulli Associate Director Scott Smith. That's partly because they put a lot of emphasis on just getting trainees into in chairs and having them build a book from scratch via cold calling, etc... “It's not a great recipe for success in this economy,” he says.

Merrill Lynch, however, is on the forefront of changing the traditional model. Over the last 18 months, the firm’s training program has undergone a broad overhaul, with changes to the hiring process, content, training, mentorship and local leadership. The results “should help push the rate of trainees who successfully get licenses and then graduate from the program from 41% to 50%,” says Dwight Mathis, the firm’s head of New Advisor Strategy. (‘Graduating’ requires 7-months of early development, followed by three years of formal practice management training, he says.)

“A 50% trainee graduation rate has never been accomplished inthis industry,” says Mathis. “And, we think we can achieve it.” Merrill is on target to add 2,500 new advisors this year (a number supported by a recent Reuters report), just as it did in 2011.

While UBS, Wells Fargo and Morgan Stanley Smith Barney would not provide their advisor trainee numbers or graduation rates, MSSB and Wells Fargo also acknowledged the importance of revamping their training programs.

“While we’ve had a good deal of success recruiting and retaining experienced FAs,” said Anthony Mattera, a spokesperson for Wells Fargo Advisors, “we also recognize the need to address an older FA population and potential shortage. Our FA training program is integral part of our recruiting effort, and one of the ways we’re working to increase the diversity of our FA workforce and to attract career changers.”

Mathis points out that Merrill Lynch has had advisor training programs in place since 1946. “The firm’s emphasis has always been more on hiring and developing our own trainees than on recruiting FAs from other firms,” he says. “We’ve always led the way when it comes to hiring and training our own.”

An industry recruiter, who asked not to be identified, said that indeed Merrill has been “virtually out of the recruiting game” compared to the other wirehouses in recent years. Tom Fickinger, Head of Advisor Growth and Development at Merrill Lynch., says “Our priorities for building a workforce are 1) growing the business of our core advisors; 2) hiring and developing new trainees; and 3) then selectively recruiting from the competition. We think it’s a better way to build a culture,” he says. “Our average recruit transitions more than 100% of his assets in his first two years—which we also believe the top rate in the industry.”

As for the training program overhaul, Mathis says, “Historically many of our top performing complexes had up to 75% graduation rates, while others underperformed the national averages. So, we’ve been implementing measures to reduce that variability and standardize our best practices. We’ve made a significant investment over the last year and a half to make sure our strategy is successful.”

This includes a more structured training phase—particularly around the licensing program, course content emphasizing consultative sales skills, activity-based executive coaching, and formalized adoption of certified financial planner (CFP) curriculum, he says.

“We’ve also put one executive who is exclusively focused on the program in each market,” Mathis says. “And, we’ve established a formal mentorship program for the trainees. Each mentor is compensated and recognized for the success that the trainees achieve.”

What’s more, the firm has put increased emphasis on selecting high achievers for its training programs (Merrill’s average trainee is 36 years old, Mathis says), such as students from the tops of their classes, highly-decorated military veterans, etc. “We’re putting less influence on people with ‘sales’ backgrounds,” he says, “because we’ve found that salespeople who are actively looking for work have often not been successful at it.”

“This industry is getting smaller, and we don’t think ‘trading players’ is the where the future lies,” adds Fickinger. Currently, almost 80% of Merrill Lynch’s business is generated by advisors who began their careers at the firm, he says.

Inthe past, Smith explains, the metrics BoMs were held to were simply too short-term-based to get them to focus much on new hire training. “It’s easier to boost AUM and GDC in the short term by recruiting a $100M team,” he says. But, that pool of prospects is shrinking every day, he says.

“Strategically pairing a solid trainee with a high level producer can create a lot of added value for both parties,” he says. Tenured advisors sometimes need to be reminded that their most productive efforts are spent in front of clients, not in the office, he says. Adding a new member to the teams can help get the advisor back on track with client contacts, while the junior advisor learns by ‘doing’.

”Ifa BOM notices a top-producing FA’s numbers slipping, that could be a great opportunity to introduce the idea of building out a team with trainees,” he continues. In fact, he says, BOMs are at an excellent vantage point from which to match trainees with experienced FAs for the best results.

“Remember, BoMs used to play a very pivotal role in training a firm’s new advisors on the day-to-day level,” Cappon says. “Now, their numbers have been cut drastically, and that’s affecting the success rate of trainees. Managers with less time to train can still improve their success rates by pairing them with the right seasoned veterans.”