Empire may be the most blatant example, but there is a lot that can be learned about wealth management -- good and bad -- from watching television. From Downton Abbey and Game of Thrones to Grey's Anatomy, the plots of multiple popular shows are dealing with real-life financial issues, writes Dian Vujovich for the Palm Beach Daily News. The shows were used as teaching moments at the recent 2015 Tiger 21 Annual Conference at the Breakers resort in West Palm Beach, Fla. Among the recurring wealth management themes driving television drama: The responsibilities that come with marrying into a lot of money, as well as marrying outside of your economic class.

Crowdfunding Your Way to Alternatives

There’s yet another new tech startup that aims to bring hedge fund and private equity investments to the masses, according to a recent AlleyWatch article. Private placements, of course, are often inaccessible to smaller investors. But Artivest pools investors’ assets into a single, special-purpose vehicle that will then invest in a private fund. The firm recently raised $15 million in funding lead by private equity firm KKR & Co. Advisors can plug into the company’s network of funds and monitor these investments online through the advisor dashboard.

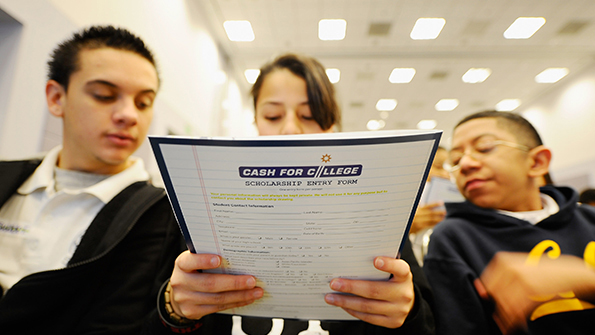

According to Edward Jones, two-thirds of Americans don’t know what a 529 plan is, so the National Associate of Student Financial Aid Administrators is naming Thursday “529 Day." Its celebrating by dispelling popular myths about the plans. For instance, NASFAA said it isn’t true distributions from a college savings plan would restrict eligibility for financial aid because it is an asset, and not income. It also isn’t true state-based 529 plans limit borrowers to in-state public schools. Finally, it’s false the federal government can tax earnings from a 529 plan: Although contributions are non-deductible, earnings in the plan grow tax-free and cannot be taxed when used to pay for educational expenses.

Using social media could be risky business for your finances, according to new research out of Australia. A report from the Herald Sun says that Facebook users who invest or gamble in the moments just after going through their news feed are more irresponsible with their money. According to Dr. Eugene Chan, a marketing expert from Sydney, Facebook users should postpone their real world financial decisions for up to an hour after checking their feed. Chan also noted that businesses might take advantage of the momentary higher risk tolerance with well-placed advertising. A similar impact from the use of LinkedIn or Twitter cannot be ruled out, Chan said.