Regular readers of this blog know how fond I am of Leuthold Group's research. This month, Leuthold's PR man, Ben Bishop, of the Lowe Group, sent me this interesting precis of this month's research. One hint: Low volatility strategies suck.

Regular readers of this blog know how fond I am of Leuthold Group's research. This month, Leuthold's PR man, Ben Bishop, of the Lowe Group, sent me this interesting precis of this month's research. One hint: Low volatility strategies suck.

Leuthold Group’s Green Book has been published for March. A few highlights:

1. Eric Weigel (Director of Research) examines the increasingly popular low-volatility equity strategies and concludes low volatility strategies are incredibly defensive and massively underperform in up equity markets - not optimal as standalone equity strategies unless one has a very bearish view of equity markets. The attached chart shows the returns spread of low volatility to high volatility stocks since 1990.

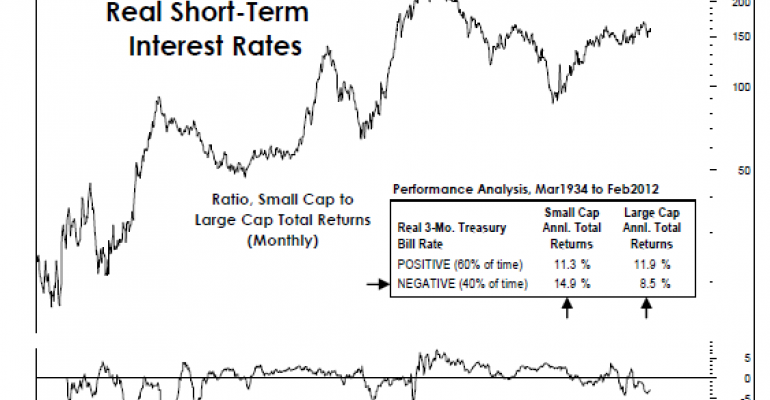

2. Doug Ramsey (CIO) looks at large versus small caps - in what may be the early stage of 4-5 years of large-cap dominance. See the attached chart -- ALL of historical small-cap outperformance has occurred when real interest rates are negative. But despite "fighting the Fed," Leuthold predicts large-cap outperformance.

3. Chun Wang (Research Analyst) writes about bond market risk remaining low. Leuthold is cautiously optimistic and recommends spread sectors. U.S. credit is improving while Europe deteriorates and rates are expected to remain in a range.