Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Angie’s List (ANGI) is in the Danger Zone this week. The customer review website is playing investors, and even its own customers, for fools. Angie’s List charges members for a service that sites like Yelp (YELP) and the Better Business Bureau offer for free. If ANGI can’t provide more accurate and impartial ratings, consumers have no reason to pay for their service. I am not sure that consumers will use ANGI’s ratings at all in the not-too-distant future. I am convinced the stock price implies usage and payment for usage that is far from realistic.

Reviews or Advertisements?

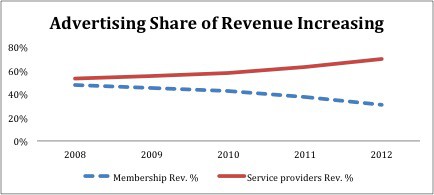

Angie’s List refers to itself as a “consumer-driven organization”, but a quick look at its revenue breakdown reveals that is far from the truth. In 2012, 69% of ANGI’s revenue came from advertisers. Figure 1 shows how advertisers have steadily become more important, and consumers less important, to ANGI’s business.

Figure 1: Service Provider Revenue vs. Membership Revenue

The company can try to claim that these advertisers don’t have any say in reviews, but there is quite a bit of evidence to the contrary. NBC affiliate channel 12 in Richmond, VA did a little digging into Angie’s List and found that lower rated companies can bump themselves up to the top of search results by paying extra money. In one case, the top rated heating & air company showed up 12th on a list of search results because they wouldn’t pay the $12,000 to $15,000 required to move up the list.

Customers are taking notice of these misleading practices. For a company that offers customer reviews, ANGI gets plenty of bad reviews of its own. A small sample of these bad reviews can be found here, here, and here. Even service providers have issues with ANGI.

With all these complaints, it’s hard to see how ANGI can keep convincing consumers to pay for a service they can get elsewhere for free.

Where Are the Profits?

ANGI has been in business for 18 years, and it has never made a profit. Despite growing revenue by 73% in 2012, ANGI’s operating loss (NOPAT) actually increased from $44 million to $50 million. The company is wholly reliant on debt and equity to finance its operations.

With less than 5 million unique visitors a month—Yelp gets over 25 million—ANGI relies on being able to squeeze as much money out of its members as possible. Unfortunately, competitive pressures have made that strategy difficult to carry out. From 2009 to 2012, ANGI’s revenue per member decreased from ~$50 to ~$25. Customers are becoming less willing to pay a lot for a service they can get for free. Pretty soon, they may not be wiling to pay at all.

Overpriced

ANGI would be dangerous at any price given its complete lack of profitability and shaky business model. However, the stock has been swept up in the social media bubble and has risen nearly 120% over the past year. It has gone from being just a bad company to being a dangerously overvalued stock also.

For ANGI to justify its valuation of ~$21/share, it would need to grow revenue by 25% compounded annually for 15 years and achieve return on invested capital (ROIC) of nearly 40%. Google (GOOG) earned an ROIC of 34% in 2012. Note that less than 4% of S&P 500 companies have an ROIC higher than 40%.

ANGI has a long way to go to reach breakeven. A valuation that implies it will become nearly as efficient and profitable as Google while also growing at 25% for 15 years should be a huge red flag for investors.

Insider Selling

Company insiders appear to agree that the stock is expensive, as they have been unloading their shares to an alarming degree this year. In 2013, investors have sold or exercised options to the tune of 2% of all outstanding shares, 910,000 shares sold in 2013 alone. Insiders have not bought a single share this year.

ANGI looks a lot like a pump and dump designed to benefit insiders at the expense of unsophisticated investors. The company calls attention to its growing membership without mentioning its declining membership revenue or its shaky business model.

ANGI offers investors no moat, no value proposition, and no profits. Furthermore, the momentum in the stock appears to have reversed as it is down 15% over the past 20 days. ANGI definitely represents an attractive short opportunity. Possible catalysts to send it downward include:

1) Slower membership growth as the company’s misleading business model receives more attention and consumers migrate to free services.

2) Declining membership revenue as the company slashes prices to stay competitive.

3) New debt or equity offerings in order to finance an unprofitable business.

4) More selling and options exercised as insiders continue to cash out.

Unless ANGI can reverse its 18 year streak of negative profits, this stock could potentially go all the way to zero.

Avoid These Funds

Investors should avoid the following mutual funds due to their allocation to ANGI and Dangerous-or-worse rating.

1) Morgan Stanley Institutional Fund: Small Company Growth Portfolio (MSSLX, MSSGX, MSSMX, MSSHX): 2.5% allocation and Dangerous rating.

2) David Opportunity Fund (RPEAX, RPFEX, DGOYX, DGOCX): 2.3% allocation and Dangerous rating.

Sam McBride and German Perez Vargas contributed to this report.

Disclosure: David Trainer, Sam McBride, and German Perez Vargas receive no compensation to write about any specific stock, sector, or theme.