To an advisor, their practice is their baby; they’ve raised it to maturity over the last 20, 30 or sometimes even 40 years, put their blood, sweat and tears into it. So much so that when it comes time to let go, an advisor expects that the perfect buyer is going to fall into their lap with a dream offer.

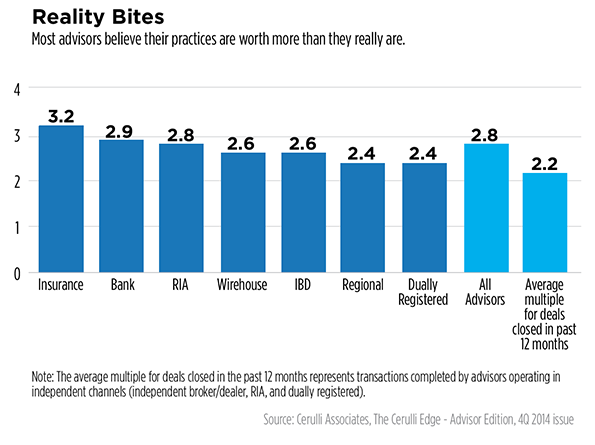

It happens all too often. But then reality sets in. Most advisors probably won’t get as much as they expect when they sell, according to a recent Cerulli Associates report. Across all channels, advisors expect to get 2.8 times revenue. But the average multiple on deals closed in the past 12 months for practices in the independent broker/dealer, RIA and dually registered channels was 2.2 times revenue, Cerulli found. Insurance and bank advisors had the highest expectations for their practice valuations, at 3.2 and 2.9 times revenue, respectively.

Yet, the ratio of buyers to sellers would indicate a seller’s market. In a recent Financial Services Institute survey of 2,300 advisors, nearly a third of advisors (29 percent) plan to buy another practice in the next one to five years. But only 15 percent expect to retire or sell their business over the same period. “With the current imbalance of buyers to sellers in the market, advisors are overly optimistic about the enterprise value of their businesses,” said Kenton Shirk, associate director at Cerulli.

Contrary to what many in this industry have taken as a fact, is it, actually, a buyer’s market?

There are several factors putting downward pressure on multiples, the Cerulli report said, including the age of advisors and their clients. The shortage of younger advisors in the industry could also bring valuations down, as firms struggle to replace older advisors. And while capital is cheap now, due to low interest rates, it could become more expensive to secure financing going forward, if rates rise. That presents a challenge to future buyers.

“As advisors begin to retire, a larger number of sellers will enter the market,” Shirk said. “Practices that are heavily weighted with older clients are less desirable because they have less potential to generate future cash flow. Retired clients are also inclined to deplete asset balances as they withdraw money for living expenses.”