Museum-goers would probably love to see Eli Whitney’s cotton gin or a singing baby doll invented by Thomas Edison. But what about fuzzy dice and two Beanie Babies previously owned by Bill Gross? These, along with Gross’s old Bloomberg terminal keyboard, a bull and a bear that used to sit on his computer, and his old Monroe bond calculator will be on display at the National Museum of American History starting July 1. It will be part of an exhibit called “American Enterprise,” according to The Washington Post. “The Monroe machine was my companion in 1979 when the stock market crashed 25 percent in one day. It was on my desk in 2008 when the world was coming apart, during the Asian market crisis in the late 1990s … and the remarkable thing is, I was still using it to calculate bond yields,” Gross told the publication.

Harvard’s School of Engineering and Applied Sciences (SEAS) will soon have a new name, with alumnus John Paulson reportedly donating $400 million in what is being tabbed as the largest gift in the school’s 379-year history. The billionaire hedge fund manager graduated from Harvard Business School in 1980. The massive gift will result in the SEAS being named after Paulson, with the money going toward a research endowment, faculty growth and financial aid.

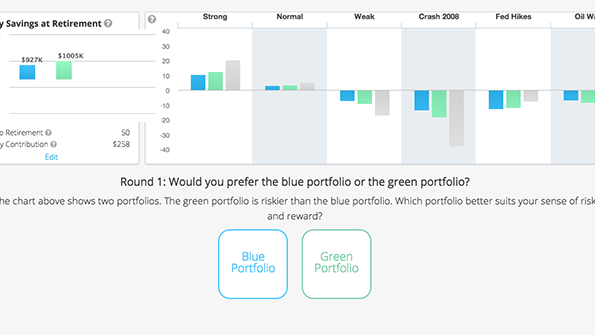

Instead of a traditional text-heavy questionnaire to determine risk tolerance, FinMason, a web-based financial education company, wants a method more akin to how optometrists measure a patient’s vision. With FinScore, a tool FinMason launched Monday, an advisor can show two portfolios side by side and let the client pick which one they prefer. Based on the choice, FinScore will repeat the process for more conservative or aggressive portfolios until the client can’t discern any further improvement, determining a risk score between 1 and 100. The company’s CEO thinks FinScore will be a more direct and intuitive way to assess risk without confusing clients with behavioral economics.

Do you have a website? What do you post and when? Do you even know the best time and best type of content to post? Buzzstream and Fractl conducted a survey of 1,200 people from the millennial, Generation X and baby boomer generations and determined what you should be sharing and when. The takeaways? Most people consume content between 8 p.m. and midnight across all generations; make sure it's mobile friendly, especially if you're trying to reach millennials; and keep it short—the optimum length is 300 words. Also keep in mind, baby boomers spend more time consuming content than other generations, with more than a quarter spending over 20 hours a week reading online content.