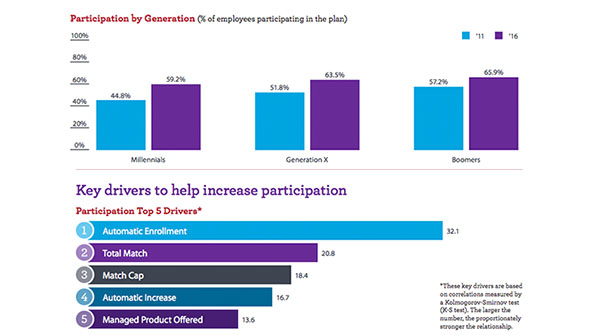

Participation in 401(k) plans increased 19 percent since 2011, with the largest jump among millennial investors, according to a new report from Wells Fargo Institutional Retirement and Trust. The firm found that nearly 60 percent of millennials have a 401(k) plan today, up from about 45 percent in 2011. To conduct the study, the firm analyzed five years’ worth of behaviors among the 4 million participants in plans administered by Wells Fargo. The biggest driver of the increase in participation was automatic enrollment, followed by a plan’s total match. Participation rates are over 80 percent for plans with automatic enrollment, while those without it have less than half participation. If you just look at plans with auto enrollment, individuals are most likely to participate if the plan match is between 6 and 9 percent, with an average participation rate of nearly 65 percent for those plans. “The gains we’re seeing among millennials clearly point to the benefits of automatic enrollment and things like target date funds and managed account options that were nowhere near as available five years ago as they are today,” said Joe Ready, director of Wells Fargo’s Institutional Retirement and Trust business.

Fellowes Sold HelloWallet for $52.5 Million - Here's His Next Co.

Matt Fellowes founded the digital retirement planning platform HelloWallet in 2009 and sold it to Morningstar five years later for $52.5 million. Now, apart from his day job as chief innovation officer at Morningstar, he's raised $5 million for another fintech start-up focused on retirees trying to put together safe, income-producing portfolios called United Income (Morningstar has invested a few million into the new company). "The software startup will provide a web portal and mobile-based app that will offer guidance on saving, financial products and good management techniques while linking their accounts and services to the company for more analysis. For a fee, users can pay to have United Income manage their assets and investments," writes the Washington Business Journal.

Second-Largest Diamond Ever Found Fails to Sell at Auction

The second largest rough diamond ever discovered failed to sell at a Sotheby’s auction in London on Wednesday. The tennis ball-sized stone, named "Lesedi La Rona," weighing in at 1,109 carats, was expected to sell for around $70 million (a record), but the highest bid was a “mere” $61 million (which also would have been a record), which did not meet the minimum reserve price. Sotheby’s took the unusual path of attempting to sell a rough stone, as opposed to a cut one, in order to attempt to cash in on the current gem price boom by reeling in a wealthy private buyer enamored with its sheer size. The gambit appears to have failed. Interestingly, this isn’t the first time Sotheby’s has tried this same tactic and come up empty. In fact, the last time they tried to auction off a rough stone, in 2000, it also failed to sell.