Since the Department of Labor released its final fiduciary rule in April, broker/dealers have been working tirelessly to change their business models and comply with the rule when it takes effect next year. But a Nationwide Retirement Institute survey reveals that advisors are out of the loop. Just 42 percent of the 622 financial advisors surveyed are aware of their firm’s timeline for implementation or what training and support will be provided, and just a third know of their firm’s new compliance procedures. The Best Interest Contract Exemption (BICE) will be quite important, as it allows firms to continue to rely on compensation and fee practices currently in place, provided they follow certain steps. Yet only 23 percent of advisors are aware of their firm’s plans to adopt the exemption. That said, the Nationwide survey was fielded in May, just a month after the final rule was released; it’s possible firms have communicated more about their implementation plans since then.

Citizens Bank Targeting the Mass Affluent

Providence, R.I.-based Citizens Bank is setting its sights on the mass affluent population to help boost its wealth management business, according to Bank Investment Consultant. The bank, which boasts that 52 percent of its 2.5 million clients are mass affluent or above, has been gearing up to serve them. It recently developed a "Platinum" product line for clients with $100,000 to $500,000 in investable assets, offering reduced rates and fees on savings and checking accounts and access to financial consultants. For its affluent, or "Premier" clients, Citizens pairs bankers and advisors to work together. To serve all those clients' needs, the bank has also boosted its advisor force, adding 50 net new advisors so far this year. Its total is now up to 350.

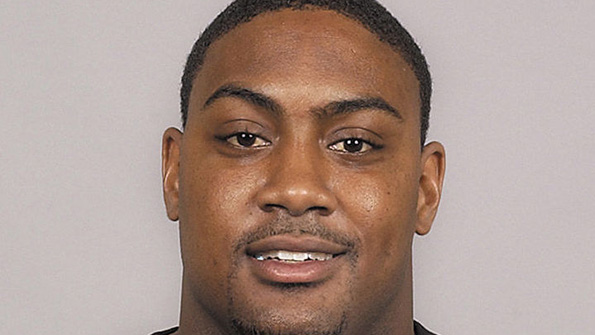

SEC Charges Former Philadelphia Eagle With Fraud

On Wednesday, the SEC accused Merrill Robertson, Jr., a former NFL linebacker who played briefly for the Philadelphia Eagles, with defrauding investors by raising $10 million and diverting $6 million towards personal expenses. Some of the investors include coaches Robertson knew during his time playing football at the Fork Union Military Academy and University of Virginia. The SEC alleges Robertson, along with Sherman Vaughn, Jr., who co-owned Cavalier Union Investments with Robertson, lied about the unregistered debt securities they sold, saying they would yield 20 percent while providing safety and security for investors. The defendants also allegedly hid the fact that Cavalier was functionally insolvent and did not have any funds or investment advisors. In addition to coaches, the scheme also targeted seniors, donors, alumni and employees of schools Robertson attended. The U.S. Attorney’s office is also pressing criminal charges.