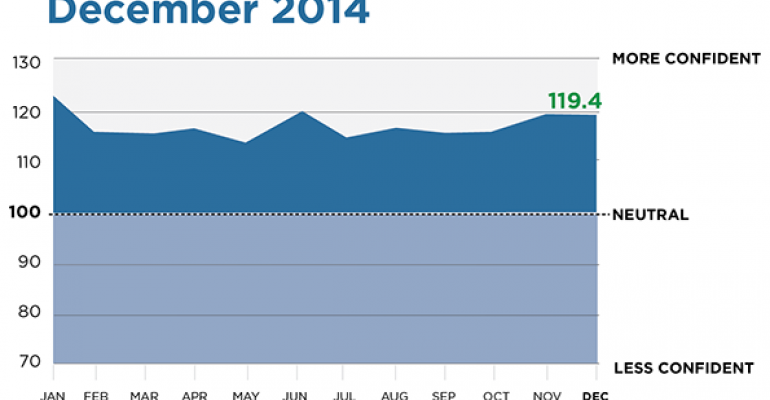

During a month characterized by a bumpy stock market and declining oil prices, advisor confidence in the economy ticked down slightly in December, although the confidence level is as high as it was in December 2013.

According to WealthManagement.com’s Advisor Confidence Index, a monthly survey of 113 wealth managers, confidence in the economy declined 0.42 percent in December. At 119.45, the Index is slightly below last month’s high of 119.95, but well above October’s level of 115.66. In December 2013, the Index was at 119.44.

Advisors’ views were well-aligned with stock market performance. The S&P 500 was also down 0.42 percent in December, with more volatility than November and a big drop toward the middle of the month as markets reacted to falling oil prices.

Advisor confidence in the markets over the next six months declined 2.6 percent during December, fueled by a fear of rising interest rates, headwinds in the international markets and a belief that stocks are overbought.

“The bull market in equities is getting a bit long in the tooth,” said Mitchell Freedman of MFAC Financial Advisors. “I fear that could have a negative impact on returns. As it appears likely that interest rates will be rising during the first half of '15, it is challenging to select appropriate durations for fixed income securities.”

“Although the US economy is improving, headwinds exist in some foreign and emerging market segments, and the timing of a rise in rates from the Federal Reserve,” said John Maffei of MFM Capital Management. “These influences may hamper further price appreciation in the markets from these levels in the next 3-6 months.”

Others expressed concern over the central banks’ actions, and the effect that could have on global deflation.

“We are in the midst of a global depression where the central banks are creating an insurmountable level of debt that has yet to have any impact on the global deflationary spiral,” said Ron Chandler of Summit Investment Management. “Continued actions down this path will continue to drive up stock prices as there will be no other assets worth investing in on a risk / reward basis....”

Still, others are more optimistic going into 2015. The decline in oil prices, in particular, could be a boon for consumer spending and the U.S. economy, some say.

“The drop in oil prices will be a huge stimulus in first half of 2015,” said Bill DeShurko of 401 Advisor. “With over a billion cars and light duty trucks on the road globally current prices could transfer $100 billion a month from oil to other discretionary expenditures.”

Others believe market fundamentals continue to be strong.

“Earnings growth continue to underpin this market,” Eve Kaplan of Kaplan Financial Advisors. “Despite all the domestic economic ‘negatives,’ the US remains relatively strong and attractive when compared with Europe, Japan, etc. I remain optimistic about the US dollar and US equities for the coming 6+ months.”