While financial advisors started out the year more optimistic than they had been in all of 2014, their confidence in the U.S. economy turned negative in February. At the same time, advisors’ short-term outlook on the markets trended up.

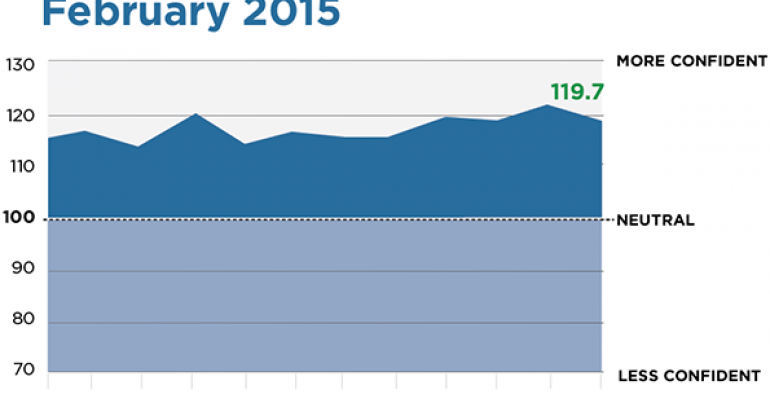

Wealthmanagement.com’s Advisor Confidence Index hit 119.66 in February, 1.5 percent lower than the previous month, and about 1.3 percent higher than February 2014.

The ACI is a monthly poll of some 150 financial advisors who have agreed to answer a series of four questions every month gauging their confidence in the health of the economy and the markets. Looking closer at the components of the index, confidence in the markets over the next six months rose 3.2 percent, while their current view of the U.S. economy fell 3.7 percent.

In general, advisors still see headwinds abroad that could impact the state of the U.S. economy.

“There are so many potential headwinds—such as the plunge in the price of oil, political uncertainties in the Ukraine, the condition of the Euro Zone economy, the ISIS crisis, and the appreciating U.S. dollar—thus it is difficult to be confident over the long term,” said Mitchell Freedman, president of MFAC Financial Advisors in Westlake Village, Calif.

“Greece is another ‘kick the can down the road’ scenario,” said Edward Murphy, owner of Elite Capital Management. “Here in the U.S. while the unemployment rate has dropped, it is due to mainly lower wage paying jobs. We still need to see higher paying new jobs to sustain economic growth.”

Some advisors believe the amount of quantitative easing and monetary policy in this country and elsewhere is overplayed.

“I believe QE and Operation Twist have run their course—not much additional boost to wage growth and GDP,” said Roger Willroth, principal with Marrs Wealth Management in Ames, Iowa.

“Earnings drive market valuation and are expected to contract in 2015,” said Doug Bales, owner of Whitewater Wealth in Vida, Ore. “No amount of QE can change fundamentals. Time to reset again.”

Others had a positive outlook on the U.S. economy and the markets, at least in the short term.

“The stock market is likely to trend higher for the next one to three months as US economic growth continues to surprise investors, the price of oil stabilizes and accommodative monetary policies keep Europe from slipping into a recession,” said Thomas Czech, president of Summit Investment Management in Milwaukee, Wis. “Investment sentiment will become excessive at that point, and without an additional positive surprises to lean on, the market could be vulnerable to a less than 15 percent correction.”

“Improving economic data and reasonable valuations for stocks should bode well for the U.S. stock market over the next 12 months,” said Liam Timmons, president of Timmons Wealth Management in Attleboro, Mass.