Kelley Rating (one asterisk = lowest, five asterisks = highest):

- Ease of navigation, design of interface and learning curve ****

- Instructional documentation and help system ***

- Carries out the goal of the product as advertised ****

- Overall usefulness ****

Market76 is designed to deliver client information for advisors engaged in wealth management. As a web-based facility, it provides access from anywhere. It’s a mobile Customer Relationship Management (CRM) application for the financial services industry and designed for use by wealth advisers and managers. It offers advisors CRM, portfolio accounting and performance reporting tools in an integrated database on a platform that does data reconciliation for them.

Market76 gathers current financial data directly from custodians' back offices and merges it with advisors' own records and publicly available information to present information for use by the advisor. It integrates data from wirehouses, broker-dealers, data aggregators and professionals serving the clients, then reconciles the data daily with asset custodians. The data assembled can be searched for clients with common elements. It creates performance reports as to which the components, such as benchmark comparisons, time frames or aggregation of accounts may be easily adjusted.

Market76 offers its service free to advisors and is financially sustained by charging a fee to marketers who want to present products and services to said advisors. It helps to organize information about financial service providers with which you may work.

What’s It All About?

Market76 is designed to help build advisory businesses with technology that gathers data from various sources, provides central data management and facilitates communication with clients and client service providers. You can quickly find any client information from tax lot breakdowns to email records.

When advisors install Market76,they may select from a list of vendors of funds, products and services. A screen called Fund Vista, provides organized references to vendors that users of Market76 can observe or work with. It helps advisors and service providers, collaborate and helps products to be identified by advisors and delivered to them.

Fund Vista assists in organizing information about the financial service providers, such as asset managers and insurance companies with which you work. Marketers never see customer or client information, since advisors control their access.

The publishers assert that the goal of Market76 is to help you be the best advisor you can be, based on fundamental and understandable technology. Thus it provides central data management and ease of communication with partners, asset managers and clients. Since the client data is accessible on any computer or mobile device,and it delivers information related to a particular client’s account in a form that is useful even on the limited viewing area of mobile devices.

The publishers state that a new, version 2.0, of the Market76 advisor platform will be released on Jan. 4, 2013, followed by a client portal with a vault, account views and advisor communication tools in February 2013.

How it Works

When you access Market76, a day planner screen comes up first with a left side navigation pane listing Contact, Activity, Accounts, Analytics, Transactions, Gift Log andQuestionaire.

You click on Contact for client contact data, descriptive client information (including estimates of client experience and risk tolerance), household memberships, a list of the service team and notes. This screen provides a conduit to communicate with the client and the client’s advisors.

Here you may find phone numbers, family relationships as well as client investment preferences.

The Activity screen tracks how you are spending your time with this client, including calls, meetings, tasks undertaken, notes and emails sorted by date.

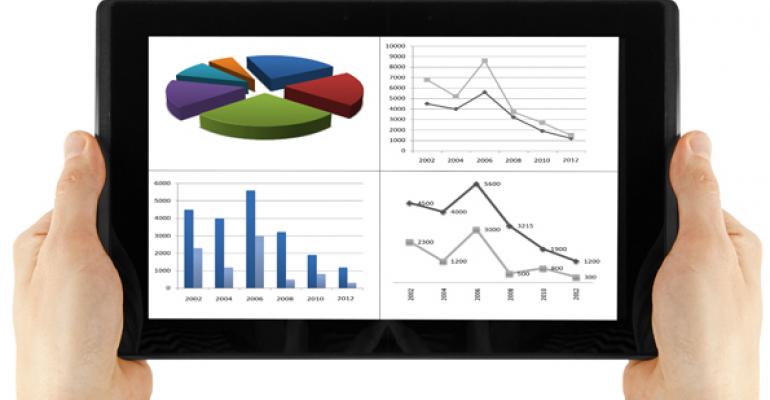

Accounts displays all client bank accounts, IRAs and other investments, along with their respective market values. It reflects investment positions by name, classification, number of units, unit price and market value. It displays line charts with value over time and rate of return and pie charts with information such as positions by asset class and unrealized gains and losses. It also lists transaction details.

The Analytics screen allows you to drill down to details of investment type, company and return on investment. Here you will find tax-lot level portfolio accounting within the relationship management tool that helps you answer questions and make decisions.

The Transactions screen lets you up pull up transaction details for a given investment over a given date range, fees charged, and a listing of investments by tax type.

The Gift Log keeps track of all gifts made by type, date and value.

The Questionnaire is designed to explore new client motivations, including needed rate of return to accomplish objectives, classifications of current investments and the degree to which current investments are meeting the client’s objectives.

Market76 provides a calendar that syncs with client emails. It displays a client family tree with activity, accounts, analytics and transactions available and allows selection of clients for targeted mailings, such as those that may benefit from particular transactions or investments. Onscreen reporting templates are provided for report generation.

You can export to Excel to merge data into spreadsheets and link to third-party software, such as Microsoft Outlook, major data aggregators, stock screeners and third party research. You can also centralize records of all client communications (firm, advisor or family) in one location.

What About Help and Support?

Navigation and entry of data is quite intuitive. An instruction manual is provided and Help by chat is furnished.

Where Do You Get This Facility?

Market76 is available from:

Market 76

Phone: 866.808.5491

Website: https://www.market76.com/

Contact: https://www.market76.com/pages/request

Bottom Line

Market76 provides a free, easy to use, advisor centric data platform that’s web based for convenient mobile access.

Trusts & Estates magazine is pleased to present the monthly Technology Review by Donald H. Kelley—a respected connoisseur of the software and Internet resources wealth management advisors use to further their practices.

Kelley is a lawyer living in Highlands Ranch, Colo., and is of counsel to the law firm of Kelley, Scritsmier & Byrne, P.C. of North Platte, Neb. He is the co-author of the Intuitive Estate Planner Software, (Thomson – West 2004). He has served on the governing boards of the American Bar Association Real Property Probate and Trust Section and the American College of Tax Counsel. He is a past regent and past chair of the Committee on Technology in the Practice of the American College of Trust and Estate Counsel.

Trusts & Estates has asked Kelley to provide his unvarnished opinions on the tech resources available in the practice today. His columns are edited for readability only. Send feedback and suggestions for articles directly to him at [email protected].