Marco Cardamone, 61, is the president and CEO of a Pittsburgh-based video production company. In 2016, Cardamone confronted a medical emergency that engulfed his family in the sprawling and bureaucratic medical-industrial complex. “When you get into the system, it’s like a machine, and it’s very difficult to slow it down and get information,” Cardamone says. “Were we getting the best health care opinions, therapies, and outcomes? It was impossible to be sure.”

Enter John Waldron, Cardamone’s financial advisor and founder and CEO of Waldron Private Wealth, a boutique financial advisory based in Bridgeville, Pa. Waldron takes a holistic interest in the financial well-being of his clients and whatever a client’s requirements—family office, estates and trusts, philanthropy—he wants to be part of the solution. For clients like Cardamone, who find health issues are top-of-mind, Waldron created a strategic alliance with a health care advisory firm, a company that helps clients address their most pressing health care challenges from beginning to end, on a concierge basis.

Cardamone jumped at the chance to get a health care advisory firm on his side. After signing appropriate privacy releases, the advisory firm went to work. The first step was gathering up all the family’s medical records—itself a chore that is beyond the resources of many individuals confronting a health crisis. After reviewing the records, a team of advisory physicians identified a specialist in a nearby city with the best treatment record for the family member’s specific issue. Though this specialist was not accepting new patients, the advisory service nevertheless secured the family an appointment. The family member is currently in treatment. “When time is of the essence and emotions are high, a service like this provides real value and benefits,” Cardamone says.

Most Valuable Asset

Wealth and health are the two things clients always put at the very top of their lists of concerns. And recent surveys suggest that, for many, it’s not easy to say which comes first. Health is arguably the most valuable asset that doesn’t show up on a balance sheet. Advisors who can master that wealth-health partnership discover they cover the two most fundamental client stressors.

Wealth and health are the two things clients always put at the very top of their lists of concerns. And recent surveys suggest that, for many, it’s not easy to say which comes first. Health is arguably the most valuable asset that doesn’t show up on a balance sheet. Advisors who can master that wealth-health partnership discover they cover the two most fundamental client stressors.

Wealth may be limitless and capable of being handed over to others, but health is inherently specific and self-limiting. Virtually every client is guaranteed to find their health under assault, with unpredictable financial consequences. The uncertainty and cost of health care now tops the list of what Americans consider the most pressing financial risk for their families.

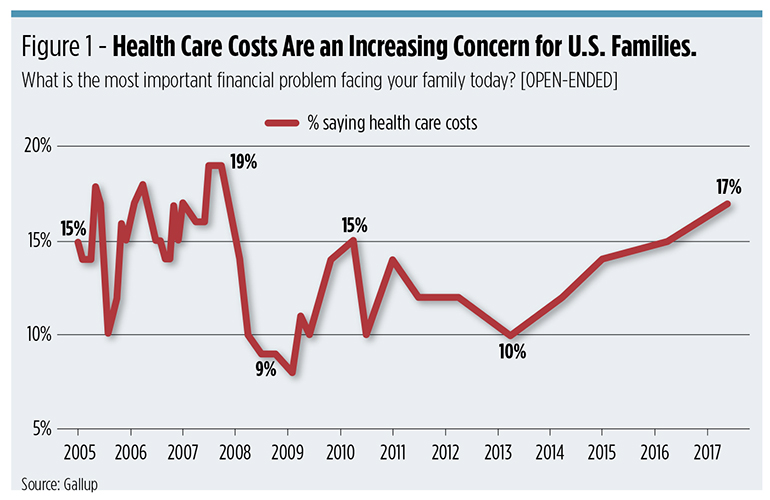

And it’s not just middle-class Americans. Two-thirds of high-net-worth individuals are worried that spiraling health care costs will negatively impact their retirement, according to a Northern Trust survey of 1,002 millionaire investors. Concern about health care costs temporarily took a back seat to concerns about debt and unemployment following the 2008 recession. But today, amid the debate about the future of The Affordable Care Act and uncertainty in the insurance markets, the concern about spiraling health care costs in retirement have emerged as the most critical financial problem facing families. (See Figure 1.)

Stewards of Health Care as Risk

As stewards of all aspects of their clients’ balance sheets, a small (but growing) number of wealth managers are offering their clients health care advisory services to prepare them for the financial and medical consequences of a health crisis. Most of the largest and most influential brokerages (including Morgan Stanley, Merrill Lynch, Suntrust, Northern Trust and Wells Fargo) offer some level of health care advisory services. The number of financial advisors within these firms using such services is relatively small, because they have discretion as to whether they choose to offer such referrals to their clients.

Waldron partnered with PinnacleCare, a Baltimore-based private concierge health care advisory firm that offers guidance to expert medical opinions and research and boasts privileged access to the best health care specialists. That’s great for current clients, but also a calling card for prospects. “Wealth managers who recognize the outsize importance clients attach to their health care concerns and can offer a holistic solution will certainly do better in a world of rising costs and uncertainty,” Waldron says.

Waldron partnered with PinnacleCare, a Baltimore-based private concierge health care advisory firm that offers guidance to expert medical opinions and research and boasts privileged access to the best health care specialists. That’s great for current clients, but also a calling card for prospects. “Wealth managers who recognize the outsize importance clients attach to their health care concerns and can offer a holistic solution will certainly do better in a world of rising costs and uncertainty,” Waldron says.

Waldron’s goal is to provide his high-net-worth clients with a platform and a third-party advocate when needed, someone who can help them navigate options for even acute conditions like cancer, and can consolidate records, surface the best specialists and treatments, and “hold their hands during an emotional period when time is of the essence,” he says.

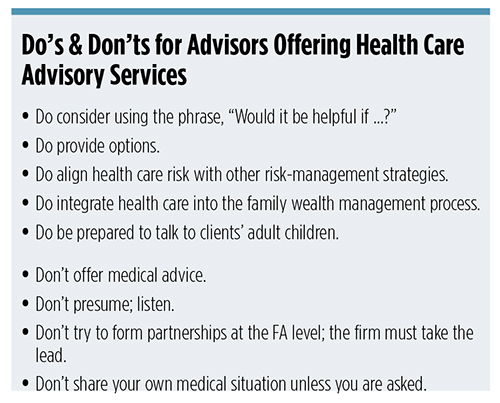

Typically, the financial advisory firms approach the health advisor as a resource for clients. In turn the health advisory team helps the wealth management firms educate the FAs on the benefits. Advisors are never charged for the partnership. To the extent that health advisory firms have offered FAs commissions, the FAs have traditionally declined so as to remain an unbiased resource. The health care advisory firms then establish the relationships with the clients, bill them directly, and the FAs have little role in the transaction.

“Medicine, like wealth management, is more an art than a science,” says Bruce Spector, chairman and co-founder of PinnacleCare. “If a client has lymphoma, there are many good and great providers, but most clients don’t know how to distinguish between the good and the great and there are precious few resources to help them.” PinnacleCare allows advisors to offer their clients a concierge health care advisory solution that is personalized, without conflict, and can be turned off and on as required.

Morgan Stanley regards health care advisory services as a differentiator. “When I meet with clients and prospects, health care is on the tip of everybody’s mind,” says Ivar Bolander, a Morgan Stanley family wealth director in Santa Rosa, Calif. For now, he says, most clients interested in health care advisory services are crisis-driven. “They have an immediate issue and are confused about the options and opinions. They are looking for a personalized, coordinated solution,” he says. The eventual goal is to incorporate wellness and prevention into Morgan Stanley’s wealth management value proposition.

With the medical system as fragmented, disjointed and time-pressured as it is, Cardamone reports great peace of mind knowing that now he has a single point of contact for primary as well as specialized care with a team willing to take as much time as his family may need. At last report, the family’s health care crisis is well-managed, and the family member is responding positively to treatment.