In a note prefacing a recent study of whether people trust financial institutions, CFA Institute President and CEO Paul Smith said the organization sees “encouraging trends.” But it wasn’t all good news. The 3,127 investors that participated in the organization’s third Global Survey on the State of Investor Trust revealed that a gap in confidence remains between the general population and financial institutions.

“Just as we have seen polarization of trust across many industries,” Smith wrote, “the investment industry must strive to relate effectively to individual investors and provide high service levels to them.”

In 2013, when the CFA Institute began its trust survey, both investors and the general population had negative feelings about the financial services industry. At the end of 2017—as markets set record highs during one of the longest bull runs in history—one of those groups, not surprisingly, had a change of heart. A growing number of investors engaged in markets (44 percent) said they trusted financial services firms.

The good news is that technology could improve that trust further, according to the study. Younger generations tend to use technology more and view it has a measure of credibility. The technology industry is the most trusted by retail investors (64 percent) and financial services and technology are blending more and more.

Perhaps that’s why younger generations tend to trust financial services firms more than older generations. While 55 percent of millennials and 49 percent of Gen-Xers aged 35 to 45 said they trust financial services firms; confidence in the industry waned with those older. Only 35 percent of Gen-Xers aged 45 to 55 trusted the industry, along with 40 percent of baby boomers aged 55 and up.

Habits and preferences of certain generations of retail investors aren’t the only things better technology in financial services could impact, in terms of trust. Technology will also bring products and services to those who aren’t invested in markets—a group that still largely has a negative view of the industry, according to the survey.

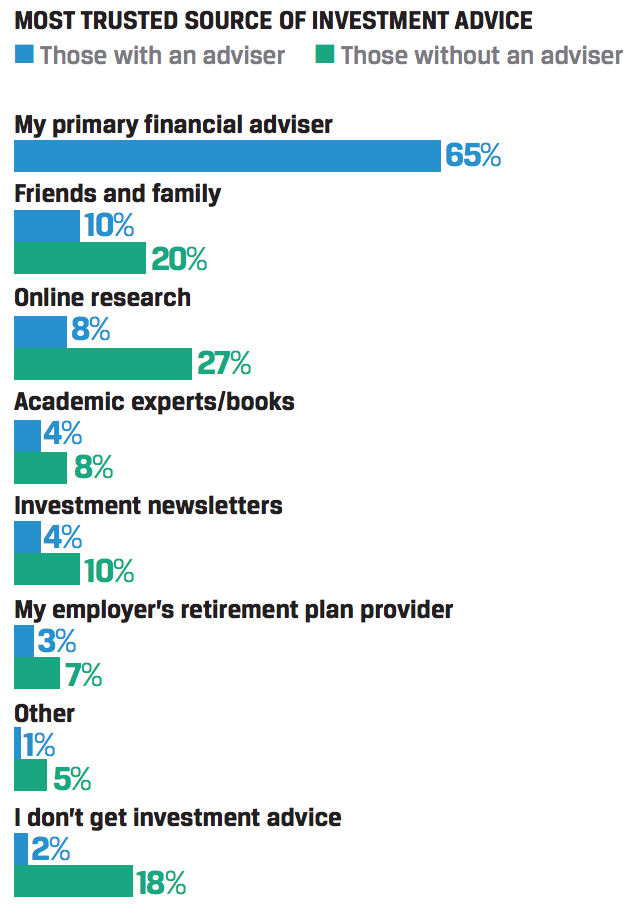

The survey also asked participants what their most trusted source of investment advice was. Most investors (65 percent) who work with a financial advisor said their primary financial advisor was their most trusted source. Participants without an advisor said online research was their most trusted source.