By Dani Burger

(Bloomberg) --The largest outside buyer of Goldman Sachs Group Inc.’s exchange-traded funds might soon become its biggest competitor.

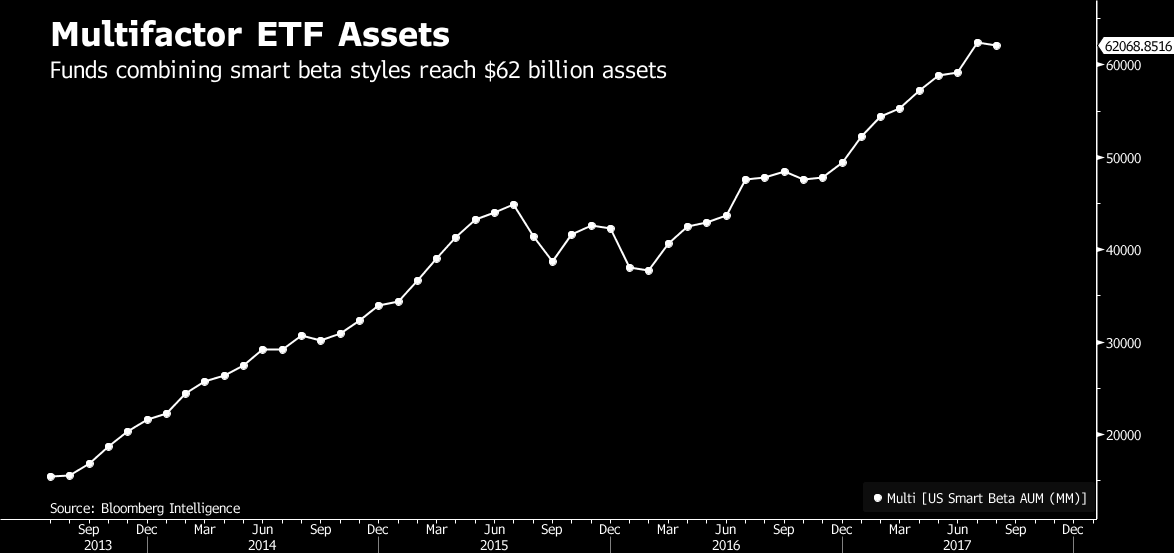

That client is USAA Capital Corp., an early adopter of the latest trend in the $619 billion smart beta industry: multifactor funds. The rules-based ETFs buy stocks that exhibit multiple characteristics -- like low volatility or cheap valuations -- that have been shown to beat the market over time.

The San Antonio-based insurance and financial planning firm first sought out exposure to the quant-based strategy through Goldman’s “ ActiveBeta” line of ETFs. As of its last filing, USAA held more than $513 million in market value of the Wall Street behemoth’s large-cap, emerging market and international ActiveBeta funds. The only larger buyer of Goldman’s ETFs is Goldman itself.

Now, USAA has filed for permission to start its own line of multifactor ETFs. The firm expects to launch the funds in the fourth quarter.

“The gap is that USAA doesn’t offer ETFs,” Lance Humphrey, executive director of global multi-assets at USAA Asset Management. “This will be filling that gap with a brand that our members trust.”

Trusting Clientele

Many newcomers’ ETFs have a hard time finding an audience and exceeding the $50 million threshold needed to make a profit and attract big brokerages. It’s especially daunting for multifactor ETFs, complex products whose appeal has more to do with math than, say, the industries they track.

In a filing with the Securities and Exchange Commission updated last week, USAA detailed its plans to launch four multifactor funds that track MSCI Inc. indexes. They blend momentum, which tracks the market’s best performing stocks, and value, which seeks out cheaply priced stocks relative to assets. Using that strategy, USAA will offer a large-cap, small-cap, international and emerging markets version. Fees for the funds are from 20 to 45 basis points. The firm also filed for two actively managed fixed income ETFs.

But USAA should have an easier time attracting assets than most of its competitors because it won’t need to court outside buyers. The firm already has a built-in trusting clientele.

Internal Talent

“Our investment products are available to all investors,” Humphrey said. “But our core focus is serving our membership.”

Relying on internal talent to build out investment products is a well-trodden path for USAA. The firm manages over $150 billion, about half of which is in its mutual funds. Now, it may tap into the $5.5 billion it holds in third-party ETFs, about a third of which are smart beta.

What’s more, USAA’s ready-made portfolios use ETFs as well. Goldman’s multifactor funds are in those products at the moment, but USAA isn’t saying whether it plans to keep them.

Goldman’s fate in all this is uncertain. USAA is the largest investor in its most popular $2.4 billion ActiveBeta U.S. Large Cap Equity ETF, with 16 percent of shares outstanding. However, Goldman’s five ActiveBeta ETFs have built up a $4.6 billion following, leaving plenty of cushion should the insurance giant leave.

BYOA Party

Goldman declined to comment on USAA specifically. But Mike Crinieri, the firm’s global head of ETF strategy, noted that typically existing clients of ETFs aren’t affected if a large investor exists the fund.

“In a traditional fund, that could be a concern, because you would have costs of that investor exiting the fund that would be borne by the fund itself,” he said. “But because with an ETF all the transaction costs are external and isolated to that one investor, you shouldn’t have a concern.”

The two firms’ asset gathering strategies are somewhat similar, catering to existing clients. And they aren’t alone. For bigger finance companies that enter the ETF industry late, most of the money comes from capturing existing clients who’d otherwise leave to seek out cheaper, passively managed funds, said Eric Balchunas, an analyst at Bloomberg Intelligence focused on ETFs.

“Whether you’re GSAM or USAA, the ETF party is still going strong. It’s just more of a BYOA party: Bring Your Own Assets,” Balchunas said. “Having a brand and having customers who trust you is a huge deal.”

--With assistance from Rachel Evans and Sonali Basak.To contact the reporter on this story: Dani Burger in New York at [email protected] To contact the editors responsible for this story: Jeremy Herron at [email protected] Eric J. Weiner, Andrew Dunn