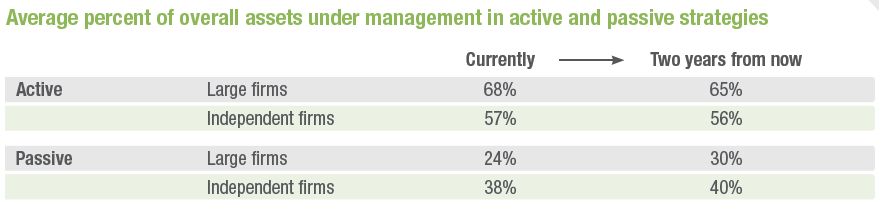

When considering all client assets under management, advisors across channels strongly favor active strategies over passive. That said, advisors at large firms report a higher average percentage of client assets invested in active strategies (68%) than the percentage reported by advisors at independent firms (57%). However, while advisors from independent firms expect their preferences to remain roughly the same over the next two years, advisors from large firms expect to slightly decrease their use of active strategies while increasing their use of passive strategies.

The trend favoring active strategies is consistent when only considering assets invested in mutual funds and ETFs, as well as across a broad range of asset and sub-asset classes. Perhaps not surprisingly, the preference for an active strategy approach is strongest when investing in alternatives.