By Lawrence Solomon

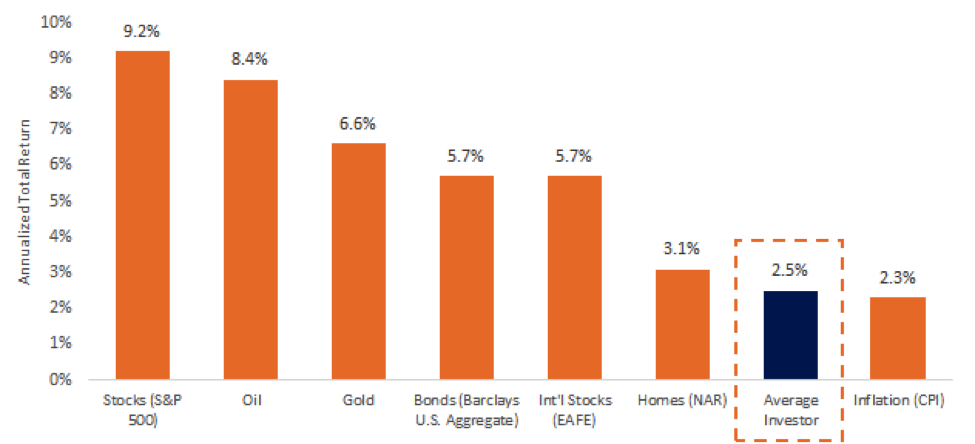

Investors have a tendency to unnecessarily intervene and rebalance their portfolios, which often results in long-term underperformance (see chart below). As Morningstar has eloquently put it, investors “suffer[ing] from poor timing and poor planning … many chase past performance and end up buying funds too late or selling too soon.”

20 Year Annualized Return by Asset Class (1994-2013)

Source: Blackrock, Dalbar

The classical industry response to investor fiddling is a combination of both advice and product.

The advice side often starts with a financial plan delivered by a trusted financial advisor. This plan is a long-term strategic document that outlines an investor’s financial objectives and the investment products he or she will use to achieve them.

If people were robots, the story would end here – just “set it and forget it.” The plan would periodically be adjusted as an investor’s needs would change – e.g., birth of a new robot, retirement from active drone duty, and so on. The portfolio composition would stay relatively constant, except for periodic rebalancing depending on asset performance and integration of new products when appropriate. And, robot investors could sit back, forget about the day-to-day fluctuations of the market, and focus on more important things to do – like traveling back in time to prevent John Connor from being born.

People, of course, aren’t robots – they can’t be told to do something once and stick with it come what may, especially when things get choppy or ambiguous. Behavioral finance research demonstrates investors crave predictability, simplicity, and transparency in their investments – extensive research by luminaries such as Daniel Kahneman and Amos Tversky has been done on the aversions that investors naturally have to loss, uncertainty, and ambiguity. Left to their own devices, many investors will eventually begin obeying their aversions and stop following long-term financial plans when things go awry, be it a market loss or underperformance of their strategy.

Thus, advisors play a crucial role in delivering ongoing guidance to their clients, which includes educating them about current financial events and coaching them to stick with their long-term plans during times of fear and greed.

Now let’s shift gears for a moment and talk about the role products play in keeping investors focused on the long term.

Even the best advice will only go so far to reassure investors to stay the course – portfolio makeup and performance returns are the potential triggers of investor aversions. Unfortunately, if the goal is to align with investor needs, Wall Street has under-delivered in many critical ways. In contrast to the predictability, simplicity, and transparency that investors seek, the financial world has regularly delivered a diet of uncertainty, complexity, and opaqueness, making it challenging to provide a satisfying portfolio for investors and encouraging, rather than limiting, investor fiddling.

At the broadest level, financial equity markets have proven to be extremely volatile over the last generation – the crashes of 2001 and 2008 wiped out a substantial portion of domestic savings. While most “stay the course” investors eventually recovered, it has by no means been a pleasant journey - e.g., it took the S&P about 6 years to recover from the 2008 financial crash, and it took the Nasdaq about 15(!) years to recover from the 2001 tech crash. This degree of volatility and financial damage does little to keep investors with ingrained sensitivities to loss in their seats – a straight equity portfolio is not for the loss averse.

Traditionally, investors would balance the volatility of equity exposure with the steady returns and low risk of fixed income – the so called “60-40” split. Unfortunately, investment grade fixed income has offered little yield in recent years while introducing a great amount of interest rate risk – should interest rates increase meaningfully from their unsustainably low current levels, an investor holding debt could see a significant amount of red. In short, balancing out an equity portfolio with fixed income does little to assuage concerns that investors have about risk in 2016.

Given the drawbacks of direct equity and debt investing, it is of no surprise that investors have continually sought “packaged products” from Wall Street that can provide alternative investment options – from active to passive, from registered funds to complex debt instruments, from leveraged to low volatility, there seems to be something for everyone.

Unfortunately, many of these products run afoul of a different but still critical aversion: ambiguity. Investors avoid what they don’t understand, and banks have a proclivity to produce products, which don’t work as investors intend – examples include leveraged ETFs providing daily leverage as opposed to long-term leverage, commodity ETFs underperforming due to contango, and managed futures outperforming consistently and then underperforming consistently. Even products that have delivered decent returns are often confusing – have you ever tried explaining what a Master Limited Partnership is and why it’s used? How about the Efficiente Index?

On the product side, investors deserve a “new deal” – a set of products that deliver reasonable return potential while catering to the understandably human needs for stability and simplicity. Low volatility solutions are an example of a relatively simple product, which mitigates some degree of aversions to loss and risk, and those funds have been rewarded with rapid asset growth. Option-based strategies are also worth a look as they contractually provide specific strike prices – investors can set in advance the precise level of exposure and loss they can live with (e.g., buy a one year downside put 10% out of the money, ensuring an investor with market exposure can’t lose more than 10% over the next year). Knowing their expected returns will fit within a pre-set band of possible outcomes may allow human investors to be a bit hands-off with their investments so that they can sit back, forget about the day-to-day fluctuations of the market, and focus on more important things to do – like traveling back in time to save John Connor.

Lawrence Solomon is the Chief Operating Officer, Exceed Investments