Min Zhang thinks financial advisors take a short-sighted view of a client’s “risk tolerance.”

Current tools do a great job determining how much financial risk an investor is comfortable taking on and customizing a portfolio based on the metric.

But for Zhang, loss aversion and willingness to take risks measure just one dimension of the client, and not particularly well. Advisors should be looking at human capital, things like health, family, geography and career prospects when determining how much portfolio risk a client should be taking on. Her company, Totum Wealth, has a product that promises to quantify that number.

The idea is to incorporate these less-tangible factors by looking at them the way an insurance actuary would. For example, a young computer engineer starting a high-paying career in Silicon Valley may check all the boxes for a typical aggressive investor with a high tolerance for risk. But what if the company she works for offers a hefty part of her compensation in equity? Putting her in an aggressive portfolio of equities may make sense from a tolerance point of view, but the compensation shares create an exposure to equities that might otherwise not be considered by the advisor using traditional risk metric tools.

Zhang says it’s not so much about giving a right or wrong answer as it is guiding advisors and helping them ask the right questions.

“The primary focus is to help advisors understand the risk in the client’s life,” as opposed to just what they could theoretically tolerate on the market, Zhang said. “Have conversations about what capacity [clients] have to take risk.”

The idea this approach came while Zhang worked on multi-asset strategies at Pimco, looking at portfolios for large institutions and their model allocations.

“Most had too much equity risk,” Zhang recalls. The company would recommend a bond strategy, but it may not have been the best product for the client. “I felt a demand for a better understanding of risk among institutional investors as well as retail and high-net-worth.”

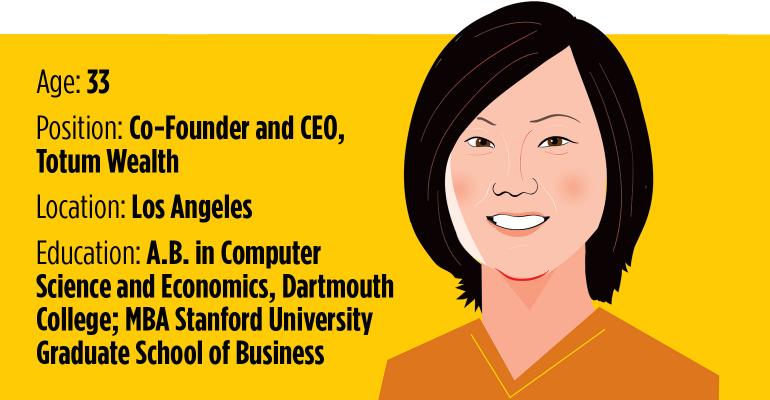

After briefly working as the director of investment risk management for Pacific Life’s variable annuities, Zhang launched Totum Wealth in 2014, drawing on a computer science degree from Dartmouth College and time spent helping build the investment engine behind the British robo advisor Nutmeg.

Zhang is trying to break Totum into the independent advisor market, where Riskalyze has already made a name for itself in the risk-assessment technology space. Totum is focused on optimizing its digital questionnaire, simplifying the scoring methodology and improving the user experience. Totum was a part of Yodlee’s incubation lab last year and has a partnership with that firm (recently acquired by Envestnet) to pull in held away accounts into Totum. A partnership with data aggregation firm Quovo is helping to pull in custodial feeds.

Next up is integration with CRM technology and the ability to generate investment proposals. Totum also wants to be able to pull social media information about clients, as well as incorporate gamification techniques to help clients get through as much of their extensive questionnaire as possible.

With the Dept. of Labor’s new fiduciary rule acting as a tailwind, Zhang thinks advisors will be craving technology that helps know their clients better and advice even more custom-tailored to their life.

“It’s going to be an exciting time for risk software once we get past April 15,” Zhang said. “Technology adoption is only going to accelerate.”