The Department of Labor fiduciary rule will likely lessen the value of investment management for advisors; savvy advisors will demonstrate their worth to clients through services like financial planning.

The problem with financial planning however is that, if done right, it is far more labor intensive than managing a portfolio. An advisor may put in 15 to 20 hours for a single client’s plan. Many of the legacy tools to do this work are difficult to use, require a lot of training and aren’t connected to the rest of an advisor’s workflow, and it’s a lot less profitable. It’s arguably both the most important and least efficient thing an advisor can do for a client.

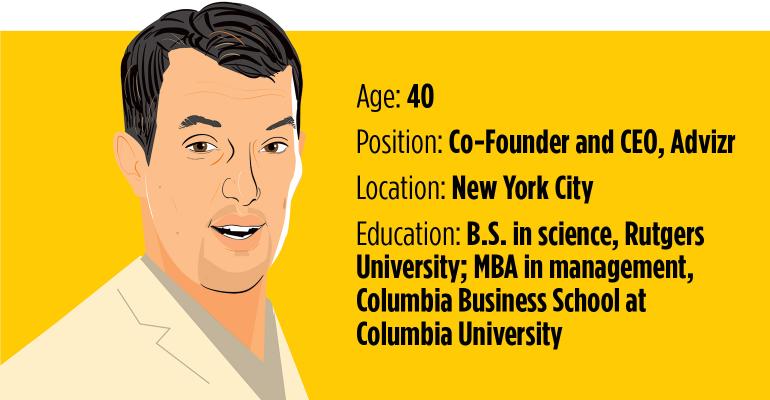

Hussain Zaidi encountered these roadblocks for over a decade while trying to get teams to bring financial planning to the forefront of the client interaction, first at American Express and then at Citigroup. He realized the only way to put planning right in the center of an advisor’s practice would be to build a new tool from scratch—so that’s what he did. He left Citigroup to form Advizr, a tech startup with the goal of digitizing as much of the financial planning process as possible.

Zaidi says a top priority at Advizr is to bring a modern, intuitive user interface so any type of advisor can add financial planning services to their practice in a scalable way. Zaidi calls it “turbo-taxing” the process.

He also wants to make the process of creating a plan more collaborative between advisors and client. By creating dynamic visual displays and interactive tools designed for touchscreens, Zaidi believes financial planning can move from the back office to the front.

Finally, Advizr places financial planning at the center of the advisor’s technology stack, rather than in a silo. The idea is to let an advisor go from creating a plan with the client (starting with goals, a cash flow plan or a combination of both) directly to opening and funding an account, all the way to executing on the recommendations.

“Investments, insurance, what it may be, we’re building in all of these workflows seamlessly into the user experience,” Zaidi says. “Some [other] companies have multiple different products that have to work together. We have one product. We think that is critical for you to really scale out financial planning.”

In the process, Zaidi hopes Advizr can change the industry’s perception about planning. In the post-DOL world, he believes the process of creating a plan is the best way an advisor can make appropriate, responsible and defensible investment recommendations.

“Research shows how clients who receive plans are much more likely to be on track for retirement, and how advisors can build more sustainable, more profitable practices. Stop thinking of this as a low-margin service, but [instead] as a way to get more customers and build deeper relationships.”

Around 1,000 advisors use the tool, and Zaidi’s team has developed strategic partnerships with major industry players such as Advent; in fact, Advizr is now bundled into Advent’s latest version of their Black Diamond platform, along with risk analytics tool Riskalyze.

Zaidi says in the near future, the company will announce more partnerships with firms that help bring together the execution side with the planning. He believes doing so will take planning to a whole level—and position Advizr at the center of the advisor’s desktop.