Betterment announced a new account aggregation capability on Wednesday to improve both the user experience and the company’s ability to provide automated advice.

The so-called robo advisor now lets users sync accounts held at other financial institutions to view their entire net worth within the Betterment platform. Alex Benke, Betterment’s director of advice products, said the aggregator will support 401(k)s, IRAs, taxable accounts, mortgages and loans held at 13,000 different financial institutions.

The feature is also coming to Betterment Institutional for advisors looking to gather all of their clients’ assets as well. According to a recent Salesforce study, 76 percent of investors said a holistic view of their accounts was a key factor in selecting a financial advisor, and both third-party vendors and traditional institutions are making it standard in their technology offering to advisors.

In addition to making Betterment a more attractive platform for retail investors and advisors, Benke said it would improve the robo’s ability to deliver personalized, holistic advice.

“Aggregation lets us automatically keep [a] plan up to date,” Benke said. “Having your retirement plan be always on and always up to date with refreshed balance every day is very valuable to people, not re-running their calculators and updating their spreadsheets.”

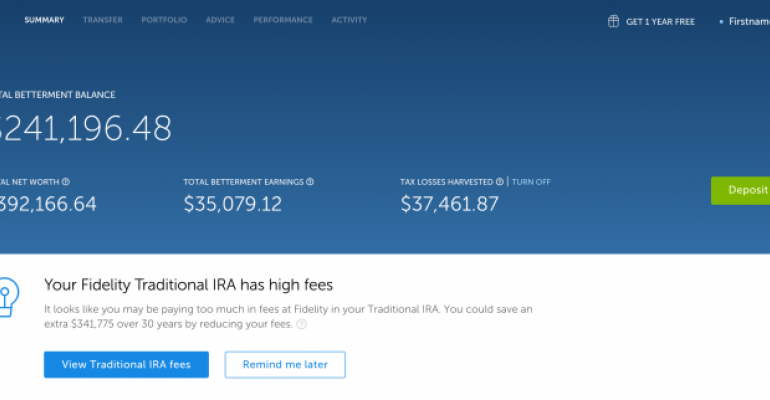

Improved functionality can certainly help attract new assets, but perhaps more important is the avenue it opens for Betterment to access held-away assets. As a totally automated service, Betterment’s fees are often much lower than traditional custodians. Benke said the aggregator allows the robo to show investors just how much they would save by moving assets to Betterment, and help them identify idle cash that could be invested.

“People are shocked usually about how much cash ends in their portfolio that they don’t even realize and don’t know the impact of,” Benke said.

Recent products like RetireGuide and Betterment for Business helped propel the company to $3.7 billion in assets under management, but it’s still short of what some believe will satisfy Betterment’s venture capital investors. Others have suggested that the firm’s growth has stagnated in recent months as automatic advice services from financial institutions gain traction.

Aggregation opens a new avenue for asset growth, but Benke said Betterment won’t use its aggregator as an advertising or lead generation tool, which he accused Mint of being, and said it will only be used to show current clients how much they can save.

“We don’t recommend you to roll over every IRA,” Benke said, adding that the goal is keep investors out of needlessly high-fee IRAs. “As fiduciaries, we really take the stance for what’s best for the end client. If you want to do it yourself, that’s fine.”

As for the institutional side, Benke said it’s a value add for advisors and said Betterment provides a better user experience to view and manage a client’s various assets than most brokerages' websites.

Benke also said that unlike aggregators like Mint or Yodlee, Betterment’s won’t be subject to the recent data restrictions instituted by some of the large banks.