Yet, at last month’s Financial Planning Association’s annual conference, I was surprised by the number of Certified Financial Planners and asset managers and advisors stated, flatly with certainty, “MPT is antiquated.”

That’s how Bryce James, president of Smart Portfolios LLC (and advisor to the Aston Dynamic Asset Allocation fund; ASENX), described his thinking. As its prospectus notes, “The Aston Dynamic Allocation Fund uses a proprietary mathematical process to select ETFs across a wide variety of asset classes—including equities, fixed-income, international, and commodities. The goal is to create an optimal portfolio designed to produce returns in excess of its blended market benchmark with an equal or lesser amount of risk.”

The problem, as Bryce and others see it, is that MPT wrongly describes upside volatility (it’s a good thing) and that averaging returns over many years is no way to model asset allocations. I put words into James’ mouth during a video interview at the conference (to view it, go to our homepage and click on RepTV), “The unprecedented happens all the time.” James agreed.

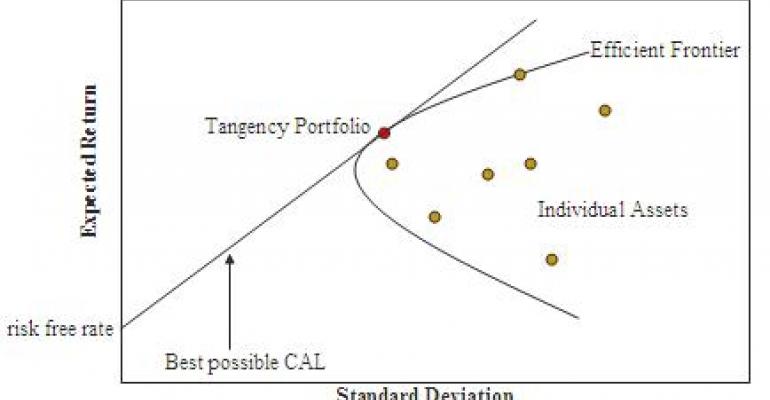

To be more precise, (and as we wrote in a cover story in July of 2009, “Everything You Know About Asset Allocation Is Wrong”): The debate between believers in the two different approaches to portfolio construction centers around how they define risk, and how that risk influences returns. MPT models risk using standard deviation above and below expected returns (also called mean variance). PMPT (Post Modern Portfolio Theory) models risk using only standard deviation below expected returns (semivariance). In other words, MPT assumes that there is such a thing as upside “risk,” whereas PMPT proponents believe that only downside risk matters to investors. PMPT tend to use non-normal distributions to create their asset allocation models.

This difference seems to give PMPT modeling greater power to predict disasters. In fact, applying MPT's concept of standard deviation to the monthly returns of the S&P 500 indicates a monthly loss greater than 12.8 percent has nearly no chance of happening. But it has occurred 12 times since 1926, according to Brent Bentrim, founder of Carolopolis Fiduciary Counsel, an RIA in Charleston, S.C. PMPT, say supporters, allows for last year's upset because it measures asymmetrical return distributions.

At the FPA confab, I also met an interesting man, G. Michael Phillips, CEO and “chief scientist” at MacroRisk Analytics. The firm provides advisor-oriented tools to help divine what economic indicators are saying about risk to clients’ portfolios—in short, the tools and research allow advisors to interpret economic data to, well, dynamically allocate your clients’ portfolios in response to real-time economic events.

Here are some other dynamic asset allocation mutual funds you might consider: Hussman Strategic Total Return (HSTRX); Ivy Asset Strategy (WASAX) and BlackRock Global Allocation (MDLOX). Our mutual fund editor Stan Luxenberg says: “These funds make top-down calls, and they have often been right.”