Based on the ASI Wealth Manager, goalgamiPro is a cloud application designed to assist advisors with simplified goal-based financial and retirement planning by providing a process to profile clients and generate modular client-focused reports.

The goalgamiPro Household Balance Sheet is an effective way to capture a snapshot of the entire financial picture of the household, and provides an initial diagnosis of the affordability of a client’s goal plan. The Household Balance Sheet also assists the advisor in discussing clients’ priority levels within goals and balance otherwise competing goals. The Household Balance Sheet allows the advisor to perform an analysis of how household goals can coexist at different funding levels.

goalgamiPro leverages the Household Balance Sheet to provide the basis of planning – to assess goals and whether they can be funded. The goalgamiPro quick plan allows advisors to apply a seamless approach to client goal analytics, from prospecting through client engagement.

goalgamiPro is a straight forward assessment tool for the advisor who wishes to create a quick baseline or periodic review of the financial circumstances of a client’s household. The publisher states that its goal for this facility is to use the power and insight from the Goal-Driven Investing paradigm to enable advisors and financial planners to deliver to their clients a new and innovative approach to financial planning. It provides a concise financial plan focused around a client’s household goals that is easily produced and assists an advisor in engaging the client in planning collaboration. It addresses the client’s questions regarding plan development, affordability of goals and creation of desired retirement funding.

What’s It All About

Goal based planning and its implementation through AdvisorSoftware’s goalgamiPro is discussed and illustrated on the publisher’s web page Goal-Driven Investing – a Better Way.

The publisher states that goalgamiPro was developed to provide a streamlined process to profile clients’ financial situations and generate modular one-page client-focused reports. It provides advisors with a tool to produce a quick assessment of the client’s ability to meet family goals using concise output to augment periodic investment reviews.

goalgamiPro works from the client’s Household Balance Sheet to provide the basis of financial and retirement planning by assessing the client’s goals and ability to fund such goals.

How Does It Work?

The client is first furnished with a fact finder client questionnaire designed to obtain and organize all client household information including financial accounts, savings and retirement contributions; educational contributions; future benefits from social security and retirement accounts; retirement expense goals; goals for personal expenses, living expenses, medical expenses, financial expenses and anticipated lump sum payments.

Clients are also furnished with a guide for creating goals for goal based planning. This guide requests entering goals for short-term, mid-term and long-term planning. It requests the clients’ household balance sheet, including investments, essential expenditures, discretionary expenditures, monthly income, debts and loans, actual weekly expenses for listed items, monthly expenses and annual expenses.

The collected information is then entered, and may be edited, in the goalgamiPro software as a household. You may enter and edit Economic Assumptions including inflation rates, goal discount rates and projected transaction costs.

The Household screen (navigated by top buttons) includes Plan Details, Plan Resources, Balance Sheet, Cash Flows and a Report.

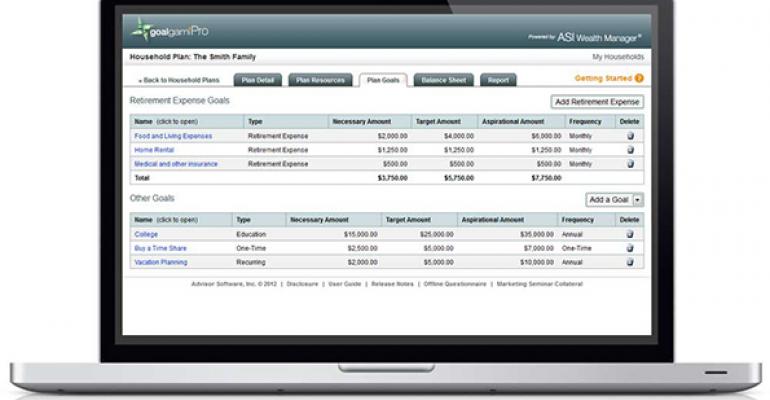

You then enter a screen that takes you through the plan steps. Step 1 is to review the household information previously entered, which is summarized and displayed. Step 2 is a screen from which you select future goals with the amount and timeframe for each goal. Goals may include Life’s Milestones, Retirement, Home & Property, Education, Vacations, Big Toys and Other. At Step 3 detailed descriptions of the goals may be entered including the necessary amount, a target amount and an aspirational amount. This screen offers bar charts of Household Resources compared to the cost of the goals and displays text describing example goal setting. Step 4 is to transmit this entered information to the client advisor, which screen includes a summary of the households included, their current and future resources, and the goals selected (with amounts and timeframes).

The results of the data entry and goal selections are displayed on the Household screen. Plan Details displays the life information of the principals of the family and the Economic Assumptions. Plan Resources shows the Household Accounts included in the plan (with types, owners and values), Anticipated Savings (with type, frequency, timing and amount) and Anticipated Benefits (with type, frequency, timing and amount). Plan Goals tabulates the goals and related expenses (type, amounts required and frequency). The Balance Sheet tabulates the household Resources, by type, as of the current date with Anticipated Savings. It also tabulates the amounts required to reach the goals, by necessary, target and aspirational levels. It reports on funding by goal level with a projected surplus or deficit and additional savings needed for each. This screen is designed to assess the clients’ ability to achieve their financial goals.

Account values are presented at liquidation value, amounts created in the future by regular funding are discounted to net present value and goal values are discounted to the present value.

In the Cash Flow screen, the Cash Flow Planner uses a client’s plan information, including expected income, expenses, goals and economic assumptions to model and compare needed annual year-by-year future cash flows from all household funding sources, to determine if the household will have enough money to pay the cost of goals when they come due.

The rate used in the Cash Flow is derived from the client’s Goal Discount Rates and the goals for the plan. The discount rate for each goal priority level is multiplied by the weight of the goal level and the Funding Ratio for each goal level. These values are summed to determine the final rate of return.

For brokerage accounts, the Cash Flow Planner uses the rate of return for retirement accounts and factors in income taxes.

For bank accounts, the Cash Flow Planner uses a fixed rate of return that is reviewed—and, if necessary, revised—periodically.

The Report screen then presents pages that include the Cover Page (including advisor information), What is my Plan?, Can I Afford my Goals charts, How Do I Pay for My Retirement and Notes about the plan. It allows you to select elements to be included in each of these pages and to edit the Notes.

Settings may be changed and reports tailored as you use the application.

What About Help and Support?

Each screen includes access to a searchable help system that describes the methodology of entering data and managing each screen of the software, offers explanatory videos, explains how the software works and includes client communication suggestions. Contact information for email support is included.

AdvisorSoftware maintains a Blog that discusses retirement and financial management topics, goal based planning and elements of their software.

Where Do You Get This Facility?

AdvisorSoftware Sales may be contacted at:

Advisor Software Inc.

Phone: 925.444.1334

Email: [email protected]

or by email from http://advisorsoftware.com/contact.html

AdvisorSoftware, goalgamiPro is priced at $495 per year for an individual advisor and the price per user is adjusted for a greater number of users.

Bottom Line

goalgamiPro provides a sophisticated, but quickly developed, base for planning, discussing and illustrating the client’s goals and methods for achieving them while promoting client collaboration and involvement.

Trusts & Estates magazine is pleased to present the monthly Technology Review by Donald H. Kelley—a respected connoisseur of the software and Internet resources wealth management advisors use to further their practices.

Kelley is a lawyer living in Highlands Ranch, Colo., and is of counsel to the law firm of Kelley, Scritsmier & Byrne, P.C. of North Platte, Neb. He is the co-author of the Intuitive Estate Planner Software, (Thomson – West 2004 to 2014) and author of The Electronic Practice ebook (WealthManagement.com 2013). He has served on the governing boards of the American Bar Association Real Property Probate and Trust Section and the American College of Tax Counsel. He is a past regent and past chair of the Committee on Technology in the Practice of the American College of Trust and Estate Counsel.

Trusts & Estates has asked Kelley to provide his unvarnished opinions on the tech resources available in the practice today. His columns are edited for readability only. Send feedback and suggestions for articles directly to him at [email protected].