For two days this week, the wealthtech world was glued to their computer screens—even more so than usual—watching and participating in the fifth annual AdviceTech.live conference.

The online audience of more than 1,000 event participants experienced 20 live, 10-minute demonstrations from advisor technology providers, several speaker and panel sessions and could visit the virtual booths of 21 sponsors—all at no cost.

Obviously, it was all too much for one intrepid tech columnist to absorb (and write about), but here are a few of the highlights.

Lydia

Adam Holt, founder and CEO of Asset-Map, declared that the theme of this year’s conference was “Elevate the Humans.”

And in that regard the first guest was one of my favorites. Brian Portnoy, a leader in behavioral finance and author of several popular books on the subject, who discussed several things, but what most caught my attention was his firm Shaping Wealth’s partnership with Alai Studios.

Shaping Wealth provides a wealth industry learning and training platform meant to power “human-first financial guidance.” Alai specializes in building artificial intelligence technology.

The partnership combines various AI capabilities with behavioral finance content and coaching.

Portnoy had me at the mention of the name Lydia. As an archaeology lover, I suspected it referred to the ancient Lydian Empire that existed in what is today modern Turkey. Coins from Lydia are some of the oldest ever found, some dating to around the 7th century BC and made of gold and silver alloys.

“With Lydia, we are creating a co-pilot type of experience, which will be rolling out in the coming months—AI that is building client empathy into a large language model,” Portnoy said.

“We want to amplify human brilliance … we want to create a partner in your day-to-day workflow. ‘Let me run my agendas through you for my upcoming client meetings,’” he said.

The intelligent chatbot will help advisory firms with meeting prep, agenda setting, roleplay scenarios and real-time guidance, or so the plan goes. Advisors can visit Meetlydia.ai to get a sense of what it can do and sign up for access.

Holistiplan

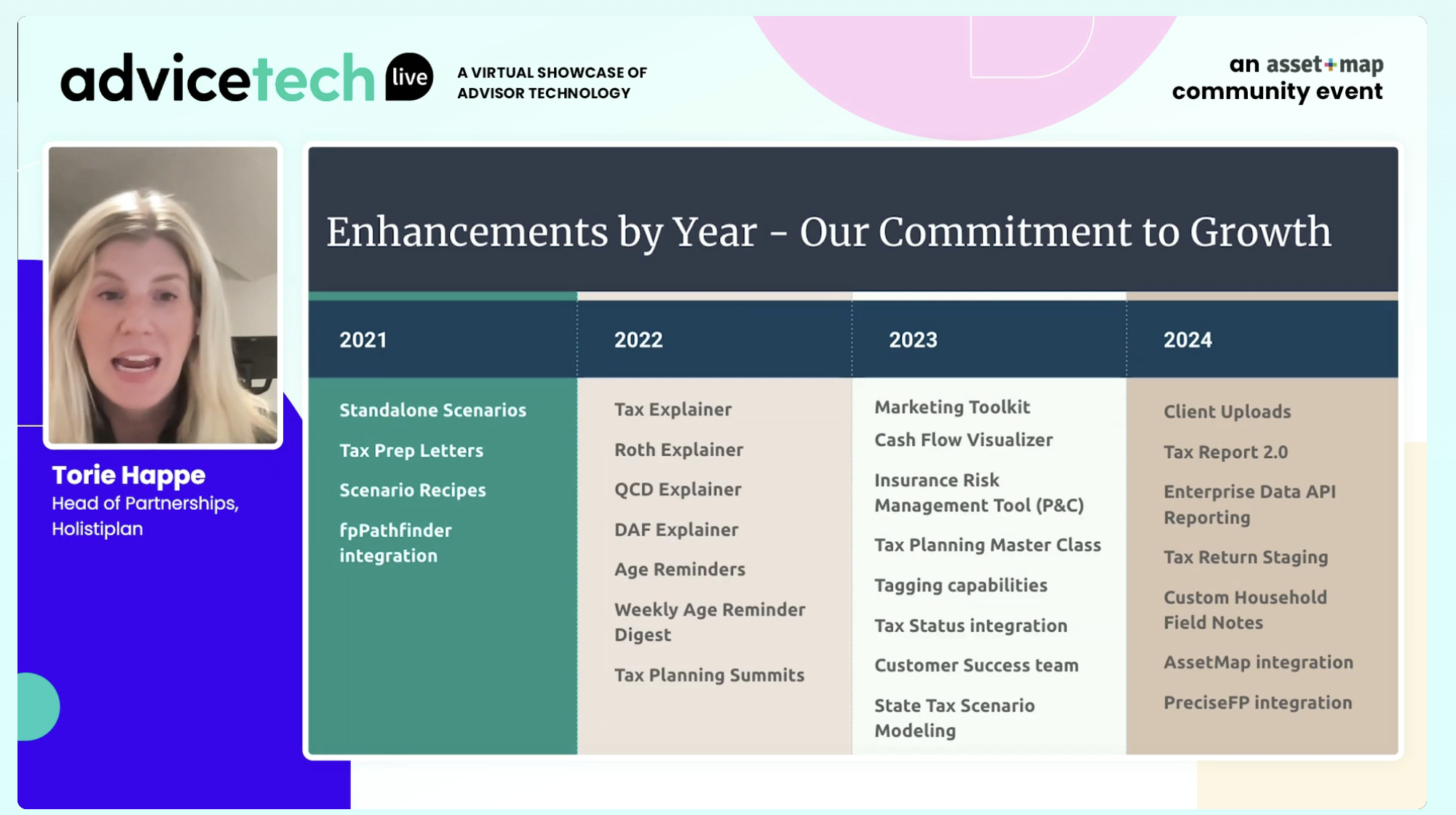

Torie Happe, head of partnerships at the popular tax planning platform provider Holistiplan—which she reports is now used by 7,600 firms and has 34,000 users—talked about several new features during the company’s demonstration.

Among these was Tax Report 2.0, which builds on the platform’s flagship tax report with a more efficient workflow and improved visualizations.

A multi-year Roth conversion feature has been added, and an estate planning one, which remains in beta, has been introduced.

VRGL

Phil Crist, SVP, head of revenue and corporate strategy at VRGL, introduced the company’s new intake workflow that includes a customizable 15-question Risk Tolerance Questionnaire.

With it, advisors can tailor questionnaires more closely to their organization’s risk frameworks and personalize the assessment process further to better match an advisory firm’s approach to risk and investment allocation.

VRGL also introduced a tax transition feature designed to automate and optimize the structuring of a bespoke portfolio recommendation—while adhering to restrictions on tax budgets.

Blueleaf

Blueleaf, which sells an all-in-one wealth management platform incorporating account aggregation, performance reporting, billing and rebalancing, announced it had just gone live with an integration with custody and clearing provider Altruist.

“No [paper] forms, an online-only instant connection, and we already have 28 [advisory] firms live on it,” said Blueleaf founder and CEO John Prendergast.

Blueleaf won a Wealth Management.com Industry Award in 2023 for its aggregation-as-a-service with direct client support.

EstateGuru

Chris Hall, head of business development and strategic partnerships for Estate Guru, which he said has been in business for 30 years, referred to it as “the only attorney-embedded” estate planning software.

“Think of us like a document engine; a lot of advisors think of us as the conduit to creating estate documents,” he said before discussing the new Guru+ concierge estate planning service, in which the advisor has “flexible involvement.”

“Rather than sending a client off to an estate attorney, send them to Estate Guru, and they will meet with the client, answer their questions, and you will be kept in the loop and can even attend the meeting and get it for a fraction of the regular cost,” Hall said.

UPTIQ

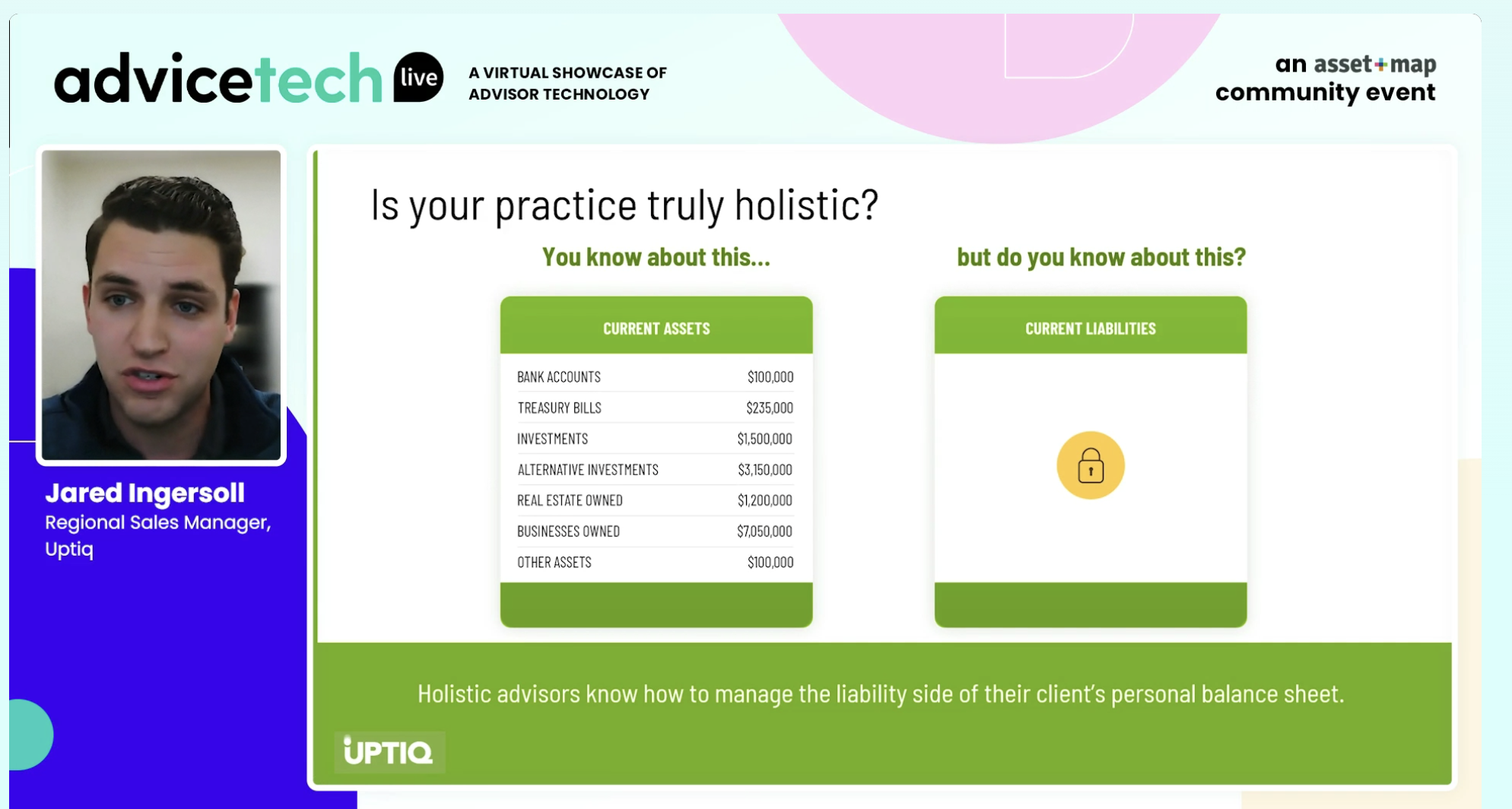

“Advisors lack visibility into their clients’ credit, and finding lenders or loans [for clients] is usually labor intensive … [and in the end] several weeks of underwriting can blow up all too easily,” said Jared Ingersoll, regional sales manager at UPTIQ.

The UPTIQ platform can send an invitation for a soft credit inquiry from within the interface, which won’t affect the client’s credit. The application can then look at the client’s existing loans and provide refinancing options and opportunities, helping the advisor to become the trusted resource for lending.

The platform’s lending marketplace features a network of over 60 lenders, who support every type of financing, from luxury cars to boats or aircraft to commercial loans for clients who own their own businesses. He also introduced Samuel, the company’s AI chatbot, that for now can answer very specific questions.

“Expanding Samuel’s role is a big part of our roadmap,” he said.

Asset-Map

“67% of working hours in the wealth management industry will be impacted by AI,” helping advisors get their time back so that they can elevate the human experience of their practices, Holt said.

Holt covered a lot of ground with what is new in Asset-Map, from being able to display whether a client’s “legal instruments” (wills, POAs, guardianship, living wills, buy-sell agreements) are complete and available to “practice insights” (being able to automatically and visually see your wallet share or other metrics related to your firm). I found most interesting the “beneficiary map.”

One of the most common failures in estate planning—after not having the correct legal documents in place—is the incomplete or haphazard election of beneficiary designations, he said.

“There is often a lot of mess about who gets what and does this match the client’s intent … [with the beneficiary map] you can see a view of what has been assigned a beneficiary and what has not,” Holt said.

Wrap Up

It was a busy week, and I missed demos from several other participants, including Estately, Pulse360, and RISR, which WealthManagement.com has previously written about.

Also, awards were handed out to the companies that participated in the demos based on audience voting: Pulse360 won the Community Impact Award, Holistiplan won in the Industry Disruptor category and Blueleaf for Rising Tech Star.

As part of the conference, event sponsors also raised $37,500 in donations to this year’s benefactor partner, Philly Phinancial Literacy Week, Inc. Over the last five years, the event has provided more than $140,000 to five different non-profit organizations.

Finally, I would be remiss in not pointing out that Asset-Map addressed the minor criticisms I expressed after covering past events, adding the ability to communicate with those putting on the event (and the rest of the audience) via a real-time chat sidebar.

On a few occasions during this year’s event, the feature proved useful beyond audience members posting comments or asking questions by providing real-time feedback to speakers.

According to Asset-Map, access to the virtual exhibitor booths and session ‘replay’ recordings will remain available on the event website for a few weeks for those who registered.