In September, the Federal Reserve lowered interest rates by 50 basis points, its first rate cut in four years, and more cuts are expected. As the cost of capital comes down and debt service ratios improve, the most active players in the registered investment advisor M&A space will invest more aggressively, according to the latest DeVoe & Company RIA Deal Book.

Specifically, DeVoe predicts that the most well-capitalized consolidators—those backed by private equity firms—will become more active in the space over the next 12 to 18 months. These consolidators have dedicated M&A teams working to build scale, enhance resources and expand geographically. These firms have historically accounted for approximately 70% of RIA acquisitions.

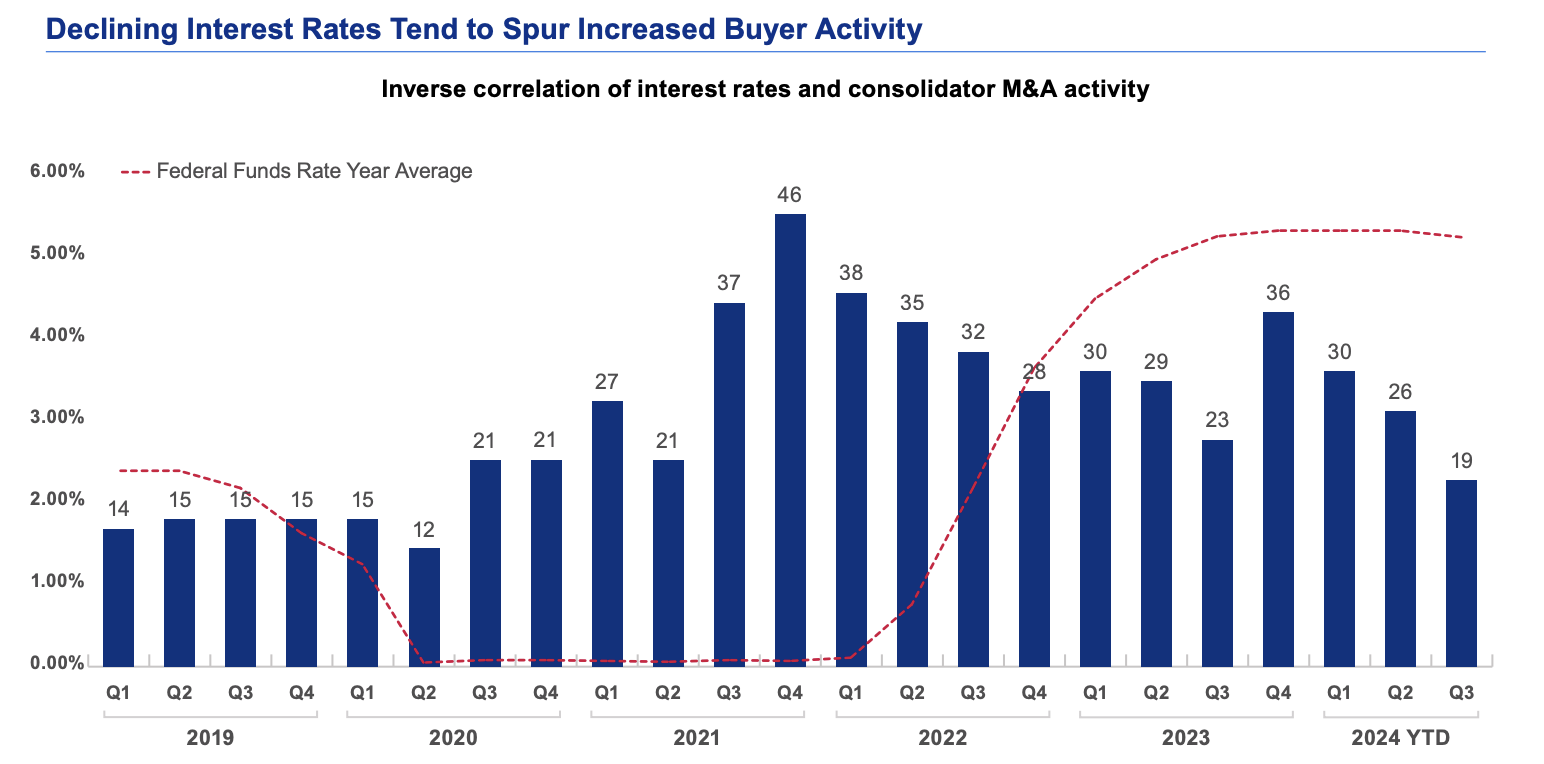

DeVoe’s prediction is based on historical data showing an inverse correlation between interest rates and consolidator M&A activity. When rates dropped to zero in the second quarter of 2020, M&A activity accelerated and increased to an all-time high in the fourth quarter of 2021. When the Fed started to raise rates in early 2022, M&A activity started slowing down.

“Interest rates directly affect the cost of debt,” the DeVoe report stated. “With the cost of acquisitions declining, the acquisition math improves. Interest rate declines are particularly good for firms with a high amount of debt on their books, as the cost of the debt has become a significant line item.”

The report also states that lower rates could lead to higher valuations and different deal structures, with more cash coming into play.

Overall, RIA M&A was flat in the third quarter of 2024, with DeVoe counting 65 transactions, in line with the quarterly volume for the last three years. The first three quarters of this year had 191 deals, up from 185 during the same period last year. This year’s volume is on pace to surpass 240 deals; that compares to 251 transactions in 2023.

Year-to-date, the average seller size has been about $1 billion in assets, up from $827 million and $819 million in the prior two years.

While consolidators have long dominated the deal landscape, acquisitive RIAs are closing the gap. In 2021, consolidators accounted for 54% of all deals, and that’s fallen to 39% so far in 2024. Meanwhile, RIAs now account for 38% of deals this year, up from 23% in 2021.

“A growing number of RIAs are turning to M&A initiatives as they identify opportunities to gain assets, acquire talent, and expand services without building them from the ground up,” the report said. “With three months remaining in 2024, RIA strategic acquirers have already matched last year’s transaction count, bringing market share back in line with pre-pandemic levels.”