Addepar, a technology provider to RIAs and wealth managers, has announced the launch of its own trading platform, the rollout of dashboard enhancements and other improvements to its products.

The new Addepar Trading platform enables full trading execution and rebalancing of client portfolios and includes model construction features. In addition, the platform is scalable and can trade and rebalance across households or bulk accounts across a firm. It also supports advanced model construction, interactive worksheets and pre-trade compliance checks. Firms can trade using flat-file execution or use options that include automated FIX trading and post-trade processing.

In late 2021 Addepar acquired trading and rebalancing startup AdvisorPeak, and while some might assume that the new platform was built using technology from that product, they would be mistaken, according to chief product officer Don Nilsson.

“Addepar Trading was built completely from scratch and is fully native to the Addepar platform,” Nilsson said of the technology. “We had already started to build our own trading solution prior to the acquisition of AdvisorPeak, and it was largely an acqui-hire—from the day that team arrived, we were already working on a brand new one."

Asked why Addepar had built its own trading platform when so many existing products are available to advisors, Phil Senseny, head of trading for Addepar, explained that larger firms were looking to the company to help them consolidate their technology stacks.

“That best-of-breed-and-then-integrating strategy is now going in the opposite direction to reduce integration cost, and vendor risk is real, and it’s costly, and it’s time-consuming,” Senseny said, referring to the risks advisory firms face associated with overseeing cybersecurity and vulnerabilities when working with multiple third-party technology vendors.

He said that it was also about being able to build in and optimize workflows to help make Addepar’s client firms more efficient.

“We’ve gathered that necessary information for you so that when you sign in in the morning, you see what you need to do and then simply work through the workflow,” said Senseny.

Addepar works with 1,000 client firms managing almost $6.5 trillion in assets across 45 countries and has an annual research and development budget of $100 million. Senseny said that many of its users had been asking for these features to help optimize their trading operations while still allowing for flexibility.

“We have advisors building centralized trading organizations within the firm where they can build their own best thinking via models, constructing model allocations and putting them on the shelf,” he said.

Firms can then go in and update, for example, that one capital market assumption, as well as many other customizations, from the ability to create equivalency rules, adding tax budgets, or adding rounding rules.

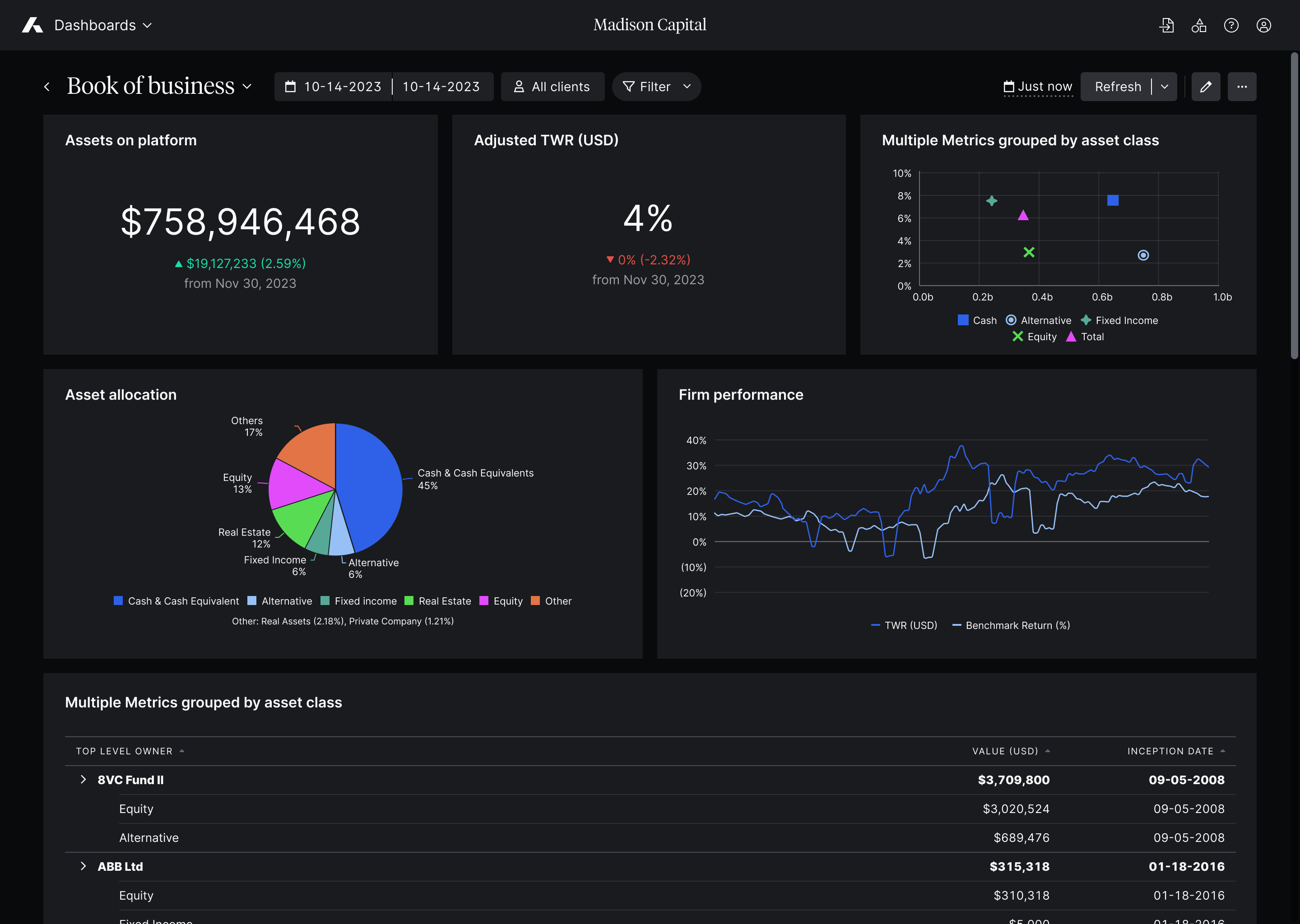

Another part of the announcement is the rollout of Addepar Dashboards, which Nilsson described as a highly customizable and visually appealing way to view strategies, tasks and portfolio data. Advisors or their firms can create and customize dashboards with drag-and-drop elements, resizable widgets, and refresh scheduling. They can also choose among custom color palettes or light or dark viewing modes.

The dashboards are meant to seamlessly integrate with data from across the Addepar ecosystem of analytics, data, and account aggregation.

“This is a big effort to uplevel the aesthetics of the platform,” said Nilsson.

He added that it was also meant as a way to surface underlying platform data and allow client firms to aggregate that data into dashboards and widgets of their choosing and customize them the way they would like to see them.

“When you are in core Addepar, you have tables and charts there, so anything you can achieve in the core analysis part you can achieve in a dashboard, but in that core, you couldn’t put tables next to each other, for example, with dashboards you can put them anywhere you want,” he said.

Asked what was on the future roadmap for the dashboards, his response was simple.

“Anywhere there is user interface depth, we are likely to provide dashboards,” he said, adding that the company already has a lengthy roadmap for the future and that dashboards had been in beta for quite some time and that the company was making the feature generally available with the announcement.

“Compliance, for example, is a common need all clients have, so we will be building that ourselves,” he said.

While the dashboard and widget features will be available to Addepar customers at no additional charge, the trading platform is an add-on service to the core Addepar platform.

Addepar does not publish pricing information or provide it to the media.

“From a trading perspective, we’ve done a lot of market research, and we think we have found a starting price that is in line with our competition,” said Senseny.