How Can Indie RIAs Avoid Being Ensnared By “Wire-Esque” Conglomerate Firms?

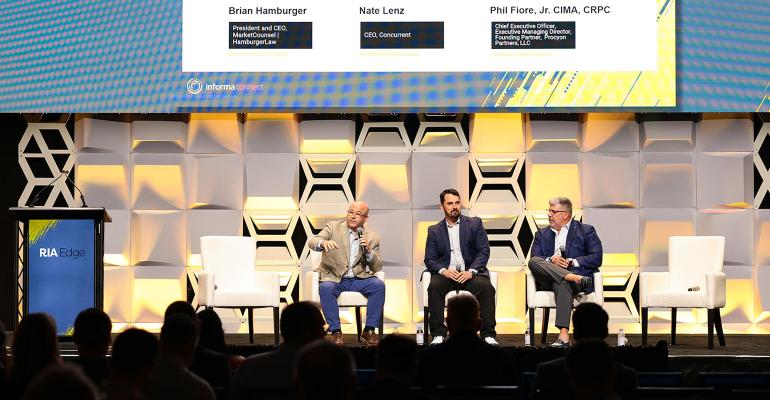

Independent RIAs should be watchful of their tech stack so that it doesn’t become the barrier that prevents advisors from leaving and making their independent firm reminiscent of a wirehouse, said MarketCounsel CEO Brian Hamburger.

Hamburger moderated a panel of RIA CEOs, including Concurrent CEO Nate Lenz and Procyon Partners Founding Partner and CEO Phil Fiore Jr.

When asked what their firms were doing to avoid becoming entangled in a conglomerate of consolidated RIAs that are so big it feels like the wirehouse environment they left behind, Hamburger said it’s a reality that some business models make him wonder if they are “building a prison outside of the prison walls.

“Is technology the next capture?” he asked. “There’s a declining appetite for restrictive covenants. Is technology one of those barriers that prevent people from leaving where now we look and feel a lot like the wirehouses?”

To Fiore, the chief difference was (and remained) that wirehouses manage downwardly compared to the firm. He believed if the firm could stick to that approach, it could find the trap of becoming “wire-esque.” He also argued that he doesn’t need 1,000 employees to make his firm successful if he has the right people.

“If we continue down that track, and not do deals just to do deals, I hope we won’t be in that trap,” he said. “But it keeps me up at night, if I’m being honest.”

As Women Amass More Assets, Financial Firms Fall Short in Reaching Them

Legal control in estate planning is “one of the greatest value-adds” firms can offer female clients. The industry's attitude toward trusts and wills will change even more as women attain an ever-greater percentage of assets.

“I want to make sure every woman has legal advice and good legal counsel,” Joanne Bradford, the chief money officer for Domain Money and a senior advisor to Female Quotient said.

Bradford focused on advice for firms trying to expand their client base to attract more women investors, saying the industry needed to catch up.

According to McKinsey, by 2030, American women will be in charge of much of the $30 trillion in assets controlled by baby boomers, which is “a potential wealth transfer of such magnitude that it approaches the annual GDP of the United States.”

Bradford said she often heard firms opine that they can’t find women employees or customers. She offered a simple solution: Take three women to a meal once a month and speak about their jobs and lives. By doing this once a month, by the year’s end, firms will recruit more female employees and clients.

“And it’s not that hard,” she said. “You’re taking the foursome off the golf course and putting it into practice every day. It’s way cheaper and easier, so just do it.”

Convergence of Wealth and Retirement

Bonnie Treichel, founder and chief solutions officer with Endeavor Retirement, noted that for a long time when there was M&A activity, it tended to be “just within wealth” or “just within retirement,” In this M&A cycle, the industry is seeing more wealth firms picking up retirement specialists so they could do retirement, or a retirement specialist adding on a firm with wealth capabilities.

Advisors working with retirement plans need to make sure they fill out 408(b)2 disclosures if they are being paid out of the retirement plan’s assets. Treichel cautioned. It’s a frequent enough mistake, but if it’s flagged, the advisor will have to give back their fee and pay penalties on top of that.

—Elaine Misonzhnik

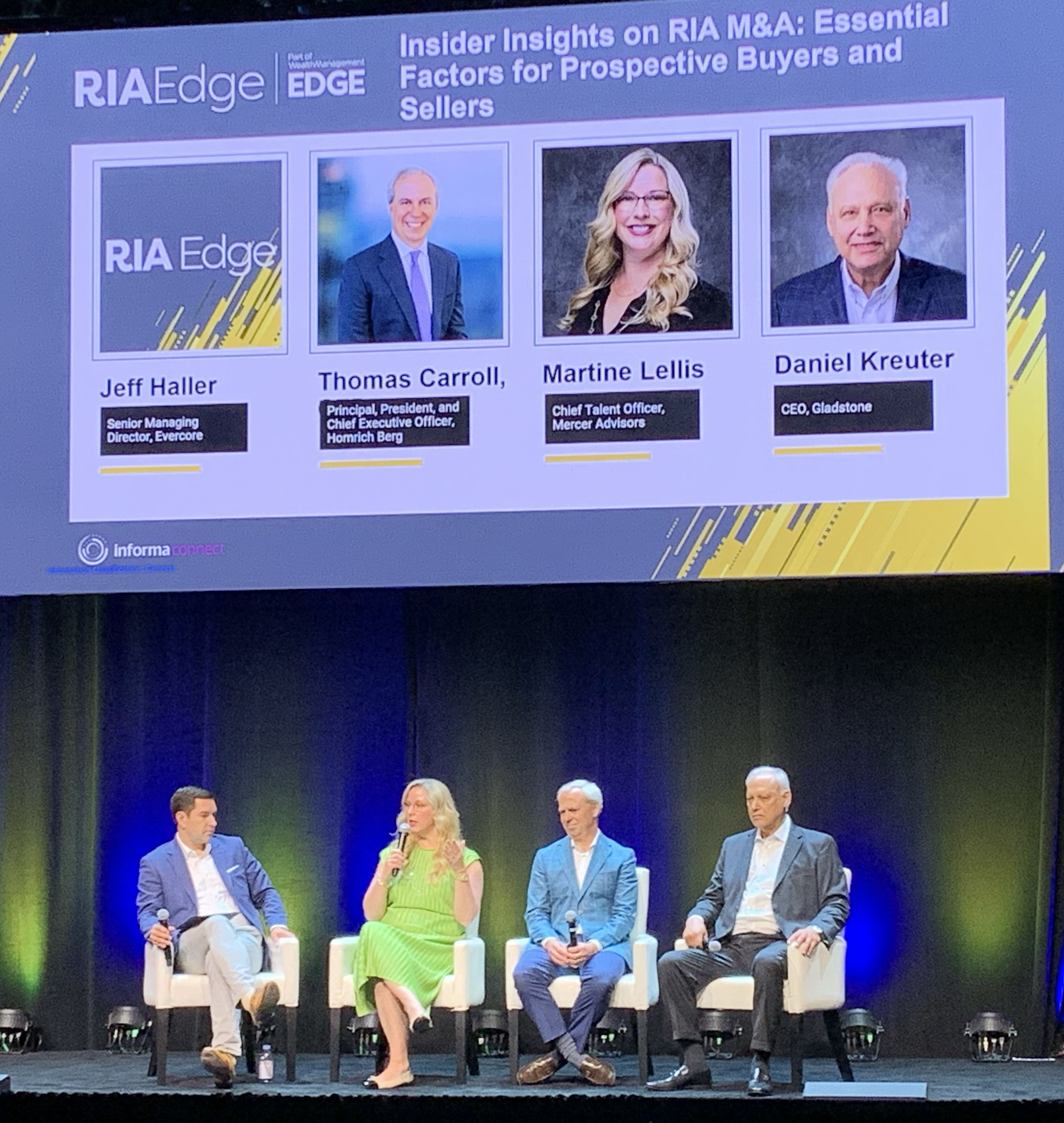

The M&A Train Not Slowing Down

Despite the retraction in RIA M&A activity in 2022, the wealth management industry is ripe for activity to continue, said panelists at RIA Edge.

Martine Lellis, principal, M&A partner development at Mercer Advisors, said there could be 25 to 30 years of consolidation.

“Nothing is slowing the train down,” said Daniel Kreuter, CEO, Gladstone.

Private equity firms, in particular, are increasingly interested in the RIA space. “They love inefficient markets with no dominant players,” he said.

But the buyer’s due diligence process is taking longer, he said. Buyers are drilling down on whether the firm’s key advisors are under employment agreements and whether there’s a flight risk there. Buyers also don’t like to see compliance or cybersecurity issues.

Navigating Cash vs. Equity in RIA Deals

How does a potential buyer determine whether cash or equity (or a combination of the two) is the right choice for a potential RIA sale?

For Merit Financial Advisors, introducing equity into the equation has been a multi-year “evolution,” according to President Kay Lynn Mayhue. Equity was the firm’s “most precious commodity” at that time, but the high cost of borrowing is leading the firm to rely on equity in deals more heavily than it had in the past.

“For our growers coming in and wanting to lead a division … we want them to have our shared currency because we want them to participate,” she said. “We want the same entrepreneurial spirit that got them into this business.”

Denitsa Balunis, a senior vice president, corporate strategy and development and chief of staff to the CEO at Edelman Financial Engines, said her firm still opts for cash in most transactions. Like Mayhue, she saw equity as one of Edelman’s most valuable assets and would offer it to firms they expect to be with Edelman for the long term.

However, according to Jessica Politio, the founder of Turkey Hill Management, structuring a cash/equity transaction can be “the first test” for the partnership between buyer and seller. And it can vary from case to case.

If you have a 45-year-old founder of a $1 billion AUM firm, that founder may be faced with a choice to invest in their business or find a partner to boost growth, Polito said. In that case, equity is the best move.

But if the seller is a 65-year-old firm leader who wants out and gives the buyer one year to transition clients, he’s not looking for equity, Polito said.

“He wants to monetize a liquid asset he’s built his entire career,” she said. “And he wants to buy his vacation home and relax.”

Firms Face ‘A Cliff’ of Potential Clients Reliant on Digital Leads, Not Referrals

The “traditional rainmaking” technique of relying on referrals is becoming less relevant as digital leads gain prominence, and “that cliff is coming sooner than we think,” according to Mary Kate Gulick, the Chief Marketing Officer and Head of Financial Services at FiComm.

During an afternoon discussion on succession planning for firms at RIA Edge at The Diplomat Beach Resort in Hollywood Beach, Fla., Gulick said it was “inherently unsustainable” for founders and lead advisors to drive the majority of growth, and questioned whether the next generation of firm leaders would do so in the same way.

“The answer is no, absolutely not,” she said. “They will largely be dependent on digital leads.”

According to Gulick, FiComm will release a study later this month showing that only 29% of customers under 60 who’ve purchased financial advice services care about a referral or feel it’s relevant. That stands in stark contrast to many present-day firms that built their books of business on referrals.

“But for consumers under the age of 60, it’s not like they’ll turn 60 and say, ‘Oh, I need a referral; that’s how I get an advisor,’” Gulick said. “No, that’s simply not how we shop anymore.”

To properly prepare for when the next generation steps into leadership positions, firms need to set up digital lead generation three to five years ahead of succession. They can’t start that process and expect results on day one, as digital leads take longer to close than referrals.

However, according to Gulick, doing so is the only way G2 can sustain the level of growth present-day founders enjoy. She also said it was important for founders to remember that their global knowledge about the firm is not replicable for the subsequent generation, even if they shadowed the firm leader for years and knew everything they knew.

“Even if they do, they’ll never be you,” Gulick said. “You can’t replace yourself.”

‘If We Win Together As A Team, We Can Make A Lot More Money’

Firms must consider which behaviors they want to encourage in their advisors.

David DeVoe, CEO and founder of DeVoe & Company, led a discussion on “Unlocking Growth Through Compensation Strategies” with Jim Horrocks, CEO of TimeScale Financial, and Molly Bennard, CEO of Connectus Wealth Advisers.

Horrocks said though compensation is a sensitive issue, his firm changed its model a few years ago to disincentivize certain tendencies, including client hoarding. His advisors see 60% of their pay as a base and the remaining 40% as a bonus based on factors including professional development and the firm’s overall health.

Bennard agreed that linking the bonus design to a firm’s profitability was important.

“It changes the way advisors think,” she said. “They also recognize that if we win together as a team, we can make a lot more money.”

Begin With The End In Mind

Industry veteran Mark Tibergien recommended advisors to “begin with the end in mind” during his Visionary Address on "The Middle Innings.”

Firms should “look at the familiar in unfamiliar ways” as they move from “practice to business to enterprise,” he said.

As businesses grow over time, Tibergien said too many people confuse size and scale.

He asked advisors to look a decade in the future and consider how old they would be, what their business would be like, who would be leading it, why people would want to work with them and who their clients would be.

Duran to Firm Leaders: Spend 30% of Time On Sales To Secure Growth

According to Rise Growth Partners CEO Joe Duran, if you’re a leader of your firm and do not spend 30% of your time on sales, it’s “guaranteed” that you won’t have organic growth.

During a conversation with WealthManagement.com Managing Editor Diana Britton at Wealth Management EDGE at The Diplomate Beach Resort in Hollywood, Fla. on Tuesday, Duran recalled how when starting in the industry, cold calling was a common practice but said following generations in the industry believed selling skirted their fiduciary duties and that it was “a dirty word.”

“There is nothing wrong with being in the sales business,” he said. “By the way, it’s the thing that will cause you to survive or not survive. So how much of your time are you spending on sales?”

If you want your firm to grow organically, you need to allocate time specifically to that goal, spending about 30% of your time tracking how you’re selling, how many meetings you have, and your close and win rates, he said.

Without originality in your firm’s ideas and approach, sales may be even more challenging, forcing a leader to spend as much as half their time on that part of the business.

“But if you have an original idea, if you feel different, if you’re clear about who you serve, you’ll only have to spend 20% of your time on sales,” he said.