Just weeks after announcing the launch of its own self-clearing platform, Altruist says it has acquired Shareholders Service Group, a brokerage and custodial services platform, in a move that adds more than 1,600 advisors to its existing RIA firms. The acquisition gives Altruist close to 10% market share of total RIA firms, SSG’s service organization and a relationship with Pershing, SSG’s clearing and custody provider.

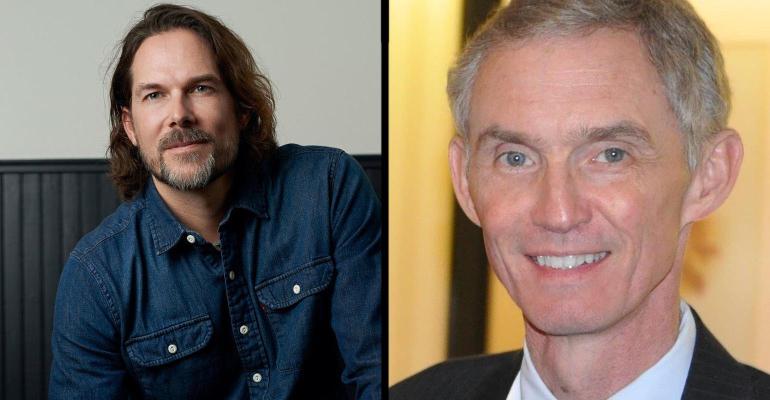

Altruist CEO Jason Wenk declined to disclose details of the transaction, except that it was a mostly cash deal, with some equity. Broadhaven Capital Partners, an independent merchant bank, advised SSG on the deal.

It's difficult to come up with an independent valuation for such privately held firms, said one advisor tech executive, who declined to be named. But he said a firm like SSG, which is not self-clearing, would likely be worth a great deal less than one that self-clears.

“It just gives us a lot more scale quickly,” Wenk said. “You think about the size of the RIA landscape, and we’ll have close to 10% market share, which is pretty remarkable for a company that’s 4 years old.”

“By having that larger base of advisors, it allows us to grow our assets a lot faster as well,” he said.

San Diego-based SSG was co-founded in 2002 by Peter Mangan and Bob Reed, who have created or managed four RIA custodial service platforms since the 1980s. Unlike Altruist, the firm never went self-clearing; it has operated as an “introducing broker/dealer,” using Pershing for clearing and custody.

Wenk said Mangan made the decision to sell as he was looking toward the next phase of growth for SSG. Mangan will stay on with the Altruist team, at least for the next couple years.

“I think SSG’s been around for 22 years, so he’s probably looking at it and going, ‘What’s the next 22 years look like?’ And there had to be a succession plan for the next 22 years,” Wenk said. “And the things they would need to grow are things like great technology, some of the infrastructure, like having our custody and clearing infrastructure in-house. That’s a really, big meaningful thing.”

One of the things Wenk was attracted to was SSG’s talent. The firm’s San Diego office will remain open, and 100% of SSG employees will stay on board. All of their employees will become shareholders in Altruist.

There’s little overlap in the type of talent the two companies have, he added. Altruist has about 330 employees, 75% of which work in product and engineering; SSG has about 30 employees, none of which are in product and engineering. The firm is more focused on servicing the advisors.

“It’s very much what they're known for—they just are really, really good at for caring for the advisors they serve, and they serve advisors that are very, very similar to Altruist,” Wenk said. They’ve always believed that you shouldn’t have to have $1 billion or $500 million to get access. They’ve been accessible. They’ve grown with firms.”

"It is definitely a services play," said one senior executive at a wealthtech company, who declined to be named. "They have their own tech stack and much of what SSG uses is from Pershing. What Altruist really needed is a services group to serve advisors."

Since it launched in 2019, Altruist has also been operating as an “introducing broker/dealer,” using Apex Clearing for custody and clearing. But two weeks ago, the company announced its own self-clearing platform, Altruist Clearing, the final step in becoming a full-service custodian—the only one, argues Wenk, built exclusively from the ground up for the RIA market.

But with the acquisition, Wenk is eager to maintain the relationship with Pershing, so that it can serve certain account and product types. For example, right now Altruist doesn’t support options or margin accounts, while Pershing does.

“There are certain things we can’t do because it takes a while to build out all of that clearing and custody infrastructure,” he said. “We’ll have true parity day one with any custody platform out there because we have all the benefits that Pershing brings with all the technology and innovation that Altruist brings.”

Tim Welsh, president, CEO and founder of Nexus Strategy, said the acquisition could be a move to corner the small advisor market, which other custodians have steered away from.

“From a strategic point of view, it’s questionable because the economics in custody don’t work very well for small clients,” he said.

“To me, it’s so counterintuitive to what the industry’s evolving toward," Welsh said. "Maybe [Jason Wenk is] zigging where everybody else is zagging, and maybe that’s not always a bad thing to do. But it also probably has to do with the fact that he has his own clearing business now, so he needs volume to make that work.”

“It’s not just having the technology,” Welsh added. “There’s a lot of financial things that go along with being your own clearing firm, so maybe that’s the only way it could really work for him is, out of the gate, get a ton of volume on it. This will do it.”

Wenk said he didn’t like the term, “small advisor,” and prefers to call them “scale-up advisors,” meaning growth-focused, upwardly mobile firms. Advisors on the SSG platform range from startup to $500 million in assets.

“‘Small advisor’ somewhat assumes that they’ll be small forever, whereas if I’m working with a growth-focused advisor, these advisors are not going to be small. They’re going to keep growing and growing.”

Davis Janowski contributed to this report.