A virtual funnel of endless prospects now awaits the 5,000 advisors of J.P. Morgan Wealth Management.

Endless is an overstatement—those advisors will be perched two clicks away from the 62 million digitally active clients who have some sort of relationship (banking, lending, etc.) at J.P. Morgan Chase, the largest U.S. bank by assets with $3.8 trillion (No. 3 in terms of number of consumer and small business accounts).

This funnel is the result of J.P. Morgan Wealth Management’s announced launch of Wealth Plan, its free digital money coach, which is now an embedded feature available within the Chase Mobile application and at chase.com.

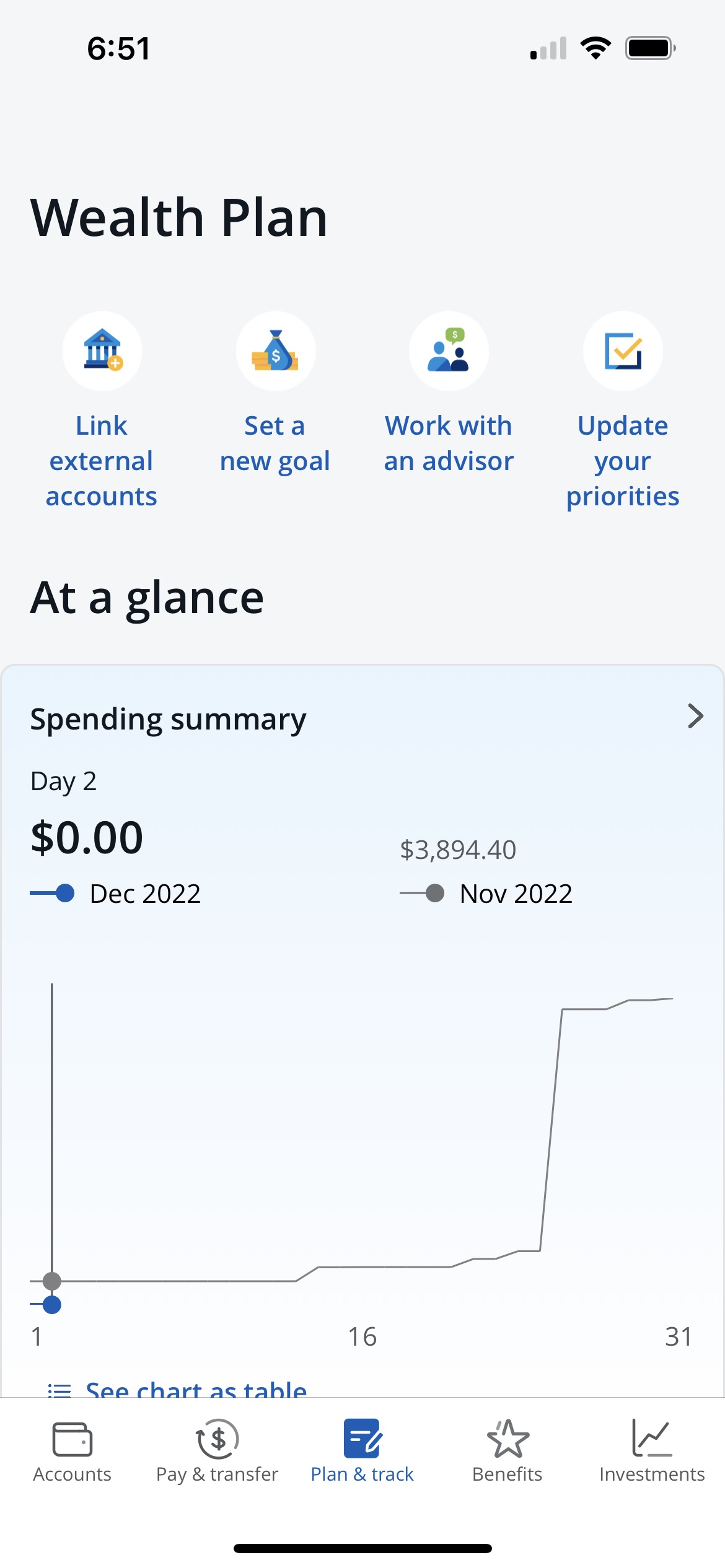

For example, the millions of users of the Chase Mobile app will find a “Plan & Track” icon at the bottom center of their phone screen.

Clicking it will open Wealth Plan, where clients are presented at the top of the screen with four other icons: “Link external accounts,” “Set a new goal,” “Work with an advisor” and “Update your priorities.”

In addition to providing J.P. Morgan Wealth a view of held-away assets and providing access to an advisor, Chase customers will be able to view their net worth, income, and spending and can easily set up and track goals.

Specifically, the “Net Worth” feature shows users a view of total assets and debt—if they linked their external accounts to provide a holistic view of all assets, including those not held at Chase. The “Income & Spending” tool shows clients their earnings monthly, quarterly or annually, and compares it with their spending. And finally, the “Goal Simulator” lets users get a sense of what the future may look like through projections based on growth of current assets, and then set, review and modify those goals. Customers can also virtually adjust those goals and perform hypotheticals to see how changes or different financial decisions might impact those goals.

Sam Palmer, head of digital planning and advice at J.P. Morgan Wealth Management, said in announcing Wealth Plan that the new features let “clients take control of their finances and interact with us however they choose, which increasingly is digitally.”

“And if they want to speak with an advisor, they can schedule a meeting right in the Chase app, and easily share their goals to have a meaningful conversation from day one,” he said.

Will Trout, director of wealth management at Javelin Strategy & Research, said this type of unified digital experience, which attempts to enable financial wellness—serving all sides of the client balance sheet through a single portal—can be a powerful one.

"Clearly, Chase is trying to plant business development seeds across a built-in base of passive clients," he said.

Trout said the coaching element found in Wealth Plan is critical.

"Our Javelin data indicates that clients are asking for 'life coaching' and personal engagement from advisers around intimate topics, such as death, divorce, mental health, and other traditionally private and sensitive matters and this platform should serve as a lever for Chase advisers to engage these clients, not least by functioning as a fount of insight and business intelligence on client needs," he said.

He added the J.P. Morgan effort is similar in scope to that which Bank of America has done with its client portal application. That tool surfaces and prioritizes financial decisions, such as saving for retirement and buying a home, among others, and all in plain English and via a single desktop or mobile experience.

While J.P. Morgan Chase has already been rolling out Wealth Plan for some time, according to a spokesperson, all the firm’s clients now have access.

J.P. Morgan Wealth Management’s more than 5,000 advisors include full-service advisors in a variety of locations, from Chase and J.P. Morgan offices and branches to advisors that are part of its new remote advice channel, J.P. Morgan Personal Advisors, launched in November.

All advisors fall under J.P. Morgan Wealth Management, according to the spokesperson.

In addition to its human advisors, J.P. Morgan Wealth Management also offers J.P. Morgan Self-Directed Investing and J.P. Morgan Automated Investing, its robo advisor, which originally launched in 2019 and saw significant growth in 2020.

J.P. Morgan Chase and Company first began piloting an automated portfolio management offering—or robo advisor—to employees with access to advice as JPMorgan Digital Investing in 2017.