Baseball great Yogi Berra famously declaimed “When you come to a fork in the road, take it.” As mind-bending as that may seem, it’s actually been good advice for investors this year.

How so? Well, 2021 has been a banner year for small-cap and value tilts and investors who’ve been able lean into both exposures have compounded their rewards. Yogi would say that these folk have indeed taken the fork in the road.

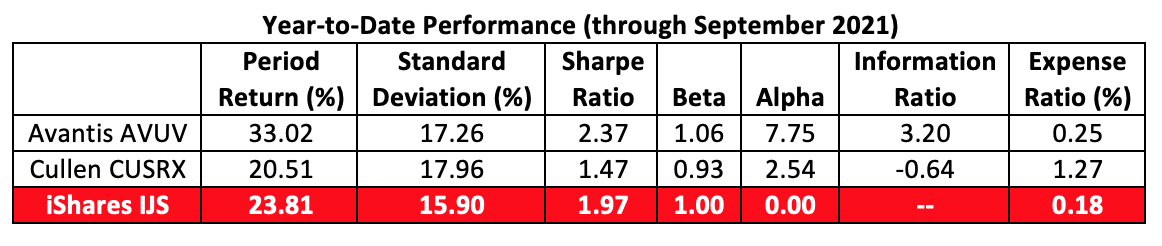

Through September, the iShares Core S&P Small-Cap ETF (IJR), a proxy for the S&P Small Cap 600 Index, gained 18.81% versus the 14.77% appreciation earned by its stablemate, the iShares S&P Core S&P 500 ETF (IVV). Filter out the value components of the S&P 600 on the basis of their book value-to-price, earnings-to-price and sales-to-price ratios and you’ll arrive at the exposure simulated by the iShares S&P Small-Cap 600 Value ETF (IJS). IJS notched a 23.81% gain on the year through September.

And what of the current month? Which small value portfolios are topping the charts in October? Among mutual funds available for new retail investment is the Cullen Small Cap Value Fund (CUSRX) with a month-to-date NAV return of 2.70%. On the exchange-traded fund side is the Avantis U.S. Small Cap Value ETF (AVUV) whose NAV nudged up 0.25%.

For the year, the track record of these two actively managed funds is mixed. One beats the performance of the IJS index tracker; the other doesn’t.

Despite their disparate returns, both portfolios cranked out positive alpha versus IJS. For the Avantis fund, it’s not hard to see why it earned its coefficient. To understand the alpha reading for the Cullen fund, though, you have to recall that alpha measures an investment’s return versus the beta-adjusted benchmark. The CUSRX fund’s lower beta more than compensated for its return coming up short against the index product. In this instance, a more definitive statement of performance is the information ratio. The ratio expresses an investment’s excess return--positive or negative--in terms of its tracking error. Practically speaking, it measures the consistency of a manager’s active bets. Big wagers require outsized returns over the benchmark to earn a positive ratio.

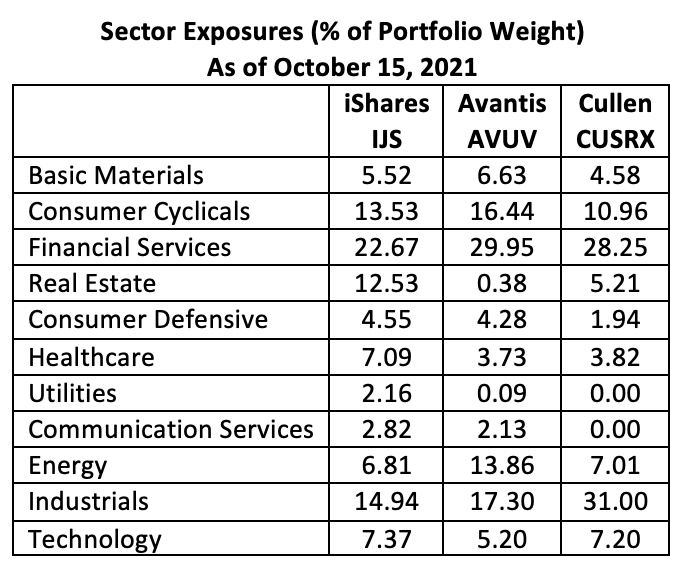

All this leads us to ask what those wagers actually were. Portfolio managers are loathe to give away specifics but there are telltale tracks in the funds’ sector exposures. Compared to IJS’ full replication of the S&P SmallCap 600 Index, the Avantis ETF significantly overweights energy stocks while underweighting real estate issues and utilities. For its part, the Cullen portfolio plays up industrials and pares down exposure to consumer defensive, utilities and communication services stocks.

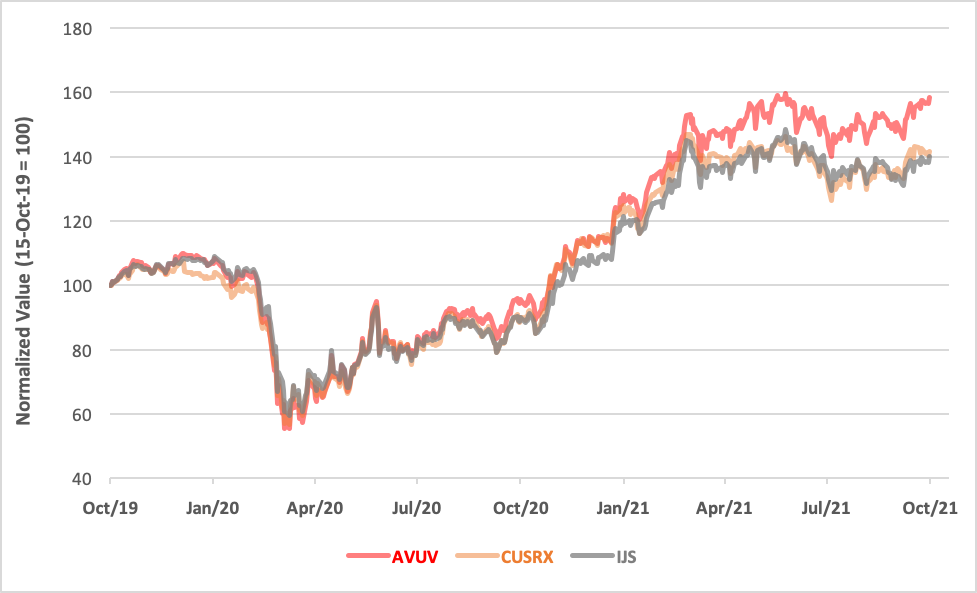

Being actively managed, the exposures in the Avantis and Cullen portfolios are fluid. Widening our viewpoint over a broader time horizon gives us a picture of the constancy of these funds’ excess returns. Unfortunately, our perspective is limited by the Avantis ETF’s relative youth. AVUV was only launched in September 2019. Still, its two-year track record conforms to its recent outperformance dynamics, namely a substantially better average annual return, a superior alpha coefficient and a modestly higher beta reading. Cumulatively, AVUV started to really pull ahead of CUSRX this January.

Two-Year Track Record (October 2019-October 2021)

Based on Daily Returns

In large part, the Avantis fund’s gain can be credited to its tilt toward the energy sector. The median year-to-date gain on AVUV’s energy positions is 63%. On a weighted basis, the most significant is the 390% appreciation in the share price of Denver-based SM Energy Co., an exploration and production outfit with substantial oil and gas holdings in Texas. SM isn’t a lone standout. Fully 35% of the fund’s energy positions have notched triple-digit returns this year.

AVUV’s management team has clearly steered the fund onto the path of outperformance this year. Yogi Berra would agree, I’m sure, that the managers’ vision has been prescient. After all, the three-time American League MVP is also credited for saying “If you don’t know where you’re going, you might wind up someplace else.”

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.