Veteran investors know that markets tend to move in cyclical fashion. What was once in favor eventually falls from grace and languishes until buying interest is again renewed.

And so it is for emerging-market funds. Our weekly scan for bullish ETFs has led us to a treasure trove of emerging-markets equity portfolios aiming to recover some lost ground. More than a dozen broad-based funds are rebounding off double bottoms formed in the last quarter of 2018. Some, like the JPMorgan Diversified Return Emerging Markets ETF (NYSE Arca: JPEM), are fairly vanilla. Others, such as the USAA MSCI Emerging Markets Value Momentum Blend ETF (NYSE Arca: UEVM), have decided factor tilts, while some portfolios, like the First Trust Emerging Markets Small Cap AlphaDEX Fund (Nasdaq: FEMS), focus their sights solely on lower-capitalized issues.

Allocating to emerging markets was a harrowing experience over the past year, to say the least.

Investors engaged in wholesale selling as the Federal Reserve cranked up interest rates and bolstered the dollar. A trade war between the U.S. and China, too, threatened to boil over, putting pressure on Chinese shares, a significant component of most emerging-market portfolios. Fund drawdowns averaged 19 percent in 2018 overall and 26 percent for the small-cap portfolios.

In the midst of the emerging-markets meltdown, though, two funds stood out for their relative stability. Now, as the Fed’s rate hike momentum slows and the prospect of an accord with China brightens, the “win by losing less” stratagem followed by this pair may pay off yet again.

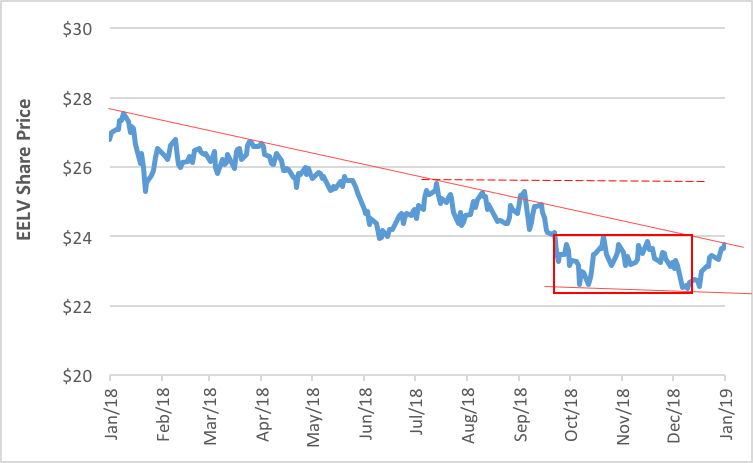

The Invesco S&P Emerging Markets Low Volatility ETF (NYSE Arca: EELV), a portfolio comprising the 200 least-volatile stocks in the S&P Emerging BMI Plus LargeMidCap Index, offers a lower-beta play on emerging markets. Weighted 72 percent in large caps and 27 percent in mid-caps, EELV's portfolio typifies a low-vol approach. From a sector standpoint, financial services stocks take up 36 percent of the portfolio’s heft, and consumer staples contribute 12 percent. All other sector exposures amount to less than 10 percent each.

EELV’s maximum drawdown over was a 13 percent erosion suffered between February and October 2018. That’s a smaller drawdown than that endured by the S&P 500 SPDR (NYSE Arca: SPY). A breakout from its double bottom in the $22.50 area would put an immediate objective of $25.50 in view, a 9 percent gain from today’s level.

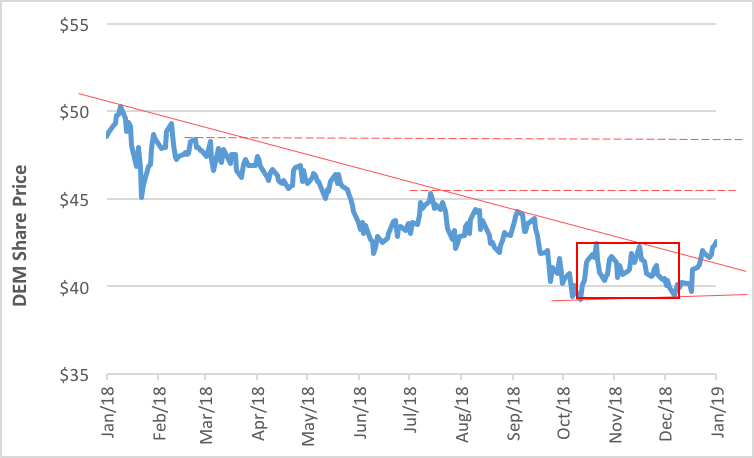

The portfolio underlying the WisdomTree Emerging Markets High Dividend ETF (NYSE Arca: DEM) is built with the highest-dividend-yielding stocks—specifically the top 30 percent—in the emerging-markets space. Like EELV, the WisdomTree portfolio is weighted heavily, i.e., 74 percent, toward large caps. Mid-cap exposure, at 21 percent, is lighter than EELV’s. Another similarity to EELV is found in DEM’s dominant sector exposure. Financials represent the largest slice of the DEM portfolio, though, at 22 percent, it’s notably lighter than EELV’s. Basic materials and energy stocks also figure prominently in the DEM mix.

DEM’s drawdown was 15 percent in the February-October grind. Now changing hands near $42, DEM broke out to the upside last week, setting up a potential run to the $45 level. If exogenous factors don’t intervene, an intermediate target in the $48-$49 area will then be eyed by traders for a 14 percent gain from today’s price.

Upside momentum is being built throughout the emerging-markets sector after a deeply disappointing year. No emerging-markets fund escaped the cruel calculus of 2018, but some—most particularly EELV and DEM—fared better than others. The bottoming action in these two ETFs portends a good start to the new year.

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.