By Eric Balchunas

(Bloomberg Opinion) --People tend to fear the wrong things when it comes to indexing and exchange-traded funds. Take the recent hand-wringing over an Index Industry Association report that there are now 3.7 million market indexes, an increase of about a half a million from last year. The Twitter commentary was predictable, with observations such as “peak passive” and “smells like CDOs.”

Sanford C. Bernstein — the firm that famously compared passive investing with Marxism in a research note and then proceeded to make two indexes and launch two ETFs tracking them — was so triggered by that number they wrote a satirical story mocking the quixotic quest for the perfect index.

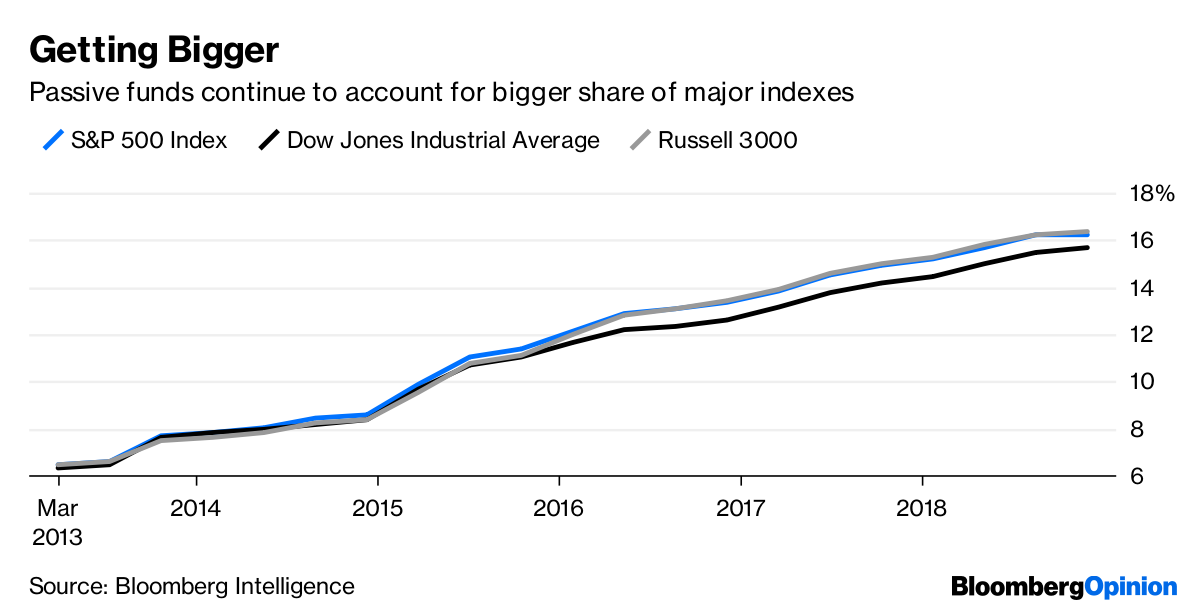

I get it. Indexing is scary to those whose livelihood comes from convincing investors they need to pay high fees for advice in order to succeed in the markets. After all, the indexing business has exploded to the point where passive funds own 16 percent of the S&P 500 Index, Dow Jones Industrial Average and Russell 3000, with some sectors as high as 25 percent.

But the 3.7 million index number is the wrong thing to fear. First, there’s an almost limitless number of indexes that can be created despite a limited number of securities, just as there are a limitless number of active or trading strategies.

Also, this concept of limitless building off of limited pieces exists everywhere. For example, there are an estimated 97 million songs built off of just 12 notes, but less than 1 percent of those songs resonate while the rest live in oblivion. The same is true of indexes. Only a microscopic number will ever be turned into investment products, and even smaller group will attract substantial money.

And why is innovation and experimentation so bad anyway? No one is bothered by it in the tech sphere. Millions of apps have been launched, but only 1 percent of them succeed. And those that do succeed are very good and worth wading through the 99 percent that fall by the wayside.

Thus, it is rather ironic that the folks who claim the rise of passive investing via index funds is a threat to capitalism are the same ones upset about a proliferation of indexes to take advantage of investor demand, which is capitalism in action.

The real thing to fear regarding indexes isn’t proliferation but rather concentration, or the fact that so few have attracted so much money. There are half a dozen indexes that have something akin to gravitational fields around them because of their popularity with passive and active funds, which use them as benchmarks.

The S&P 500, which has more than 20 percent of passive U.S. equity passive assets tracking it, is a prime example, as well as trillions of dollars more in active funds and institutional assets. Throw in a few MSCI indexes and the Russell 2000 and you basically get to a majority of fund assets that bow down to a handful of indexes. That kind of concentration is more worth monitoring than a bunch of random new indexes being made that exist almost entirely in isolation.

So, if a few indexes hold too much sway over markets, then what is the solution? One – which is happening naturally — is for low conviction active mutual funds that tend to hug their benchmarks in an effort to retain assets (commonly known as “closet indexing”) to be weeded out. Now that beta is basically free via index funds, there’s really no point to paying for that. Those funds just add redundant money orbiting around these few select indexes.

This vision was laid out nicely by John Authers, a Bloomberg Opinion columnist, on ETF IQ a few weeks ago:

“You probably need to move to a point where you barbell. You are either indexing or you’re absolutely not, meaning taking no interest in any benchmark. The analogy Andrew Lo at MIT makes is with dinosaurs. You have big lumbering herbivores — think ETFs or Vanguard mutual funds — that munch away at the beta and are creating these opportunities that are snapped up by the Velociraptors, who are going around arbitraging and being activist, following around companies. That is what we’re very slowly moving towards but at this point the markets ecology is incomplete.”

I basically made the same argument in this column on how active would be better — and frankly, happier — embracing a more “active” albeit supporting role in portfolios. Although they should probably act fast as many of the indexes being made are high active share, high conviction strategies — effectively beating them to the spot.

Another solution is, of course, more and better competition. Which brings us full circle to the 3.7 million indexes. Perhaps index No. 3,732,021 is going to be “the one” that cuts into the stranglehold of the S&P 500 or the MSCI Emerging Markets Index.

Thus, proliferation could actually be the antidote to concentration. And that is something that should not be feared.

Concentration is the same worry John Bogle, founder of Vanguard, has on the issuer side. He recently wrote an opinion piece for the Wall Street Journal about how asset concentration among a few issuers concerns him.

Eric Balchunas is an analyst at Bloomberg Intelligence focused on exchange-traded funds.

To contact the author of this story: Eric Balchunas at [email protected]

For more columns from Bloomberg View, visit bloomberg.com/view