Sponsored by Direxion

Part 1: Does the Financial Sector Sweat the Summer More?

Financials sweat the summer even more

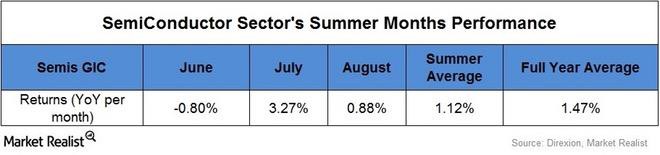

Surprisingly, the big recent winner, the Financial Sector, fares even a little bit worse in the summer. (See Chart: Financial Sector’s Summer Months Performance)

Past performance is not indicative of future returns.

During the summer the average monthly return is -0.16%, worse than that of the S&P 500 as a whole and a bigger spread versus their own full-year returns of 0.70% per month. They do follow the same seesaw pattern though: down in June, back up in July, and then back down in August. The interesting thing here is that how much they swing month to month makes leveraged ETFs possibly even more valuable to investors. Often though, the trend is your friend, and Financials have been in the strongest uptrend since the election. Recently though, they have underperformed with rates dropping.

Financials have been in the strongest uptrend since elections

The big winner since the US elections has been the financial sector, which is up 14% as of May 8, 2017. President Trump’s plans to dismantle the Dodd-Frank Act and replace it with new policies to create jobs and promote economic growth certainly have benefited the financial sector.

With the Russell 1000 Financial Services Index up 12% since the elections, the Direxion Daily Financial Bull 3X ETF (FAS) has returned 41% as of May 8, 2017, as depicted in the chart above. The Direxion Daily Financial Bull 3X ETF seeks daily leveraged investment results and aims to magnify the daily performance of the Russell 1000 Financial Services Index.

The Fed’s decisions can drive the financial sector further

As the figure above shows, the financial sector tends to return -0.16% on average during the summer months. However, under Donald Trump’s presidency with lighter regulations and rising interest rates, the financials sector can recover from its losses. After increasing interest rates by 25 basis points to the range of 0.75%–1% in the March meeting, the Fed kept the benchmark rate constant at its May meeting. The Fed predicts two additional quarter-point rate increases this year. Cleveland Federal Reserve President Loretta Mester said, “A gradual upward path of rate hikes will help prolong the expansion, not curtail it.” Higher interest rates will drive the financial sector’s margins and earnings growth.

Better economic growth driving lending activity along with a steepening yield curve will promote the financial sector (XLF).

Part 2: Will Semiconductors Have Fun in the Sun This Summer?

Semis have fun in the sun

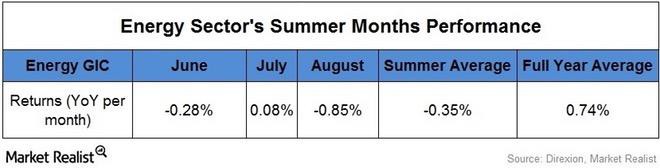

Often tech takes the most heat for wilting in the summer. But according to the historical data, it simply is not true for semiconductors. Granted they do underperform their own high returns for the year; however, over the summer they do very well with a 1.12% monthly average return, an impressive outperformance compared to the S&P500’s slightly negative return. See the chart below:

Past performance is not indicative of future returns.

Nothing is a sure thing, but with a solid trend of outperformance in place and summer seasonality actually behind you, SOXL should remain interesting to investors, at least once June passes.

Past performance is not indicative of future returns.

Do Trump policies concern the semiconductor sector?

The historical figures above show that semiconductors have outperformed during summer months, returning 1.1% on average. However, there’s no guarantee that history will repeat itself, considering the uncertainty along with Donald Trump’s victory. Even though President Trump hasn’t particularly talked about any policies related to the semiconductors industry, his restriction on trade barriers with China might pose a threat to the sector. China is a key market for the global semiconductor industry. According to consultancy Bain & Co, China consumes more than $100 billion worth of semiconductors, which is roughly one-third of the world production.

Major semiconductor companies like Qualcomm (QCOM), Apple (AAPL), Applied Materials (AMAT), Intel (INTC), and NVIDIA (NVDA) earn a significant amount of revenue from China. Thus trade restrictions with China will hamper these companies’ earnings drastically.

The semiconductors industry, however, is doing quite well on the back of strong earnings and growth outlook from companies like Intel, NVIDIA (NVDA), and Texas Instruments (TXN). The semiconductor sector (XSD) has gained 14% since elections as of May 8, 2017. The Direxion Daily Semiconductors Bull 3X ETF (SOXL) is a good choice in the leveraged ETF category with a 68% rise since elections.

Part 3: Will the Energy Sector Lag in Summer Months?

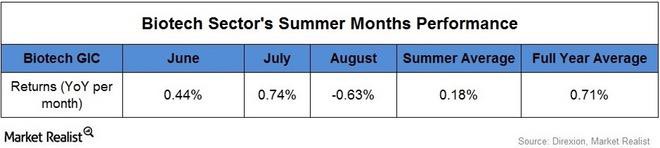

Energy has lagged and has always felt the heat in summer

One of the worst-performing sectors since the election has been Energy. But we know that OPEC and supply and demand dynamics have a lot to do with how well Energy does in any timeframe, no matter what election has happened or what season it is. Having said that, energy does tend to lag even more in the summer. Maybe it has something to do with buying up until the driving season starts on Memorial Day and then selling afterward. In fairness, the volatility is not as great, but the gap between the summer month average -0.35% and the full year (0.74%) is more than a full percentage point.

Past performance is not indicative of future returns.

It will be interesting to see if Energy can buck its own poor seasonal track record as well as its recent underperformance.

Past performance is not indicative of future returns.

Energy sector has been the worst performance since the election

2016 proved fruitful for the energy sector (XLE) with an improvement in oil prices (USO) (USL). The sector rose around 25% for the year. However, since the elections, the sector has seen a declining trend owing to negative earnings in some energy stocks. The sector has fallen 2% since elections as of May 8, 2017.

The World Bank’s quarterly report states that an agreement between the OPEC (Organization of the Petroleum Exporting Countries) producers and non-OPEC producers to cap crude-oil output in the first half of 2017 drove the forecast for crude oil prices to $55 per barrel in 2017, an increase of $12 per barrel. Production cuts of crude oil by 1.2 million barrels a day were also announced in November by members of OPEC to boost prices.

Can Trump’s proposed energy policy benefit the sector?

President Trump proposed to lift regulatory restrictions on crude oil and natural gas exploration and production and devote more federal land to crude oil and natural gas drilling. He also supports increasing the production of fossil fuels like coal, crude oil, and natural gas. He also has promised to support the coal industry. These policies could benefit the energy sector in 2017. Also, any unanticipated decisions from OPEC in 2017 could bring a change in crude oil price movement.

The chart of historical data shows that the energy sector underperforms during summer months on average. Having said that, supply and demand seem to be harmonizing with global and US oil demand gaining modest growth. So either way, investors can consider the Direxion Daily Energy Bull (ERX) and the Bear 3X ETF (ERY).

Part 4: Are Stock Returns during Summer Months That Bad?

Biotech stays healthy in the summertime

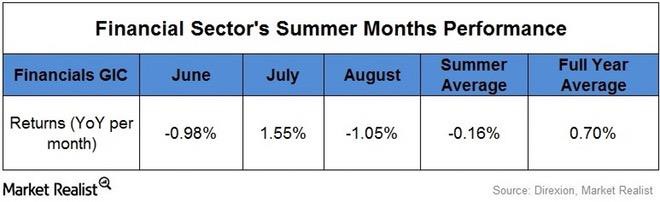

Even though the Biotech and Life Sciences GIC underperform themselves during the rest of the year, they do stay positive during the summer and easily outperform the S&P 500 by 30 basis points. This is again somewhat surprising, as many people think of summer as a risk-off time when in fact it is a good time to stay invested in Biotechnology stocks historically. The GIC has done well since the election despite Donald Trump’s considerable rhetoric talking down drug prices (with of course no backup to that). It jumped massively the day after the election, as many thought Hillary Clinton would have been tougher on drug companies. Recently the index has given some back along with the rest of the market. Here are the summer returns for Biotech:

Past performance is not indicative of future returns.

Conclusion: Summer returns aren’t all bad, but sectors matter

Interestingly, two of the highest beta sectors, Semis and Biotech, outperform during the summer. The S&P500 is slightly down, while Energy can’t seem to catch a break. But as always in investing, returns are never like the averages and never just like the past. This year more than most, exogenous (mainly regulatory) forces can have an outsized effect on the markets and sectors. So whether you want to bet on seasonality or look through, Direxion has a range of Leveraged ETFs to express your investing views from the beach this summer.

Past performance is not indicative of future returns.

Biotech stocks cool off during summer

The health care sector (IBB) (VHT) (XBI) has been the most challenged sector since Donald Trump’s presidential campaign, as it has been a significant topic of discussion. Fear arose from Trump’s administrative plans to revive the health care sector, as his first executive order after being sworn in as president was to take prompt action to repeal the Affordable Care Act (or ACA). These actions could affect hospital stocks adversely while benefiting life science companies and pharmaceuticals.

Despite the fact that President Trump plans to allow US manufactured drugs to be reimported and to require price transparency from all health care providers could affect hospitals and drug manufacturers, the biotech sector (XBI) has risen 18% since elections. The overall health care sector (XLV), on the other hand, has risen only 6% since elections as of May 8, 2017.

The table above shows that on average, biotech has had positive returns during the summer months. The Direxion Daily S&P Biotech 3X Bull ETF (LABU), which has also outperformed compared to the Direxion Daily Healthcare Bull 3X ETF (CURE), has risen 44% since elections as of May 8, 2017.

Overall summer returns haven’t been all that bad. However, this summer, they seem to rely heavily on regulatory changes that are proposed and expected from the new administration. Investors need to carefully watch how these regulations, the improving economy, and rising interest rates drive the returns of each sector and the S&P 500 overall over the coming months. As we discussed in this series, investors can consider Direxion’s wide range of leveraged ETFs for each sector.

* The Net Expense Ratio includes management fees, other operating expenses and Acquired Fund Fees and Expenses. If Acquired Fund Fees and Expenses were excluded, the Net Expense Ratio would be 0.95%. The Funds’ Adviser, Rafferty Asset Management, LLC (“Rafferty”) has entered into an Operating Expense Limitation Agreement with each Fund, under which Rafferty has contractually agreed to cap all or a portion of its management fee and/or reimburse each Fund for Other Expenses through September 1, 2018, to the extent that the Fund’s Total Annual Fund Operating Expenses exceed 0.95% of the Fund’s daily net assets other than the following: taxes, swap financing and related costs, acquired fund fees and expenses, dividends or interest on short positions, other interest expenses, brokerage commissions and extraordinary expenses. If these expenses were included, the expense ratio would be higher.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns for performance under one year are cumulative, not annualized. For the most recent month-end performance please visit the funds website at direxioninvestments.com.

Disclosure: An investor should consider the investment objectives, risks, charges, and expenses of Direxion Shares and Direxion Funds carefully before investing. The prospectus and summary prospectus contain this and other important information about Direxion Shares and Direxion Funds. Click here to obtain a prospectus or call (877) 437- 9363. The prospectus or summary prospectus should be read carefully before investing.

Direxion Shares Risks - An investment in the ETFs involve risk, including the possible loss of principal. The ETFs are non- diversified and include risks associated with concentration that results from the Funds' investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts, forward contracts, options and swaps are subject to market risks that may cause their price to fluctuate over time. The funds do not attempt to, and should not be expected to, provide returns which are a multiple of the return of the Index for periods other than a single day. For other risks including leverage, correlation, compounding, market volatility and specific risks regarding each sector, please read the prospectus.

Distributor for Direxion Shares: Foreside Fund Services, LLC.