Sponsored by Direxion

How Volatility Affects Portfolio+ ETFs

Portfolio+ ETFs are a suite of exchange traded funds that add 25% more daily exposure to popular broad-based indexes. By applying a modest amount of leverage (1.25X), these ETFs allow investors to obtain $1.25 worth of daily exposure to their benchmark index for every $1.00 invested, with little change to a portfolio’s risk profile.

The Portfolio+ ETFs seek investment results that are 125% of the return of a benchmark index for a single day. These ETFs should not be expected to provide 1.25 times the return of the benchmark’s cumulative return for periods greater than a day. In order to achieve their investment objectives, the Portfolio+ ETFs must rebalance exposure ratio on a daily basis, which means that the returns of these ETFs are the product of a series of daily returns over time.

This product of a series of daily returns over time is known as compounding. Compounding will cause an ETF’s performance to vary or “drift” from that of the performance of its benchmark index.

Why Does it Matter?

Although compounding can help performance over time, it has a negative affect during periods of high volatility. The following example illustrates that increased volatility has a negative effect over periods of elevated volatility.

The S&P 500® Index experienced a spike in volatility over the period from 1/14/2016 to 2/12/2016. The benchmark index declined 2.77% over the holding period. The Portfolio+ S&P 500® ETF (PPLC) declined 3.55%. That’s 0.06 percentage points less than the 125% of the benchmark’s return. It’s important to understand why this effect occurs, but also import to recognize that, even in this period of high volatility, the variance is not very substantial.

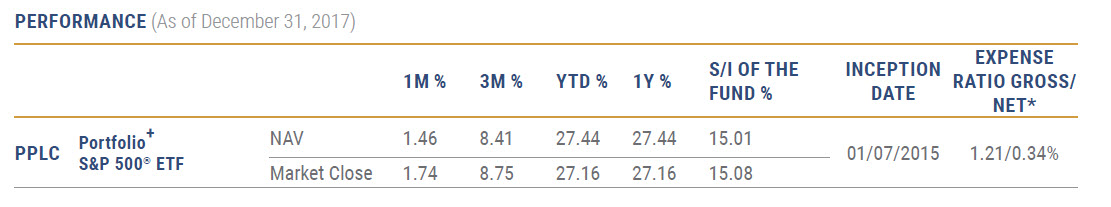

Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns for performance under one year are cumulative, not annualized. For the most recent month-end performance please visit the funds website at portfolioplusetfs.com.

The Long Run. When Less May Be More.

Compounding works both ways. Sustained market trends and periods of low volatility can result in positive effects on returns.

Over a longer timeframe, the same S&P 500® Index experienced much less overall volatility than in the previous shorter time period.

PPLC’s benchmark index gained 48.53% over the holding period. PPLC gained 61.88%. That’s 13.35 percentage points MORE than 125% of the benchmark’s

return.

Past performance does not guarantee future results.

Potential for Enhanced Returns with Minimal Negative Compounding.

Unlike highly leveraged ETFs employed by short-term traders, Portfolio+ ETFs are intended to be used for longer term investors. Portfolio+ ETFs help you seek enhanced

daily returns with minimal negative compounding, allowing investors to manage them easily within longer term asset allocation strategies.

During periods of low volatility in rising markets the ETFs provide added strength that can overcome the short-term impact of negative compounding.

The performance data quoted represents past performance. Past performance does not guarantee future results. Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes. For additional information, see the fund’s prospectus.

*The Net Expense Ratio includes management fees, other operating expenses and Acquired Fund Fees and Expenses. If Acquired Fund Fees and Expenses were excluded, the Net Expense Ratio would be 0.25%, respectively. The Fund’s Adviser, Direxion Advisors, LLC (“Direxion”) has entered into an Operating Expense Limitation Agreement with the Fund, under which Direxion has contractually agreed to cap all or a portion of its management fee and/or reimburse the Fund for Other Expenses through September 1, 2019, to the extent that the Fund’s Total Annual Fund Operating Expenses exceed a % of the Fund’s daily net assets (excluding, as applicable, among other expenses, taxes, swap financing and related costs, acquired fund fees and expenses, dividends or interest on short positions, other interest expenses, brokerage commissions and extraordinary expenses). If these expenses were included, the expense ratio would be higher.