Wealth Management IQ and ISS Market Intelligence (ISS MI) have compiled a list of RIAs growing fast while keeping sight of their priorities: the client experience and the sustainability of the business.

Advisors Who Ignore Next-Gen Clients Are Missing Out on BillionsAdvisors Who Ignore Next-Gen Clients Are Missing Out on Billions

It may be time for wealth management firms to adjust fees, take that crypto course and hire a junior advisor, according to a new Fidelity report.

Advisors reluctant to target next-gen investors could be leaving huge sums of money on the table, according to a new report, regardless of whether the goal is continued growth or an eventual sale.

Research produced by Fidelity Institutional Insights found investors under the ageof 40 are inheriting more than $540 billion in the United States every year—30% of the total wealth transferred. According to data from Cerulli, the demographic will control three-quarters of $84 trillion in inherited wealth by 2045. The report is an admonition to wealth managers that shy away from younger clients for all the usual reasons: more debt, fewer investable assets and cultural chasms between generations.

The revenue-weighted age of the average Fidelity advisor’s client is 65, said Anand Sekhar, Fidelity Investment’s vice president of practice management and consulting. And only 1 in 5 firms claims a revenue-weighted age, which factors in where a firm's revenue comes from in terms of clients' ages, under 60.

This presents a big problem for the future of financial advice, according to Sekhar and other industry experts, as client rosters appear headed for widespread drawdowns with few assets waiting in the wings. To make matters worse, only 13% of advisors are making the effort to engage with clients’ children and grandchildren, putting billions in currently managed assets at risk.

The negative effect on a firm’s growth trajectory should be evident, but Sekhar prefers to look at it from another perspective. Fidelity’s data suggests that reducing the revenue-weighted age of clients by just seven years—from 69 to 62—can increase a firm’s growth tenfold.

And growing firms not only produce more revenue but also command significantly higher prices at market.

“Client demographics is a critical piece that we emphasize when valuing a firm,” said John Furey, managing partner at Advisor Growth Strategies, a business management and M&A consultant for the financial advice industry. “It’s simple. Age is a predictive indicator of future AUM.”

Rick Shoff, who heads up advisor support for Captrust, told WealthManagement.com he doesn’t even know how much value he would place on a potential acquisition with an aging client list if advisors weren’t building relationships with their younger family members—because that firm wouldn’t even make it to the valuation stage.

Clearly, reaching next-gen investors is essential for any firm’s long-term survival, but the Fidelity research suggests establishing those relationships now could produce greater returns. Individuals under the age of 40 are investing earlier than their elders, seeking advice for the long haul and willing to pay for it. They’re also three times more likely to give referrals and would prefer to consolidate their business with a single firm.

That said, they’re also expecting more—more personalization, more hand-holding, more services, more investment options and more technology. They’re also more likely to jump ship if unhappy with service or prices.

The Fidelity study identified six hallmarks of younger clients that shape the way they make financial decisions and choose financial advisors:

Diversity—In addition to belonging to the most diverse generations in American history, next-gen investors also value diversity in their personal and professional circles, with 62% feeling that it’s “important for financial advisors to visibly demonstrate a social equality and diversity commitment” online (versus just 16% of baby boomers).

Life Path—Younger generations are getting married later and less often, and choosing more creative and entrepreneurial vocations. While many are working second jobs, they still prioritize enjoying work and making a difference above simply “making a lot of money.” They’re also more likely to seek financial advice as a path to personal fulfillment.

Values—Next-gen investors are choosing purchases, investments and employers that share their values, with more than half saying values-aligned investing is more important than maximum returns. Advisors unable to offer ESG and thematic investments are at a disadvantage with these clients.

FOMO—An age-old phenomenon, the fear of missing out has been wildly exacerbated by the rise of social media and can have an outsize effect on the financial decisions of younger individuals. Nearly half (48%) say they worry about missing out on the next big investment fad (compared with 10% of boomers), while 64% of those under the age of 34 confessed to making impulse purchases “often.” Advisors who are knowledgeable about crypto and other new and interesting investment opportunities will have an advantage with these investors, and those well versed in the behavioral aspect of finance will be better prepared to help navigate associated pitfalls.

Mental Health—Whether they’re experiencing issues more often or simply are more open about their experiences, mental health has emerged as a key concern, particularly for generations Y and Z. Large swaths of both cohorts reported feeling stressed or anxious most of the time, with finances a top driver. These individuals are more likely to prioritize work/life balance in their careers and leave a job that interferes with their emotional well-being. They’re also more likely to look to their financial advisor for emotional support through key life events and market turmoil.Additionally, younger clients are seeking referrals to more third parties from their financial advisors—including health and wellness providers such as mental health specialists and relationship counselors—so it may be a good idea to develop those relationships.

Technology—Raised in the era of cellular phones and Facebook, the next generations “expect social media and technology to facilitate every aspect of their lives—including their finances,” the report found. Nearly 8 in 10 Gen Y and Gen Zers said they’re more likely to hire an advisor with the latest technology, and about half are already using a robo advisor. These generations also prefer to learn about financial topics through online tools and interactive media over talking with their advisor. Advisors that aren’t active on social and proactive about their tech are doing it all wrong.

Sekhar said aging advisors must adjust, adapt, innovate and relate if they want to attract and retain young investors in this new paradigm.

“No 1. is getting over the mindset that these clients aren’t going to eventually fit their target market,” he said. On the contrary, young investors are exactly where many of today’s top clients used to be, with all the potential for growth that implies, he argued.

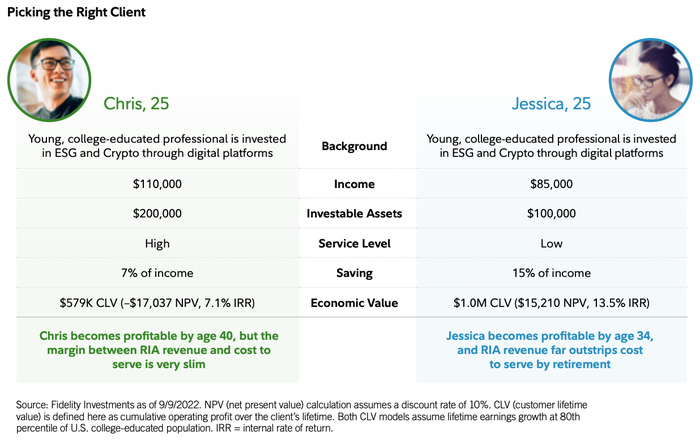

The Fidelity study cautions against targeting potential clients on net worth alone. A 25-year-old with lower annual income and fewer investable assets but with low service requirements and good savings habits is likely to become profitable well before someone with more money and income that has high-level needs and saves less, even when both have the same investment preferences.

The report makes specific recommendations for firms that want to reach more next-gen clients, including defining targets; providing desired services; expanding investment options; embracing social media; identifying a related niche; adjusting fees to accommodate HENRY (high earner, not rich yet) investors; and hiring next-gen advisors.

Pointing out that the age of clients tends to track closely with the age of the advisor (within about 10 years, usually older), Sekhar, Furey and others agree that adding next-gen talent is probably the easiest way to reach young investors—but both cautioned that a quick fix is unrealistic and investment in other areas will likely be necessary for aging firms that want to remain competitive.

According to Captrust's Shoff and Michael Belluomini, VP of M&A for Carson Group, a younger staff may even make up for an aging client base at the negotiation table—at least for larger acquirers that are able to provide either the advisors or the clients required for a successful practice to grow. (But neither sees the point in an acquisition that doesn’t bring at least one of those two things to the table.)

“Let's say the advisor is older and therefore his or her clients are also older, but they have a really strong G2 advisor in place, or a second generation maybe in their 40s or 50s,” said Belluomini. “If that advisor has shown historical growth or we know we're going to come in, take over that practice and stabilize the book, then there is a premium we’ll assign to that practice.”

Advisors in their late 50s should think about selling now if they don’t intend to court new investors or advisors, according to Furey.

“If you don’t have that younger team, you shouldn't wait too long to sell your business or find a partner,” he said. “You should be doing that in your 50s, not your 60s. If you don't bring on young people, then you wait too long and your clients are probably 10 years older than you, the buyer is going to say, ‘Wait, the founders are old and want to exit the business soon, and their clients are older, so it's less valuable.”

Currently, 14% of millennials are actively looking for an advisor, according to Fidelity, a group that is expected to control nearly $28 trillion of inherited wealth within the next 25 years. During the same time, Gens Y and Z are expected to inherit another $48 trillion—and the research indicates they understand the importance of financial advice today.

If the promise of future gains isn’t enough, Sekhar said Fidelity found the 13% of advisors who are actually engaging with their clients’ children are already seeing 1.6 times more revenue growth and 2.7 times more profit.

“Advisors today are not even doing the foundational basics of just engaging their existing clients,” he said. “It's great to get on social media and other things, but just start there. You have 87% opportunity there just based on our data.”

“Firms like ours are trying to help advisors see the light,” said Furey. “Do they want to perpetuate their firm or be more attractive to a buyer in the future? It’s easy, you have to invest in your people. Look, it's hard to do, but it does need to be done.”

SAVE THE DATE for the 2023 RIA Edge Conference on May 21-24 at The Diplomat Beach Resort, Hollywood Beach, Fla. REGISTER NOW #bullmarketforadvice

About the Author

You May Also Like