By Lionel Laurent

(Bloomberg Opinion) --The world of finance isn’t done yet with its effort to turn artistic masterpieces into tradeable securities. A decade ago it was hedge funds and bankers selling small shares in works by Andy Warhol and his ilk as investment opportunities. Today it's the cryptocurrency crowd.

If history’s a guide, the risk and cost of owning a tiny part of an illiquid, hard-to-value asset still outweighs the rewards. And all that without ever getting to hang the picture on your wall.

The new tilt at art trading is as much a throwback to pre-crisis financial engineering as it is about crypto-futurism. A British gallery is promising to sell up to 49 percent of Warhol’s 14 Small Electric Chairs in a blockchain-powered online auction. Buyers can pay in Bitcoin, Ether or other tokens. They’ll take cash too if you’re that way inclined.

These micro-stakes would then be traded on a marketplace. There may be a blockchain verifying transactions, and crypto-currencies changing hands, but we've seen art investment pools and art stock markets before. They don't always end well.

Despite all the airy talk about democratizing art ownership and disrupting the gilded world of auction houses and dealers, this doesn’t really do that. Nobody owning a piece of the Warhol will take it home. It's locked up in a tax-free zone somewhere. What’s being traded is a stake in the special purpose vehicle that holds it.

This may be a wonderful way for the ultimate owner to make money from an artwork without taking it out of storage or ceding control, but it's hardly the Barnes Foundation.

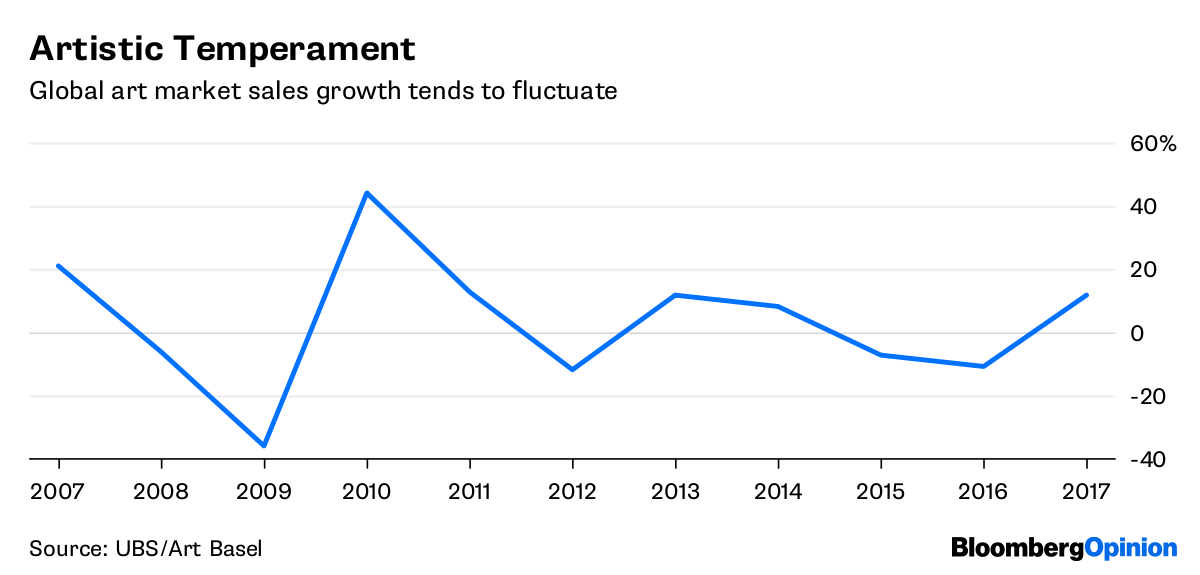

As for the idea that this is a clever bet on the future value of a piece of art, these assets are as risky as any others. The art market is illiquid and can be volatile. Blue-chip artists are no protection against a market crash. Even Warhols were sold at a loss during the financial crisis. Do punters know the difference between this “Electric chairs” canvas, which the gallery says has been valued at 4.2 million pounds ($5.6 million), and others by the same artist?

Imagine what the combined volatility of cryptocurrency markets and the art market might create in times of stress. Liquidity would evaporate. That initial buy-in fee of 2 percent wouldn’t seem so cheap then.

Warhol himself might have enjoyed the idea of trading and owning pieces of art that you've never seen. And there is at least one tangible thing on offer: The people running the auction say buyers can choose to receive a special scanned print of the work in question, which to the naked eye looks just as good as the original. As David Bowie once sang in a song about Warhol: “Can't tell them apart at all.”

If people do manage to make money from this, then finance truly will have reached its post-modern apotheosis.

To contact the author of this story: Lionel Laurent at [email protected]

For more columns from Bloomberg View, visit bloomberg.com/view