The non-farm payroll report just came out and it’s rather disappointing.

The overall gain was a tad lame versus expectations, but with 30,000 in upward revision, it pretty much matches the 193,000 consensus. However, the drop to a 3.9 percent unemployment rate was a function of a fall in participation (i.e., fewer people in the labor force for the number of jobs out there) and average hourly earnings was up a slim 0.1 percent, with a downward revision, which should extract some from concerns over mounting wage pressures. This information won’t change the Fed’s next two hikes, but odds for a third are, deservedly, trimmed a bit.

It’s enough for a bullish correction with the high caution that no one wants to rally the market ahead of the May Refunding. Ten-year notes have some resistance at 2.86 to 2.89 percent, the 40-day and 21-day moving averages, and I won’t get more bullish than that. The belly should outperform, given where supply is coming. I’d put 2s/5s/10s moving to about 8 basis points. Bulls may take some encouragement from NFP, but there’s a potential oddity in the report, given the unusually high level of people out due to the weather. The average for April is 76,000; this report came in at 133,000. Also, 253,000 who usually work full time could only work part time due to the inclement weather, which may have impacted wages somewhat.

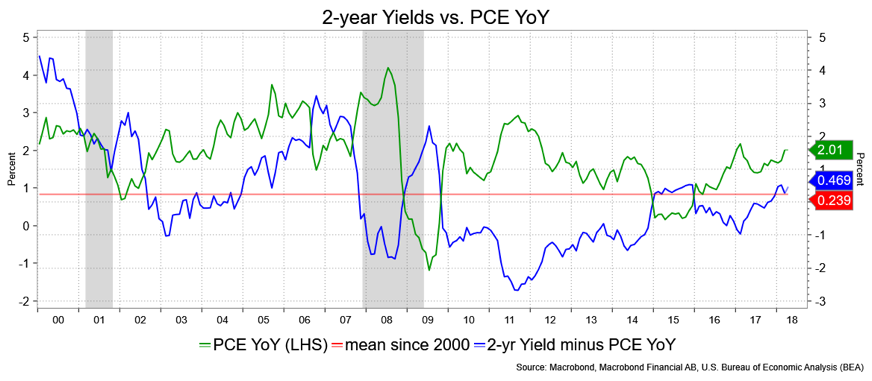

I’m playing around with ideas here, so bear with me. I’m trying to imagine where 2s go relative to the Fed and assuming a symmetric view to 2 percent year-over-year personal consumption expenditure, i.e., around that target. The first chart below shows 2s minus YoY PCE. It indicates that at about 50 bps now, we’re near the recent wides, and to get wider, you’d have to go back to 2008-9, when PCE was lower (under 1 percent). By this measure, 2s are into a “value” area relative to PCE, which begs the question “whither 2s?”

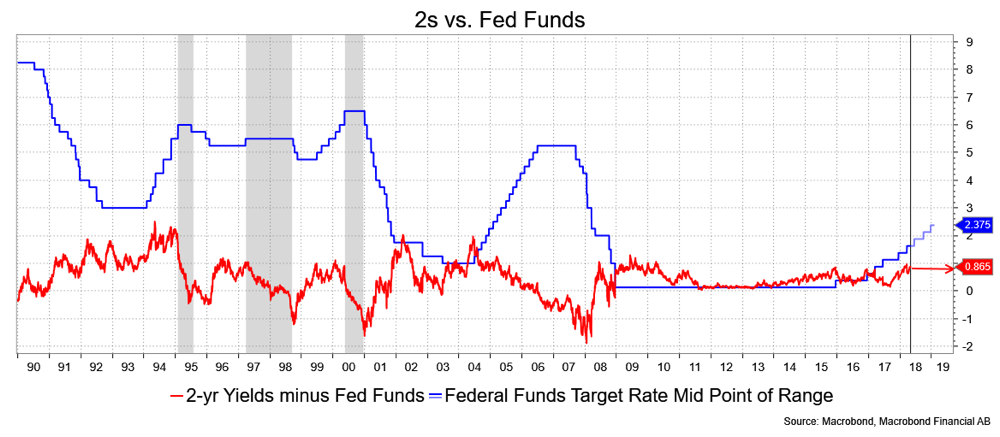

This next chart shows Fed Funds projected to a mid-target of 2.375 percent in December (implying three more hikes) and a steady spread to 2s. In the event, at 86.5 bps, we’ll have 2s around 3.25 percent. This result seems very unlikely, unless the projection is for even more aggressive moves by the Fed. In the past hiking cycles, from the middle of said cycle on, 2s versus Funds tended to narrow and then narrow sharply as the end of such a cycle enters the liturgy.

There are a lot of assumptions in all that—a third hike this year or earlier next year and the idea that added supply won’t push this sort of spread out, for starters. So, I’m open to counterpoints.

Anyway, it would seem that against current 2s at 2.50 percent the likelihood is that the spread to Funds will narrow somewhat making for a generous target of 3 percent by year-end—that might be the case with merely two hikes and a bias for one in Q1.

The mean spread between 2s and YoY PCE has been 24 bps since 2000 and 138 bps going back to 1990. I don’t think we’ll see it return to that era when YoY PCE averaged 2.3 percent from 1990 to 2000 because I think the Fed will be vigilant against such a “norm,” and between debt and demographics, I think growth will be slower than during those days. So, take the middle spread, i.e., 75 bp difference between PCE and 2s. This, too, would suggest 2.75 percent potential, 3 percent generously, all things being equal. I’m not sure that would give us an inverted curve, but certainly, against 3 percent 2s, a very flat one.

David Ader is Chief Macro Strategist for Informa Financial Intelligence.