Utilities are supposed to be defensive stocks. Risk-averse investors especially rely upon utility stocks when the economy sinks into recession. Much of the appeal stems from the stocks’ high dividend payouts. There’s nothing like a regular income stream to soften the blows to one’s portfolio in precarious times.

Not all utility dividends are created equal, though. Some are more secure than others. Thanks to the good folks at Reality Shares, the purveyors of an exchange-traded fund family based on its proprietary DIVCON rating system, we can gauge which dividends appear secure and which seem wonky. Looking forward, DIVCON ranks stocks on the basis of the issuers’ health and the likelihood of changes in the companies’ dividend policies.

There are five utilities that made the most recent DIVCON list as “most likely to decrease or cut their dividends within the next 12 months”:

- Avangrid, Inc. (NYSE: AGR), a Connecticut-based holding company that owns eight electric and natural gas utilities serving over 3 million customers in New York and New England.

- NRG Energy, Inc. (NYSE: NRG) provides electricity generated from natural gas, coal, nuclear and alternative sources for nearly 3 million users in the New Jersey market.

- Aside from supplying the island chain with electricity, Hawaiian Electric Industries, Inc. (NYSE: HE) also has exposure to the financial sector through its ownership of a savings bank.

- A natural gas and electricity supplier, NiSource Inc. (NYSE: NI) operates in Ohio, Pennsylvania, Virginia, Massachusetts, Maryland and Indiana.

- Headquartered in Akron, Ohio, FirstEnergy Corp. (NYSE: FE) generates and transmits electricity to 6 million customers in six Midwestern and mid-Atlantic states.

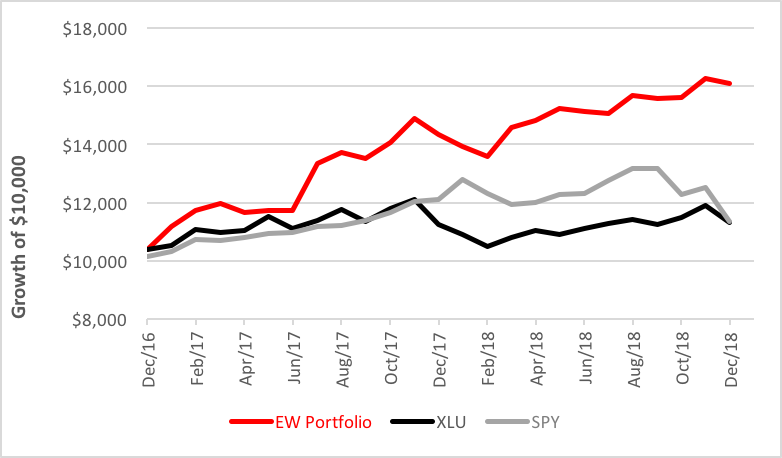

Investors have been aggressive buyers of these five stocks over the past two years. As you can see in the chart below, an equal-weighted portfolio of these issues would have significantly outdone the large-cap sector represented by the SPDR S&P 500 ETF (NYSE Arca: SPY) and the S&P’s utility sector proxied by the Utilities Select Sector SPDR (NYSE Arca: XLU).

According to Reality Shares’ senior analyst Kian Salehizadeh, investors have been drawn to these five names as the prospect of future interest hikes diminished. The precipitous rise in the prices of these stocks may have been good news for recent investors but it could make for bad headlines going forward.

“People piling money into high-yielding, low-quality names could very well forewarn of market danger,” says Salehizadeh. “We saw an uptick in volume with utilities prior to the recession of 2008–2009.”

Dividend cuts are generally poisonous to stocks. Witness the halving of General Electric’s (NYSE: GE) share price when a 92 percent reduction in its quarterly payout was recently announced.

So, what of these high-flying utilities?

“Unless dividend cuts are already baked in the prices of these stocks,” Salehizadeh declares, “we'll most likely see negative price reactions in the event of a cut.”

Dividend cuts could have a ripple effect on the half-dozen utility sector ETFs that hold these stocks. Especially vulnerable are the Invesco DWA Utilities Momentum ETF (Nasdaq: PUI) and the Invesco S&P 500 Equal Weight Utilities ETF (NYSE Arca: RYU), both of which have outsize exposure.

PUI follows a Dorsey Wright relative strength model that selects stocks on the basis of their momentum. That’s an invitation to concentration risk. PUI’s 30-stock portfolio includes two of our high-fliers. Together, NRG and NI make up 8 percent of PUI’s portfolio. Technically, NRG’s shares could lose a quarter of their current value while NI could shed as much as 15 percent.

Equal dollops of NRG, NI and FE are held in the RYU portfolio, altogether accounting for nearly 11 percent of the fund’s capitalization. FE is setting up for a 15 percent fall on the charts.

What does all this mean? Utility sector ETFs1 with exposure to the DIVCON 1 stocks could see as much as a 12 percent diminution in value in the wake of dividend cuts.

If I suffer a 12 percent loss in a safe harbor, I sure as heck don’t want to be out on open water.

End notes

1. Other ETFs holding one or more of the DIVCON 1 utilities include the First Trust Utilities AlphaDEX ETF (NYSE Arca: FXU), the Utilities Select Sector SPDR (NYSE Arca: XLU), the iShares U.S. Utilities ETF (NYSE Arca: IDU) and the iShares Global Utilities ETF (NYSE Arca: JXI).

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.