By all lights, ‘tis the season for stock picking. Stock correlations, measured by the CBOE S&P 500 Implied Correlation Index (CBOE: KCJ), have plummeted since the election. Combine that with a deep downdraft in the CBOE S&P 500 Volatility Index (CBOE: VIX) and you get a real holiday tableau: widening opportunities to earn alpha coupled with complacency in its pursuit.

Both CBOE indices are derived from option prices. VIX is the well-known “fear index” derived from the implied volatility embedded in S&P 500 Index option premia. VIX rises as traders price in more risk over the short term trading horizon. VIX is now is in the 12 percent range, well below its 30 percent red zone.

The correlation index tracks changes in the relative premia between S&P 500 index options and contracts for the index’s 50 largest component stocks. A decline in the index indicates expectations for diverse returns, i.e., increasing chances to take home some alpha. A rising index signals beta dominance.

The current environment should be a playground for active managers, especially if Fed accommodation moderates to produce further steepening in the yield curve and higher real interest rates. Below you’ll see real 10-year rates plotted inversely against gold prices (because alpha could be worth more than its weight in gold now).

Active managers could certainly use a holiday. As we saw in our September article, a lot of alpha hunters have been coming up empty handed lately.

Of course, opportunity is just that – opportunity. It ain’t a guarantee. Alpha comes only to those managers with the trading savvy to pluck it from the market.

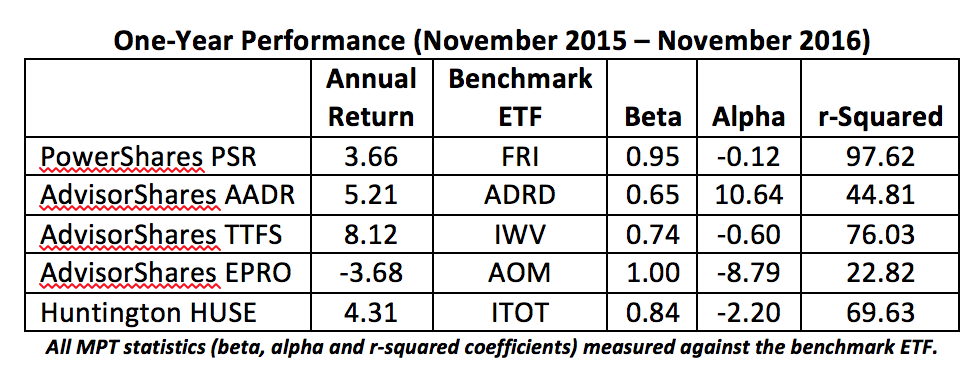

Alpha-earning mutual funds may be rare but successful actively managed ETFs are even more extraordinary. Some active ETFs worth watching in the coming weeks are five from our December study of alpha seekers. Time will tell if their alpha coefficients improve.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.