Amid all the hoopla surrounding the stock market—new records on an almost daily basis—something has been quietly developing in a non-correlated corner. Commodities have been rising off a mid-summer bottom. And not by just a little. The Thomson Reuters/CoreCommodity CRB Index, an equal-weighted benchmark of 17 futures contracts, shot up nearly 19 percent from late June through early November. That’s nearly double the contemporaneous gain in the S&P 500 Index. This has piqued the interest of portfolio builders who’ve been growing more and more concerned about a potential top in the equities market.

Commodities have a long track record as a non-correlated asset, and in the recent past that’s not been a comfort. While stocks have zigged since depths of the Great Recession, commodities have mostly zagged. Put more simply, stocks went up—big time—while commodities tanked.

Witness the WisdomTree Continuous Commodity ETF (NYSE Amex: GCC), an exchange traded fund that tracks the aforementioned CRB Index. Over the past five years, GCC slipped lower by 8.8 percent annually while the S&P 500, proxied by the SPDR S&P 500 ETF (NYSE Arca: SPY), rose at a 14.4 percent pace.

Measured over the 12 months since October 2016, in fact, GCC was still on a downward trajectory. The ETF netted a 1.8 percent loss in the past year, even counting the recent rebound. The question is this: Is the commodity rally a short-lived phenomenon or is it a secular sea change? Are commodities finally ready to cycle higher? There’s a corollary question too. Can active management produce better risk-adjusted returns than a passive long-only stance?

Actively managed commodities funds, more commonly known as “managed futures” funds, differ from commodity index products in a couple of ways. First and foremost is discretion. Instead of slavishly tracking an index, managed futures funds allow the portfolio managers to trade on their ideas in an effort to outdo the passive benchmark. That mandate may include the ability to sell futures short. The beauty about futures trading has always been the ease by which any commodity trend—up or down—can be exploited. Every futures trade, long or short, is margined at the same rate. Ostensibly, that doubles the alpha opportunities for managed futures players, though in reality, downtrends are historically better money makers.

Have managed futures ETFs actually bettered their index-tracking brethren? Well, yes and no. Real active management doesn’t have a long track record in the ETF space, so it’s difficult to see how it works over a market cycle. To boot, those original managed futures products started out as more mechanistic algorithms than discretionary portfolios.

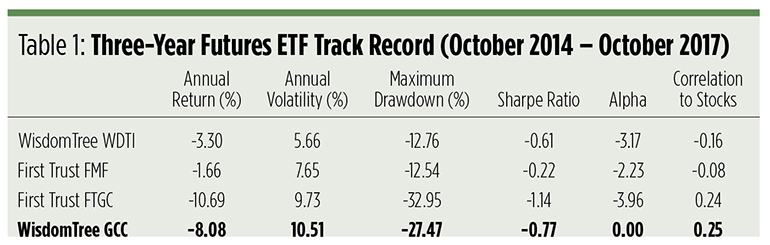

Go back just three years and there are only three managed futures ETFs extant:

- The WisdomTree Managed Futures Strategy Fund (NYSE Amex: WDTI) is a short/long portfolio managed to emulate the returns of an index consisting of currency, commodity and Treasury futures; there’s no exposure to equity futures. In a riff on the S&P Diversified Trend Index, the fund’s former target, WDTI’s current methodology looks across different time horizons to select trends with the lowest volatility, sizing its allocations by conviction.

- Stock futures aren’t shunned by the First Trust Morningstar Managed Futures Strategy Fund (NYSE Arca: FMF) but debt futures are. FMF managers use short and long commodity, currency and equity exposures in an attempt to outdo the fund’s Morningstar Diversified Futures Index benchmark.

- Liquidity and volatility are the primary considerations for the managers of the long-only First Trust Global Tactical Commodity Strategy Fund (Nasdaq: FTGC). FTCG stays away from the financial sector and limits its exposure to commodity, energy and metal futures.

Active management, as you can see in Table 1, produced mixed results over the past three years. Two ETFs—WDTI and FMF—outperformed the long-only GCC, though their returns were still negative. Some of that outperformance can be attributed to the funds’ ability to sell futures short. The FTGC portfolio’s returns lagged the passive fund and, despite its lower volatility, yielded an inferior Sharpe ratio. FTGC, as a long-only fund, clearly faced a headwind in the commodity slump. All told, none of the funds cranked out positive alpha when held up against the GCC portfolio.

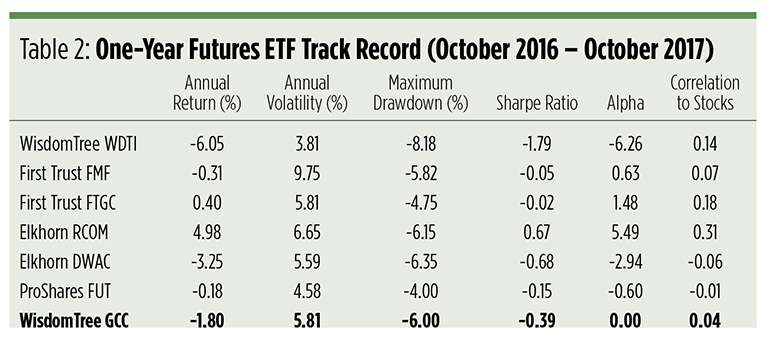

Though what about the recent resurgence in commodity prices? Would ETF performance look any different from a shorter perspective? Yes, in part. Once again, the results are mixed, especially after adding in the track records of some newly introduced managed futures portfolios.

One-year track records have now been built for three of the new ETFs:

- The Elkhorn Fundamental Commodity Strategy ETF (BATS: RCOM) represents the newest wave in managed futures ETFs: index-tracking funds with active overlays. RCOM’s futures portfolio emulates the long-only Dow Jones RAFI Commodity Index but its collateral, the money market instruments used as margin deposits, is managed with an aim to boost returns. The rationale is simple. Alpha’s easier to obtain in the debt market. The underlying futures portfolio holds positions in energy, agricultural and metals contracts, with individual positions weighted by liquidity, momentum and roll yield.

- RCOM’s sibling, the Elkhorn Commodity Rotation Strategy ETF (Nasdaq: DWAC) aims to outdo a Dorsey Wright index of five equal-weighted futures selected from a universe of 21 nonfinancial commodities. This long-only futures portfolio is designed to follow a momentum-based strategy that seeks out commodities with high relative strength. Like RCOM, active management for DWAC really means alpha-seeking on the collateral side.

- Risk contribution determines the weight of each futures’ position in the ProShares Managed Futures Strategy ETF (NYSE Amex: FUT), but price momentum determines the trade’s direction. Positive price momentum earns long exposure in commodity, currency and Treasury futures; shorts are taken when price momentum turns negative.

Two long-only funds, FTGC and RCOM, produced positive returns for the 12 months ending October 2017, though four portfolios, in total, outpaced the GCC benchmark. From Figure 2 below, you can see the mid-2017 commodity rebound reflected in most of these outperformers. All told, three managed futures funds produced positive alpha. The real winner, though, is the Elkhorn RCOM fund which earned a trifecta—a positive return, together with a positive Sharpe ratio and a positive alpha coefficient.

Certainly, RCOM’s underlying index contributes some of the alpha. Credit the Dow Jones RAFI Commodity Index, a fundamental factor-weighted benchmark that utilizes a dynamic roll methodology to minimize the effect of contango.

Contango represents the “carrying charge” embedded in futures contracts, typically made up of storage and insurance costs. In a normal market, these carrying charges cause distant futures deliveries to trade at a premium to nearby contracts. At each monthly roll, RCOM’s index methodology looks for the most liquid delivery over a 24-month horizon that can be purchased with the least negative or most positive yield.

In comparison to other futures portfolios, RCOM’s opportunity set is made up of longer-maturity contracts, a strategy that normally reduces turnover and lowers overall portfolio volatility. The strategy allocates to commodities with a positive roll yield and momentum, primary drivers of excess returns in commodity investing. Contango’s been building significantly in the commodity sector, so an aggressive strategy like RCOM’s gives it a definite advantage in dealing with rolls.

On the collateral side, the fund relies on high-quality, liquid paper with average maturities of six months or less with the vast majority of its portfolio held in Treasury bills. Keeping the portfolio’s duration low has reduced overall interest rate risk.

Can RCOM continue to outperform the field going forward? Well, commodity price inflation is certainly a tailwind for the Elkhorn funds. If you’re confident that commodities will continue their upward path, RCOM’s definitely worth a look, especially when you consider its cost. RCOM’s annual expense ratio is 75 basis points (0.75 percent), the same as charged for the passive GCC portfolio. The average holding cost for the half-dozen managed futures ETFs examined above is 85 bps per year.

Another half-dozen portfolios, mostly index trackers with active overlays, have launched recently. So next year, comparisons will be even more complex as even newer active futures ETFs earn their stripes.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange’s (now NYSE Arca) option market and the iShares complex of exchange traded funds.