The problem with fixed income investments isn’t the income. Not directly, anyway. It’s the value of that income in relation to prevailing market rates. The laws of bond physics dictate that the resale price of a 3 percent coupon is likely to be diminished if yields rise to 4 percent. This manifestation of interest rate risk is especially worrisome for holders of bond ETFs. For traditional bond ETFs, that is.

Over the past few years, a slew of rate-hedged bond ETFs have launched with an eye toward mitigating the deleterious effects of rising yields. The hedge is accomplished by shorting Treasury futures or entering into swap agreements that offset the overall duration of the bond portfolio. Swaps entitle the ETF to floating payments tied to prevailing interest rates in return for a series of fixed disbursements. If rates rise, the increasing cash sums received by the ETF help to offset declines in the value of the underlying bond portfolio.

Duration combines the timing of interest payments and the return of principal into a gauge of a bond or bond fund’s relative value. Expressed in years, duration is most commonly known to investors as an estimate of an instrument’s sensitivity to interest rate fluctuations. A one percentage-point shift in rates will generally push a bond portfolio’s value in the opposite direction by a like amount, multiplied by the security’s duration. You’d therefore expect the value of a bond ETF with a five-year duration to slump by 5 percent in response to a one percentage-point hike in rates. Interest rate-hedged ETFs are designed to have a duration approximating zero.

Mind you, duration hedging doesn’t wipe away the entirety of a bond ETF’s risk. Neutralizing interest rate risk merely isolates the portfolio’s credit risk—in other words, the danger of default. With that, ETF holders become exquisitely sensitive to changes in economic conditions that affect default rates. This makes rate-hedged ETFs a good bet when investor sentiment about economic growth and corporate earnings is positive. When credit conditions worsen, however, the hedge is a drag. At the very least, a portfolio hedge should dampen the volatility found in a traditional bond ETF. That, in turn, ought to produce a performance advantage.

Hedging doesn’t come without cost. That cost is reflected in dividend yields. A rate-hedged ETF’s payouts will typically be smaller than that of a comparable unhedged portfolio but may be still higher than those of floating rate ETFs of similar quality or funds populated with notes of shorter maturities.

So, how do rate-hedged ETFs stack up against conventional bond products? To answer that question, we sorted the universe for pairs of directly comparable investment-grade portfolios. In each pair, one fund is hedged, the other unhedged. We then set them up against the iShares Core U.S. Aggregate Bond ETF (NYSE Arca: AGG), a long-established tracker of investment-grade corporate bonds, Treasurys, agencies, CMBS and ABS. Three hedged/unhedged pairs immediately hove into view.

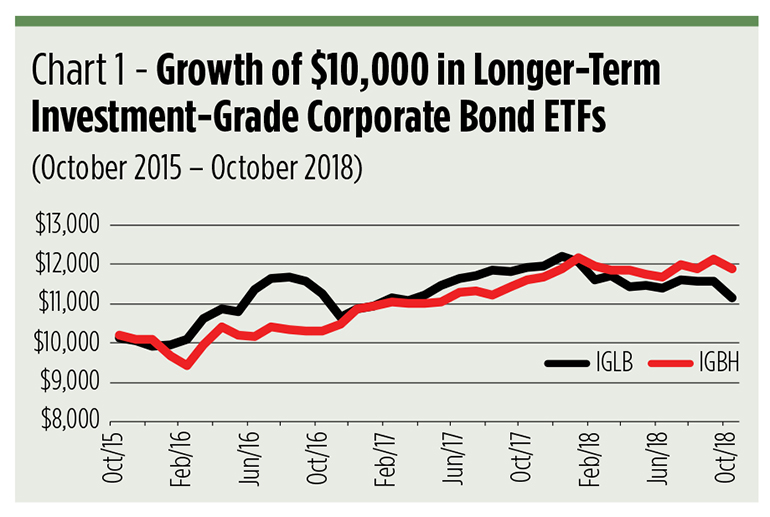

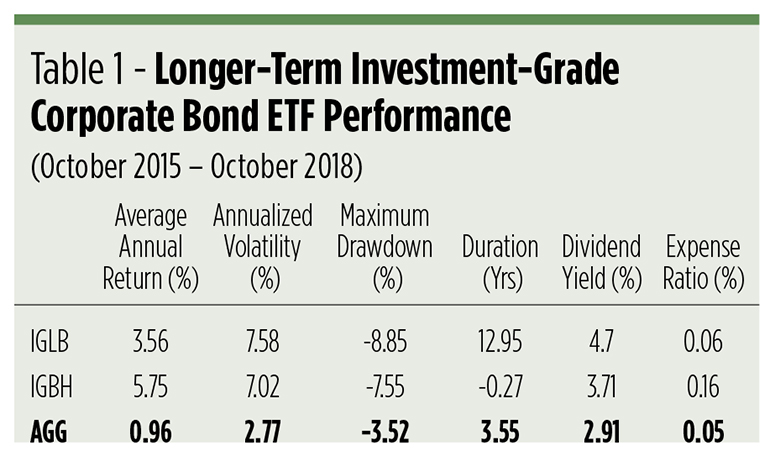

At the long end of the yield curve are iShares portfolios keyed to the ICE BoAML 10+ Year U.S. Corporate Index. The unhedged iShares Long-Term Corporate Bond ETF (NYSE Arca: IGLB) lays a foundation for the iShares Interest Rate Hedged Long-Term Corporate Bond ETF (NYSE Arca: IGBH), an actively managed portfolio that uses Treasury note swaps—primarily of three tenors—to hedge away rate risk across the right side of the term structure. For this, IGBH charges an extra 10 basis points in annual holding expenses versus IGLB. That’s a portfolio management upcharge. There’s another cost reflected in dividend yields. Presently, IGBH’s yield is nearly a full percentage point less than IGLB’s.

And what do you get for these additional costs? IGBH pulls down an average annual return 219 basis points higher than the underlying IGLB portfolio. With significantly less volatility, to boot. One consequence of interest rate hedging during the recent equities bull market, however, is noteworthy— heightened correlation. IGLB owns a 0.39 correlation coefficient to the domestic stock market; it’s 0.64 for IGBH.

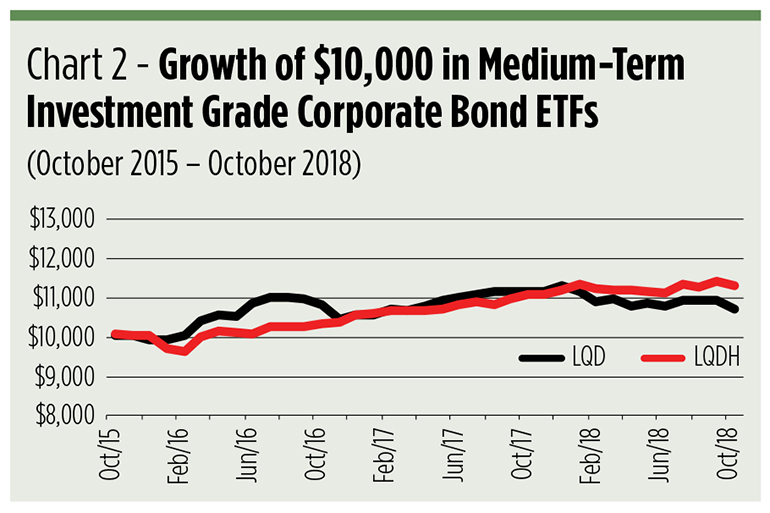

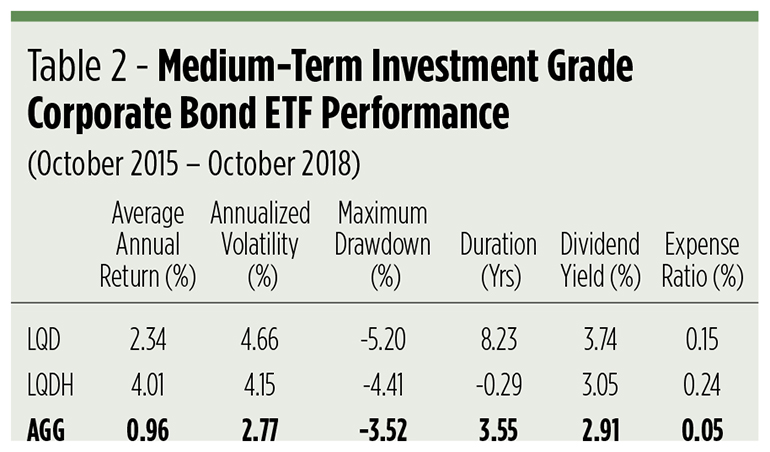

In the middle of the term structure are a pair of iShares portfolios based on the Markit iBoxx USD Liquid Investment Grade Index. The iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE Arca: LQD) draws only notes with maturities three or more years out. That’s not to say that the fund’s average weighted maturity is short. In actuality, it’s nearly 13 years. LQD correlates to the broad stock market with a 0.36 coefficient.

With LQD as its base, the iShares Interest Rate Hedged Corporate Bond ETF (NYSE Arca: LQDH) also relies on swaps to lay off risk. As with the iBoxx pair of ETFs, hedging goosed up returns, tamped down volatility and chewed into dividend yields. LQDH’s correlation to the stock market, at 0.63, is also conspicuously higher than LQD’s.

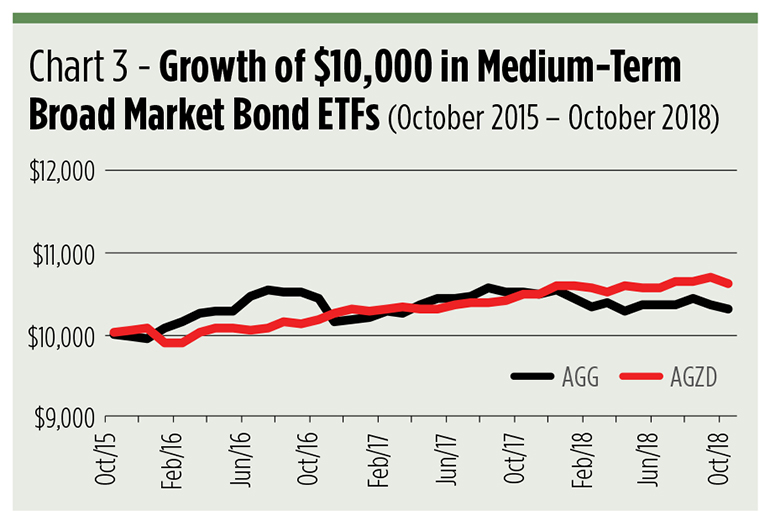

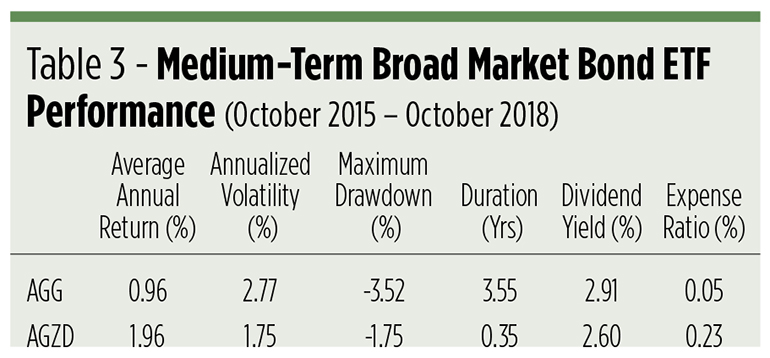

Last, we looked at the hedged analogue of our AGG benchmark. The WisdomTree Barclays Interest Rate Hedged U.S. Aggregate Bond Fund (NYSE Arca: AGZD) uses Treasury futures instead of swaps to insulate its bond portfolio from interest rate risk. Another distinction: AGZD doesn’t hold an ETF at its core. Instead, the fund replicates the Bloomberg Barclays U.S. Aggregate Bond Index by taking long positions in the benchmark’s investment-grade constituents. Maturities are on par with those of the LQD/LQDH pair and the hedging effect is also similar. AGG earns a -0.02 correlation to the stock market. The Treasury futures overlay ratchets the coefficient up to 0.58 for the AGZD fund.

The good and the not-so-good

So, what’s the upshot of our survey? Well, put simply, hedging works. Whether swaps or futures are employed by portfolio runners, zeroing out duration produces a double benefit: Across the board, it boosts gross returns and reduces volatility in a rising rate environment. The cost for this is at once obvious and subtle. We’ve clearly seen the impact hedging has in reducing dividend yields and increasing ongoing holding expense. We’ve also noted that hedging with Treasury instruments mitigates the risk that abounds as rates ratchet higher, but it won’t diminish credit risk. If economic prospects worsen, default risk will rise, though less so in the investment-grade sector compared with lower-quality issues.

This brings us to a more global risk. Adopting a hedged approach to the bond market carries with it an explicit assumption that Treasury yields will rise. It’s fairly apparent that the multi-decade bull market in bonds is coming to an end, but there’s no guarantee that rates will rise over any discrete period of time in the short or intermediate term. Considering the costs enumerated above, flat rates can be just as deleterious to a hedged position as falling rates. One has only to look at the Japanese bond market as a paragon of an obstinately stagnant rate environment.

Above all, investors should heed Page One of the hedging rulebook: So long as rate protection is in place, an investor forgoes the windfall profits obtainable in an unhedged position. Holders of unhedged bond funds can enjoy capital gains if interest rates fall. Those gains are forfeited in a hedged portfolio.

Keeping this in mind, hedged bond portfolios are ideally designed to capitalize upon relatively quick and steep interest rate hikes. The question for investors and their advisors to measure now is how confident they are in such a future.

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.