By Stephen Gandel -- BlackRock Inc. just rocked. Sort of.

The world's biggest asset manager reported Wednesday morning that its third quarter earnings rose 10 percent, solidly beating expectations for the first time in three quarters. The company earned $5.78 per share -- analysts were expecting $5.54 per share. Its revenue of $3.2 billion also exceeded expectations for the first time in 15 months, and its shares rose $9.50, or 2 percent, to $475 in pre-market trading.

But sales and earnings still rose more slowly in the quarter than asset growth. The company has been dubbed the Amazon.com of ETFs because it's been enjoying fast growth paired with disappointing profits. The third quarter hasn't quite shaken that image.

The earnings report also showed that BlackRock is approaching a significant milestone. The firm ended the third quarter just $25 billion shy of having $6 trillion in assets under management for the first time. It passed $5 trillion less than a year ago. To get a sense of what that means look to T. Rowe Price Group Inc., the popular mutual fund manager, which has just less than $1 trillion in assets under management. JPMorgan Chase & Co., the nation's largest bank, has less than $1.5 trillion in its vaults.

The $6 trillion figure is yet another signal that passive managers like BlackRock and Vanguard have convinced investors that they are better off in their low cost funds than in actively-managed stock and bond funds. BlackRock owns the enormous iShares ETF business, which drew in $52 billion in new assets during the quarter. Non-ETF index funds at BlackRock attracted another $16 billion. The fact that there hasn't been a big reversal in interest rates has helped sustain BlackRock's bond business.

BlackRock's success may be also be the source of some of its problems. The popular index fund and ETF business has attracted more competitors and BlackRock has had to pay bigger distribution fees to stay ahead. The result: Assets continue to pour in, but profits are not rising nearly as fast because expenses have been climbing. That phenomenon is what caused BlackRock to miss expectations in a string of quarters starting in the middle of last year.

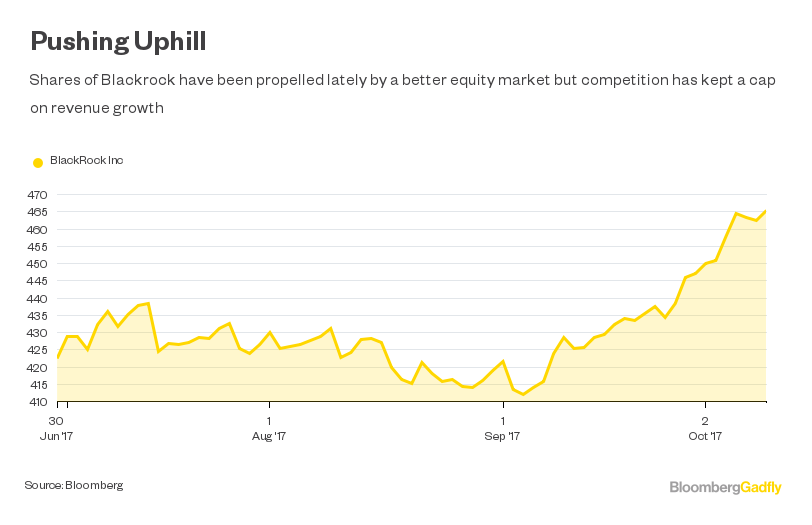

None of that has stopped investors from piling into the stock. BlackRock shareholders have rewarded the firm for its growth and -- just like Amazon.com's investors -- have also often ignored its profit problems.

Shares of BlackRock have risen nearly 33 percent in the past year, shooting up 10 percent since the end of September alone. Its stock now has a price-to-earnings ratio of 22. But if the market turns, or interest rates rise, BlackRock's rising tide of assets could flow out.

If that happens, investors may worry that BlackRock can't manage its expenses as well as other people's money. Bottom line: Even with nearly $6 trillion in assets, BlackRock hasn't quite figured how to master scale profitably while pursuing growth. That could eventually become a liability.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Stephen Gandel is a Bloomberg Gadfly columnist covering equity markets. He was previously a deputy digital editor for Fortune and an economics blogger at Time. He has also covered finance and the housing market.

To contact the author of this story: Stephen Gandel in New York at [email protected] To contact the editor responsible for this story: Timothy L. O'Brien at [email protected]