(Bloomberg) -- America’s exchange-traded funds are shutting down at a record pace and the production line is stuttering as issuers struggle to sell new products in the $5 trillion market.

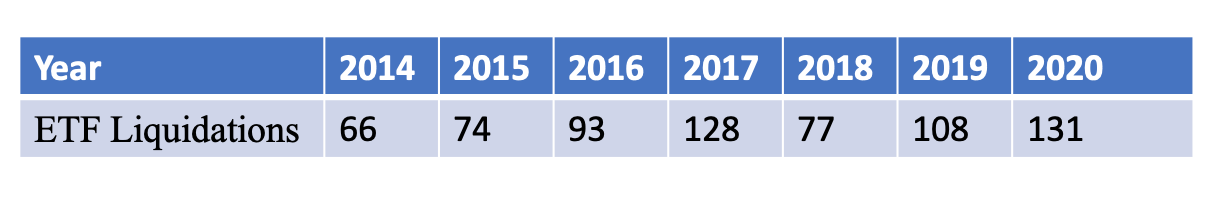

More than 130 ETFs have been liquidated in 2020, already the most ever, while 178 funds have started trading -- roughly on course to match last year’s launches. That was the lowest number of debuts since 2014 and the second drop in a row.

A glance at flows helps explain why: Almost a third of all existing ETFs were launched within the past three years, yet they account for only about $2 of every $100 currently invested in the industry, according to data compiled by Bloomberg Intelligence.

It’s way tougher” to create a successful product now, said Athanasios Psarofagis, a Bloomberg Intelligence analyst. “Getting $1 billion today in real assets is really, really hard. It’s like getting $6 billion in the past when there was less product, and less of an issue to get on the platforms.”

While the industry as a whole has enjoyed solid growth in the last few years and total assets recently hit a record, giants such as BlackRock Inc. and Vanguard Group dominate the scene. Their size and influence gives them huge advantages in terms of distribution and marketing. They also benefitted from economies of scale when a heated fee war broke out.

Funds from the biggest three issuers account for more than 80% of all ETF assets, and roughly 70% is in products launched more than a decade ago, the data show. The top 10 funds by size were all launched before 2013 and hold a combined $1.3 trillion.

“In the ETF space, distribution is king,” said Nate Geraci, president of investment-advisory firm the ETF Store. “You can have the best ETF in the world, but if investors aren’t aware it exists, it doesn’t matter.”

Even the much-hyped arrival of actively managed, non-transparent ETFs -- which reveal holdings just once a quarter, similar to mutual funds -- have failed to attract big flows. The 15 funds that have launched so far have drawn in just $546 million worth of assets.

Of course, there are some success stories. The Roundhill Sports Betting & iGaming ETF has grown to roughly $129 million after launching in June, while the Direxion Work From Home ETF has also crossed the $100 million milestone after its June debut. And so-called buffer funds -- which shield against losses in exchange for a cap on gains -- have steadily accumulated assets amid this year’s turbulent markets.

Still, for every winner there is likely to be at least 10 failures, according to Psarofagis, who says this puts the onus on issuers to ramp up their sales and distribution efforts.

Distribution muscle has helped firms such as JPMorgan Asset Management quickly establish themselves. Though the company didn’t launch its first fund until 2014, the JPMorgan Ultra-Short Income ETF became the largest actively managed ETF earlier this month.

“Firms with distribution clout have been able to make inroads despite being late to arrive,” said Ben Johnson, Morningstar’s global director of ETF research. “Schwab, Fidelity, Goldman and JPMorgan are great examples of firms that have come late to the game with me-too offerings but have sold those in to their own captive channels and affiliates.”

--With assistance from Claire Ballentine.