By Robert Brand

(Bloomberg) --Citigroup Inc. says it may be time to bet on Donald Trump.

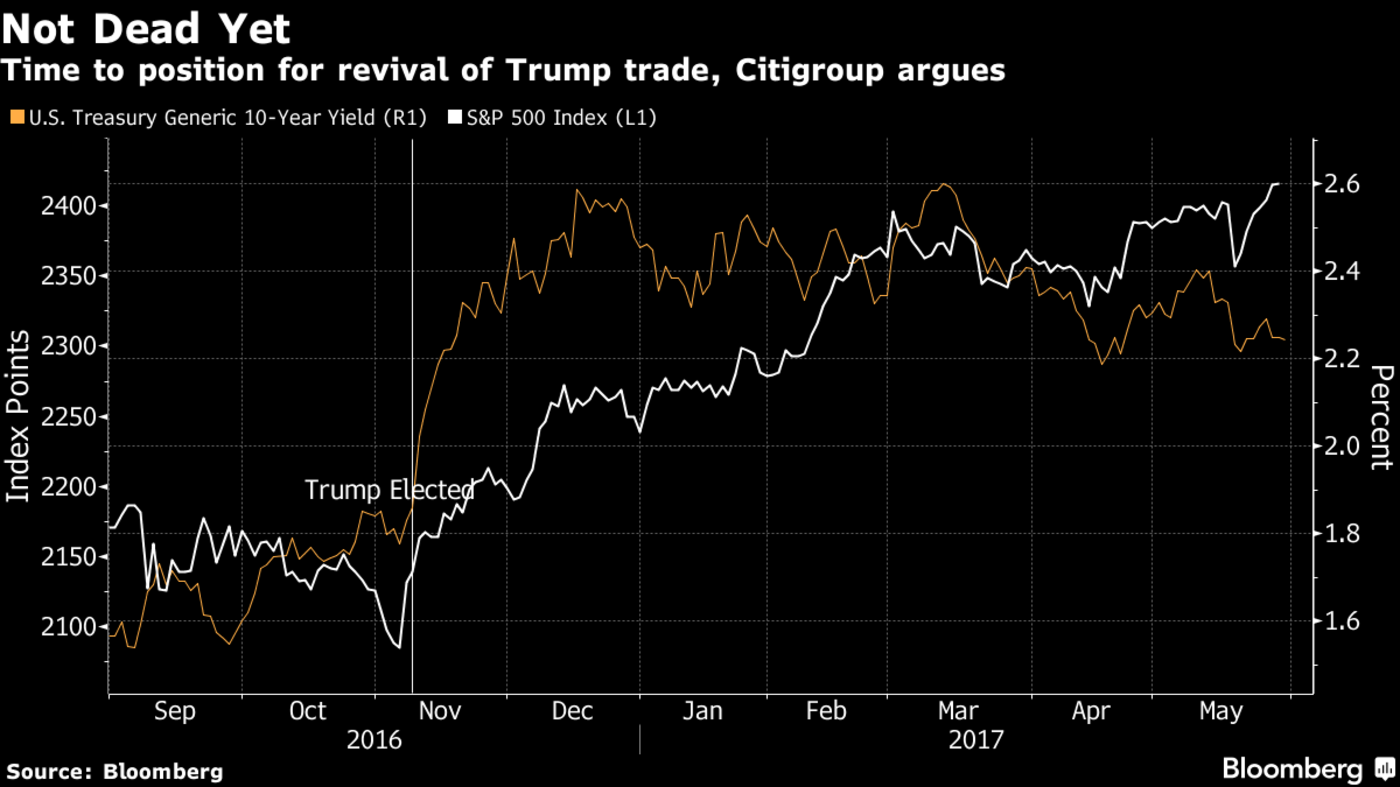

With inflation trending lower and economic growth picking up globally, “Trumponomics” -- tax cuts and increased government spending -- has largely lost its grip on asset markets, Citi strategists led by Jeremy Hale wrote in a recent note. That’s made the risk-reward equation for the medium-term reflation trade favorable, they wrote.

“Citi economists have not changed their base case, still expecting fiscal stimulus and tax cuts or reform later this year,” the strategists wrote in a May 25 note. Citi is “slightly” overweight equities and underweight bonds. But it’s also overweight cash, “given that markets are rich and we want powder to buy dips,” they wrote.

Some of those opportunities might soon be at hand, now that the dollar has weakened 6 percent since its Jan. 3 high and 10-year Treasury yields have fallen back below 2.25 percent. While equities trade near records, it’s no longer companies with high tax rates or ones that rely disproportionately on economic growth that are pacing the gains.

Yields may fall further as the Fed raises borrowing costs and President Donald Trump’s tax and spending plans face delays, but would probably start rising again “in the medium term,” the Citi strategists wrote.

“We are still inclined to expect higher yields eventually, especially given the likely return of fiscal policy and tax reform as a driver,” the strategists wrote. “If we are entering a world where fiscal stimulus takes over from monetary policy and quantitative easing, real rates and term premia have ample room to re-price higher.”

Not everyone sees it that way.

The “honeymoon period” could end for U.S. stocks, driven to record highs on policy expectations, if the Trump administration fails to deliver on promised tax cuts, Federal Reserve Bank of St. Louis President James Bullard said Tuesday, while reiterating his view that rates are already close to where they should be.

To contact the reporter on this story: Robert Brand in Cape Town at [email protected] To contact the editors responsible for this story: Samuel Potter at [email protected] Jeremy Herron